IAG sinks to first half loss, braces for claims rush

IAG has declined to provide guidance, as provisioning for expected pandemic claims dragged it to a $460m first half loss.

IAG shares jumped on Wednesday as investors looked through the near-term business interruption risks to focus on solid growth trends.

For the six months through December, IAG posted a $460m loss, swinging from a $283m profit in the prior corresponding period, as its business interruption provisioning hurt profitability.

Cash earnings, meanwhile, rose 21.6 per cent to $462m.

Despite the statutory loss, it announced a 7c per share unfranked interim dividend.

IAG shares jumped 5.6 per cent in afternoon trade to $5.34 before falling back slightly to close at $5.29.

CEO Nick Hawkins said the business had been stable over the half and that it was a strong result with a strong underlying margin.

“We have seen a strong underlying performance across our businesses over the last six months and we will build on this performance as we sharpen our focus to deliver a stronger, more resilient IAG,” he said.

He also suggested that a higher dividend was likely at the full-year, as he flagged his intention for the payout to be back up to its typical 60-80 per cent of cash earnings by then.

Mr Hawkins told The Australian he wanted the business interruption uncertainty to be resolved quickly to provide clarity to the insurer and policyholders.

“We want to bring this to a head as quickly as possible. We’re working as an industry so we can get some consistency, and we want to create clarity for our customers and stakeholders around this,” he said.

IAG in November moved to raise $750m from shareholders after an adverse ruling by the Court of Appeal in NSW on a business interruption insurance test case. In a unanimous judgment, the Court of Appeal determined that pandemic exclusions referring to the Quarantine Act, rather than the Biosecurity Act, failed to exclude cover for losses associated with COVID-19.

About half of IAG’s 76,000 business interruption policies referred to pandemic exclusions under the Quarantine Act when COVID-19 hit. This number has been falling steadily as the Biosecurity Act is substituted for the Quarantine Act when customers renew their policies.

The insurance industry is currently seeking leave to appeal the court decision.

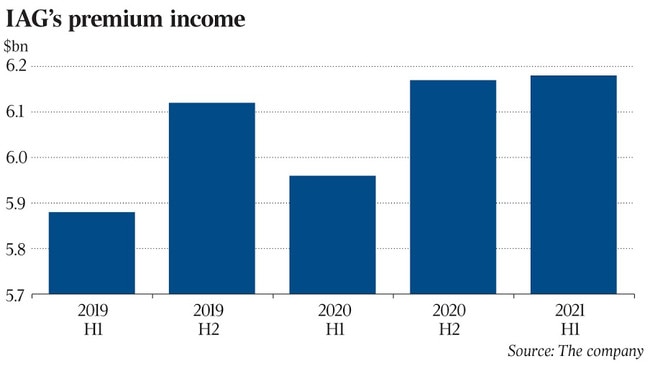

IAG’s gross written premium growth came in at 3.8 per cent, well above the 1.4 per cent recorded over the same period last year. This was a strong result given the uncertain conditions, Mr Hawkins said.

Growth was predominantly driven by rate increases in its commercial and home insurance businesses in Australia and across all key classes in New Zealand. Customer growth in New Zealand and high retention rates in commercial portfolios in Australia also helped to boost growth.

Over the six-month period, IAG posted insurance profit of $667m, up from the prior year’s $501m, equating to a higher reported margin of 17.9 per cent.

“In addition to the COVID-19 effect, this result benefited from a relatively benign natural perils period, which meant we came in $39m lower than our natural perils allowance, and credit spreads were favourable,” Mr Hawkins said.

Its underlying margin of 15.9 per cent was an improvement on the prior half’s 15.1 per cent, as it benefited from lower motor claims as a result of COVID-19 lockdowns.

Mr Hawkins said he was hopeful pricing would continue to harden in the near term.

“It’s a complex topic around changes with some of our claims costs and reinsurance perils, so we have seen a little bit of pricing go through. And we would like to continue to see some inflationary pressure on some of those input costs that are going to cause some pricing as well,” he said.

Macquarie analysts said first impressions were that the result was “very strong”.

“GWP growth and underlying margins were exceptional compared with the very low expectations,” the analysts said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout