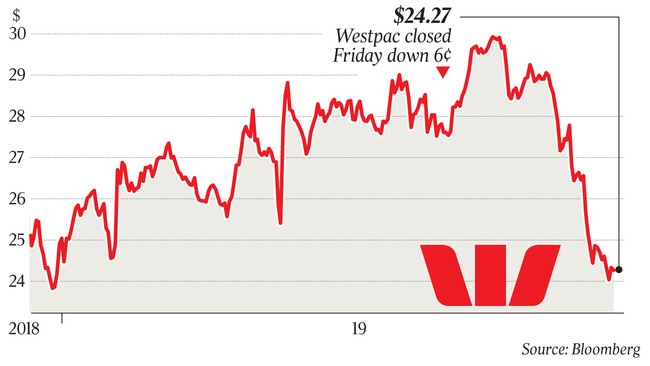

Humbled Westpac faces shareholder anger at GM

Westpac shareholders will have their first chance to express anger at the board at their annual meeting on Thursday.

Westpac shareholders will have their first chance to express anger at the board’s handling of the Austrac scandal at their annual meeting in Sydney on Thursday.

While the bank faces a second strike against its remuneration report — following a first strike at its annual meeting last year, when 64 per cent of shareholders voting against the remuneration report — it is expected to avoid a board spill, which requires another resolution.

The Australian Shareholders’ Association, which will have proxies for more than 2000 shareholders, is voting against the remuneration report but will not support the subsequent resolution for a meeting to consider a complete spill of the board.

Shareholders are also expected to vent anger at the proposed re-election of Peter Marriott, a former KPMG partner who chairs the bank’s audit committee and is a member of its risk committee, who has been a Westpac director since June 2013.

While the mood at the meeting will be less critical than it would be had chief executive Brian Hartzer not resigned, Mr Marriott’s re-election will face opposition, given his key board role overseeing the handling of the response to the Austrac case. CGI Glass Lewis is recommending a vote against Marriott’s re-election “due to the length of his tenure and his banking background”.

“We also believe that … his accountability for these matters should be enforced and that his re-election should not be supported,” it said in a note to clients.

Expectations are that Mr Marriott could get enough votes for his re-election but the votes against him will be an important sign of shareholder anger.

Proxy advisers Ownership Matters is voting in favour of the re-election of all four directors and in favour of the remuneration report. Meanwhile, CGI Glass Lewis is voting in favour of the remuneration report but Institutional Shareholder Services is recommending against the remuneration report.

In its statement of claim, lodged in the Federal Court on November 20, Austrac alleged Westpac contravened anti-money laundering legislation more than 23 million times. Austrac claimed the contraventions were “the result of systematic failures in (the bank’s) control environment, indifference by senior management and inadequate oversight by the board”.

Marriott’s longevity on the board and his role on several board committees is expected to attract criticism during the meeting, with some shareholders expected to argue the board should have been more diligent in its oversight of anti-money laundering transactions and more co-operative with Austrac’s investigations.

Marriott’s re-election faces opposition from the Australian Shareholders’ Association and other proxy advisers, including CGI Glass Lewis.

But the Australian Council of Superannuation Investors, which advises $2.2 trillion of superannuation finds, will be voting in favour of all four directors facing election and the remuneration report.

“I expected it is going to be a long meeting,” Australian Shareholders’ Association director and Westpac company monitor, retired banker Carol Limmer said.

“People will want to vent their feelings and I expect the chairman will allow a fair amount of that to happen,” she said.

She said many small shareholders were “pretty horrified” at the allegations made against the bank by Austrac and unhappy at the time the bank had taken to respond to the allegations.

“For most people, 23 million transactions is a lot of transactions,” she said, adding they were also upset “at the fact some may have involved child exploitation”.

She said the ASA was voting against the remuneration report as it believed executives should not be paid short-term incentives in the wake of the Austrac scandal.

“There should be a top level collective response to what has happened. They should be prepared to take the short term incentives to zero,” she said.

But she said the ASA would not be voting in favour of a motion to spill the whole board: “It is important to maintain stability.”

The board has withdrawn the proposed re-election of director Ewen Crouch, who chaired the bank’s risk and compliance committee. This will mean the exit of Mr Crowch from the bank.

The meeting is also expected to see the re-election of director Nerida Caesar and for the election of Steven Harker and Margaret Seal who were both appointed to the board in March.

“Our base case is no spill meeting,” equities analysts at Morgan Stanley said in a note to clients

The Australian Council of Superannuation Investors said Westpac had done enough in response to the allegations to win support at the annual meeting.

“If they had not taken the actions they had, our voting directions would have been different,” ACSI chair Louise Davidson told The Australian.

“Under the circumstances, the Westpac board has shown accountability at the board and executive level,” she said.

Westpac chair Lindsay Maxsted, who has announced he will bring forward his retirement from the bank’s board to the first half of next year, is expected to update shareholders on the bank’s planned response to the Austrac allegations and the steps it is taking to repair the situation, which saw its chief executive Brian Hartzer forced to resign.

A directions hearing commence for the Austrac case is scheduled to begin on Monday in the Federal Court.

Westpac is not expected to fight the case and is believed to be in discussions with Austrac about an agreement statement of facts and a potential fine as high as $1bn.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout