How teflon bank boss Brian Hartzer came unstuck

Brian Hartzer, who was given a low-key farewell at Westpac on Friday, gets a mixed report card for his financial stewardship.

Outgoing chief executive Brian Hartzer was given a low-key farewell on Friday at Westpac’s Sydney Kent Street headquarters as he finished up his seven years at Australia’s second largest bank and possibly ended a 20-year banking career.

While the furore over his handling of Westpac’s relationship with anti-money laundering regulator Austrac played out, and questions were being asked how the country’s oldest bank could have overlooked potential transactions of people involved in child exploitation, the American-born Hartzer kept going to work after the announcement of his sudden resignation on Tuesday morning, as the days counted down before handing over to his chief financial officer Peter King who takes over on Monday. “It’s a sad day for Brian and a sad day for Westpac,” one observer told The Weekend Australian. “It’s been brutal.”

The 52-year-old Princeton-educated banker, who has been chief executive of Westpac since February 2015, has been saying quiet farewells to different staff members. He is leaving an organisation with more than 35,000 staff whose brands include Westpac, St George, Bank of Melbourne and Rams.

He has also been responding to messages of support on social media including Linked In.

With a family from his second marriage in Sydney and his first marriage in Melbourne, (he is a supporter of the this year’s AFL premiers Richmond Tigers) Hartzer has no plans to jet back to America or disappear overseas.

But observers say he will take time out to reflect on what has happened during what must be the worst ever week of an otherwise illustrious banking career.

By all accounts Hartzer, who worked in New York and San Francisco for a consulting firm before moving to Melbourne to join ANZ Bank in 1999, is a highly intelligent, high quality individual with high ethical standards, having run a bank with a strong commitment to sustainability and community involvement.

As a boy, he attended the prestigious Choate Rosemary Hall school in Connecticut whose alumni include former US president John F Kennedy, and tinkered with computers.

He studied European history at Princeton before heading to New York to work with the First Manhattan Consulting Group.

No one believes for a second that Hartzer, who was proud of the bank’s Westpac Foundation and the Westpac scholarship system set up to celebrate the bank’s 200th anniversary, would have deliberately ignored any allegations that the bank was facilitating child sex exploitation.

But critics says that the problems could have arisen from organisational hubris, a culture where bad news was not encouraged to be passed up the management chain, where the focus was on generating new revenue and holding down costs, where decisions were made not to spend money on much needed IT upgrades and systems and where the board did not provide the degree of monitoring of the questionable transaction issues once they were raised that it should have.

Political payback

Some say that Hartzer has suffered for daring to take on regulators in the wake of the royal commission, battling two cases against Westpac led by ASIC, with the Austrac action against Westpac some form of political payback for a perceived arrogance.

“Every financial institution has outstanding issues with Austrac and they all think they are working through them constructively,” one former Westpac banker told The Weekend Australian.

“But at Westpac something snapped and they were completely blindsided.”

“I think they thought they were working through the issues and taking the right measures, but the regulators wanted a head on a stick.

“Out of all the big four bankers, Brian was the only one who litigated against them,” they said.

“It’s a sad way for Brian to go. He may have won the battles against ASIC, but he lost the war and has been brought down to earth.

“There was a complete failure at the bank to recognise that they had a problem,” another financial market executive, who remains a strong supporter of Hartzer, told The Weekend Australian.

“They had a lot of trouble implementing the IT upgrades in 2011 and 2012. There was also a lack of knowledge about banking on the board,” the exeucitive said.

“They had IT issues in 2017 but they didn’t see it as a big problem. They just saw it as a computer error. But they have completely misunderstood the regulatory environment post the royal commission.

“They thought they had committed a misdemeanour and could get over it and move on.”

At the least, Hartzer’s reported comments made to internal staff meeting on Monday showed he was out of touch with community sentiment, trying to play down the importance of the allegations against his bank, which had in fact been the talk of weekend dinner parties and talkback radio in the days since Austrac lodged its statement of claim.

Shaw and Partners’ banking analyst Brett Le Mesurier told The Weekend Australian that it was an “aggregation of factors” which led to Hartzer’s downfall.

“He was under pressure, like all bankers, to maximise profits for shareholders. But they should have paid more attention to the law. There was a strong focus on the profit objective with risk and compliance being secondary issues. But as we all know, the two are combined.”

Expectations are that Westpac will not fight the Austrac case in the Federal Court, lodged last week, and will agree on a settlement which could involve a payment of as much as $1bn.

Teflon executive

Before the scandal broke, Hartzer was known as the near-teflon bank chief executive who had managed to steer his organisation through the royal commission to emerge relatively unscathed while others had seen chairmen, chief executives and senior executives leave in disgrace.

He took over as chief executive at a time when the bank was still handling the integration of Westpac and St George, which had been bought by former CEO Gail Kelly in 2008. Kelly was known for having a strong on customer focus, but her critics argue that she was also able to deliver on strong profit figures by not investing the amount of money needed to upgrade and integrate IT systems, while other banks such as the Commonwealth were pushing ahead with more cutting edge IT investments.

Hartzer took over looking forward to celebrating the bank’s 200-year anniversary in 2017. But he soon found himself having to deal with a rising ride of complaints against banks including an action by ASIC, which was lodged the day ahead of a Westpac celebration in early 2016.

He then found himself having to deal with the royal commission into the financial system which was announced in November 2017.

One of the first moves of the royal commissioner was to call on all the major financial institutions to self report any poor behaviour — a move which saw Westpac self- report some of the breaches to Austrac which were the source of its problems.

Westpac has already admitted its decision to buy a cheaper program to monitor suspicious transactions when the problem was first raised was one of its downfalls.

In his introduction to a lavishly illustrated book on Westpac’s 200 year history in 2017, Hartzer talks about the Westpac story as being one of “entrepreneurialism, growth, resilience, overcoming setbacks and adaptation.”

“Above all, it’s a story of individuals — who had a dream, had a go, confronted challenges, dusted themselves off and kept going,” he wrote.

Just how Hartzer will dust himself off and keep going remains to be seen. In his early 50s, he is young enough for another full-time job.

One headhunter said this week that he would have to sit out of the market for at least a year or so before he could put himself forward for another position including a board position.

“He would want to lie low for 12 months or so,” one executive recruiter said on Friday. “He will find it difficult to get positions on public companies in the short term and probably won’t want them anyway,” the person said.

But the recruiter suggested that he could consider sitting on boards of not-for-profit organisations and possibly teach at a business school.

Another observer, who described Hartzer as one of the best of Australia’s banking chief executives, predicted that he could be approached to run other banks overseas.

Hartzer gets a mixed report card for his financial stewardship of Westpac. One critic said Hartzer never had the strong focus on what he wanted to do at the bank like Gail Kelly or her predecessor David Morgan whose job was to repair Westpac’s balance sheet.

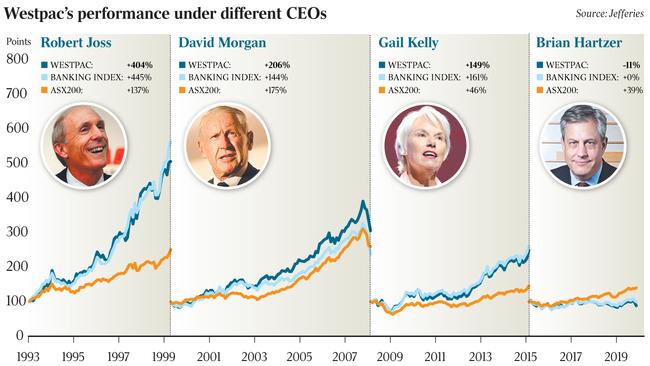

“Five years into his tenure as chief executive, he has not delivered the stellar outperformance that was evident under previous Westpac chief executives David Morgan and Gail Kelly,” broker Jefferies says in a report.

“Westpac’s operational performance and share price had underperformed the banking sector and broader market under the tenure of Hartzer and (chairman Lindsay) Maxsted.

“While we rate the new acting chief executive Peter King highly, a strategic reset under a newly external appointment may be on the cards.”

Ahead of the bank is now a potentially difficult annual meeting on December 12 and the prospect of having to raise even more capital to meet the Austrac fine.

The broker estimates that the cost of the Austrac settlement could be around $1bn in civil and another potential $250m in remediation charges in each half over the next three years. “It would be naive to think this is not a lasting impact on Westpac, all the more so given its tenuous capital position,” the report said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout