House price falls to add to banks pain: Macquarie

Banks face a further remediation bill of up to $6bn for breaches of lending obligations if house prices keep falling.

The nation’s banks are looking down the barrel at a further remediation bill of up to $6 billion for potential breaches of their responsible lending obligations if house prices continue their downward spiral and fall 15-20 per cent from their peak, according to a report.

Ahead of this morning’s grilling of National Australia Bank chief executive Andrew Thorburn by the House economics committee, a Macquarie report warned that a price slump could create widespread negative equity in properties and legal consequences for the banks if they were shown to have lent irresponsibly.

In the worst of three scenarios, where prices would fall a further 15 per cent and return to levels last seen in September 2014, about 310,000 houses would plunge into negative equity after shedding $166bn in value compared to original purchase prices.

Potential remediation costs would be in a “manageable” range of $2.5bn-$6bn, with Westpac having the biggest exposure at $1.8bn.

Next in line would be Commonwealth Bank ($1.4bn), followed by National Australia Bank ($900 million), ANZ ($800m) and other banks ($1.2bn).

“While our analysis highlights that Westpac has higher exposure than peers, we believe the differences are not large enough to justify a material valuation discount,” the report said.

In hearings earlier this month, Mr Thorburn’s counterparts have all admitted to poor behaviour and conduct leading to unacceptable outcomes for customers.

Commonwealth Bank chief executive Matt Comyn said there had been failures of judgment, process and leadership, and in some cases there was greed.

“We’ve been too slow to identify problems, too slow to fix underlying issues, and too slow to put things right for customers,” Mr Comyn said.

“We have underinvested in prevention even though we have significantly invested in customer remediation. This is completely unacceptable.”

Mr Thorburn is expected to make similar concessions this morning.

The cost of customer refunds and remediation in 2018 has smashed through $2bn, with a similar amount likely in the 2019 financial year.

Forecasts beyond then start to get rubbery, although Brett Le Mesurier from Shaw and Partners has taken a stab at $7.4bn all up, while conceding that the banks had not yet uncovered everything.

Royal commissioner Kenneth Hayne said in his interim report that the banks’ compliance record in responsible lending had been patchy.

The former High Court judge blamed greed by bank employees and intermediaries, such as mortgage brokers. The key to responsible lending is the requirement to assess whether a credit contract is “not unsuitable” for the customer.

To do this, the lender has to make reasonable inquiries — and take steps to verify — the customer’s financial situation.

Mr Hayne said in his report there was a “body of evidence” that indicated lenders had not made inquiries about their customers’ circumstances, requirements and objectives.

According to Macquarie, though, it could be difficult to prove that the banks had breached their responsible lending obligations and were liable for potential losses.

“For legal actions to eventuate, a customer would need to have suffered a financial loss and (prove) direct causation; that is, a loss was a direct result of the initial responsible obligation issue,” the report said.

The subdued level of arrears in bank mortgage portfolios would make it difficult to show a direct link between the customer’s financial loss and the breach of responsible lending practices, particularly if interest rates remained low.

A notable exception could be an increase in repayments for interest-only loans after they converted to interest and principal.

The other two scenarios in the Macquarie report assumed flat property prices with minimal risk of remediation charges, and a further 10 per cent decline in prices leading to a potential $1bn-$2.5bn in remediation costs.

The benign scenario would lead to an aggregate loss of $17bn compared to original purchase prices, while a 10 per cent fall in prices would trigger a $73bn loss in value.

“While these figures are substantial in absolute value and relative to banks’ capital levels, the losses are likely to be manageable given embedded equity in the housing portfolio,” Macquarie said. “We also note that the market correction implied (in the worst-case scenario) would imply a 23 per cent correction for the entire market peak to trough, which appears high even in the international context experienced during the financial crisis.

“We also note that under this scenario the decline in the Sydney and Melbourne markets would be 25 per cent.”

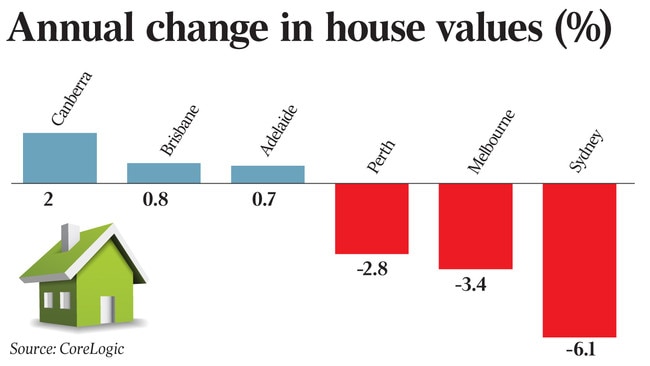

So far, Australian dwelling prices have fallen about 2 per cent from their peak, with previous downturns of greater magnitude leading to insignificant bank losses.

But Macquarie said the current situation was different.

Banks had tightened their credit standards, leading to a 15-25 per cent contraction in borrowing capacity, and a further decline in property prices and moderation in credit growth was likely to flow from any reforms to negative gearing.

There was also widespread uncertainty about responsible lending obligations.