Hostplus on the acquisition trail with $2.6bn Intrust Super deal

Hostplus is hoovering up even more small fry in the superannuation sector, signing a deal to merge with the $2.6bn Queensland-based Intrust Super.

Hostplus is hoovering up even more small fry in the superannuation sector, signing a deal to merge with the $2.6bn Queensland-based Intrust Super and adding 96,000 hospitality, retail and tourism workers to its membership base in the process.

The latest in a series of mergers to be agreed between the heavy hitters and the minnows was announced on Friday, after being foreshadowed by The Australian. Staff were informed of the tie-up on Thursday.

Hostplus CEO David Elia said the merger represented a “significant and positive milestone” for the funds and their members, contributing employers and stakeholders.

The move is a calculated strategy by the $50bn Hostplus, the industry super fund for the hospitality sector, to broaden its base in Queensland. But more than that, it scores itself close to 100,000 workers — many of whom will be young and in their first years of employment — days after new legislation that will see a person ‘stapled’ to a fund for life was passed by the Senate.

The government’s Your Future, Your Super legislation includes a new rule that will see workers ‘stapled’, or tied, to a single fund for life; one that they can take with them from job to job, as they do with a bank account or tax file number.

Tying workers to a single account was the government’s way of ridding the sector of the scourge of duplicate accounts that has plagued it for years.

For Hostplus, the merger has the added benefit of bringing across 96,000 members, many of whom will be young and not very engaged with super, and likely content to be tied to one of the best performing funds in the country.

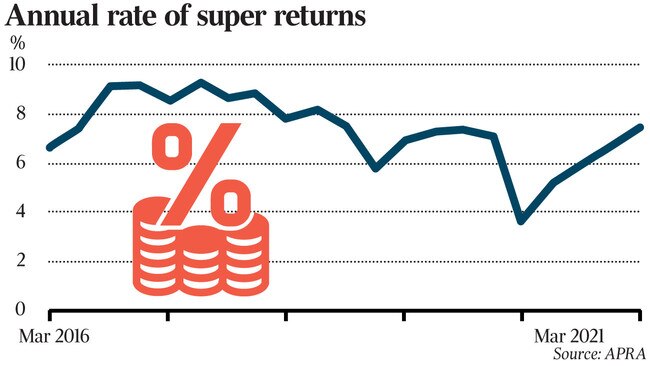

Hostplus’s ‘‘Shares Plus’’ growth option returned 23 per cent over the 11 months through May, above the median growth fund’s 20 per cent return. It is understood to be in merger discussions with a number of smaller super funds.

The move by Intrust to fasten itself to an industry leader comes weeks after APRA piled onto the pressure facing smaller operators, declaring super funds with less than $30bn in funds under management “uncompetitive”.

APRA deputy chair Helen Rowell at the same time fired a warning shot to funds embarking on “bus-stop” mergers, saying small funds should take the “express” route and merge with larger players to be competitive with the sector’s mega-funds.

“The emerging industry view seems to be that any fund with less than around $30bn in assets under management is increasingly going to be uncompetitive against the so-called ‘mega-funds’. While there will inevitably be debate about the threshold level of assets needed, we agree with the sentiment,” she said.

Smaller, underperforming funds should be merging with larger, better performing partners rather than other small players, Ms Rowell added.

“APRA doesn’t intend to let perfection be the enemy of the good. But we expect trustees to consider whether a small fund to small fund (or bus-stop) merger is going to tackle underlying issues or just be a temporary stop on the way to the ultimate destination of sustainability.”

The big super funds have in recent months fielded an unprecedented volume of enquiries from sub-scale funds hunting for new homes, with experts warning APRA’s $30bn threshold could result in “traffic jams” as the small fry line up to be swallowed by their bigger peers.

Just a handful of the 170 APRA-regulated super funds sit above the $30bn threshold, raising the prospect of a period of gridlock.

Last month, AustralianSuper and the $2.7bn Club Plus announced they would work toward a merger, with Club Plus chief executive Stefan Strano saying it was in the best interests of the fund’s members.

“Our declared purpose is to ‘support and enhance the journey of our members to retire on their own terms.’ While most of our members join us at the start of their working lives, we recognise they need support across all stages of life, through careers that may span multiple industries,” Mr Strano said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout