Home and contents insurance premiums spike after floods, storms and bushfires

Floods, bushfires, hail and storms have seen the average home and contents insurance premium skyrocket in the past year.

Rolling natural disasters over the past 18 months including bushfires, storms and floods have sent home and contents insurance premiums skyrocketing, with policyholders in Victoria the most impacted.

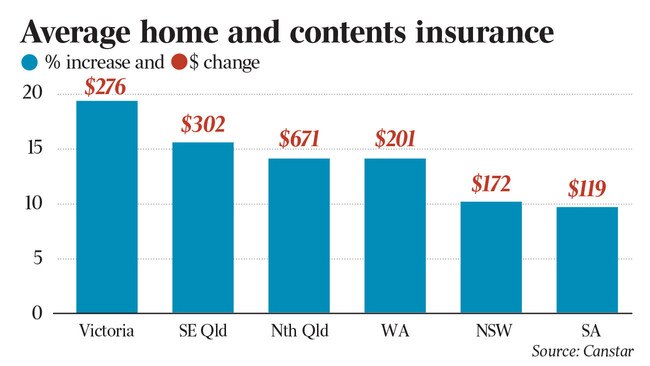

A comparison of sample premium quotes from eight insurers by financial comparison site Canstar has revealed the average yearly cost of $550,000 of building cover and $50,000 of contents cover has shot up by almost 14 per cent in one year.

Victorians, who have now submitted more than 4000 claims relating to last week’s earthquake, saw the steepest increase with the average policy in the state shooting up 19.3 per cent to $1433.

But residents of cyclone and flood-prone North Queensland still have the highest overall average premium cost of $4813, an increase of 14 per cent.

Canstar finance expert and executive Steve Mickenbecker said North Queensland’s higher premiums showed the impact more frequent severe weather has on premiums.

“Canstar’s research confirms that this increase in the frequency and severity of extreme weather corresponds with a rise in home and contents insurance premium prices,” he said.

“We need look no further than the premiums paid in Far North Queensland, to see the effect of natural disasters, as they average more than two times more than the premiums paid in the south of the state.

He added the price hikes also reflected an expectation that there would be heightened severe weather events this summer.

“Insurers don’t wait for a storm before putting premiums up, but apply increases when they form a view that the risk has increased,” Mr Mickenbecker said.

Queensland as a whole had an average premium of $1916, which lifted by 15.8 per cent.

South Australia has the lowest average premium quote, which lifted a comparatively low 9.7 per cent to $1219 in the last year.

The premium price hike comes after insurers were hit with a wave of claims over the past 18 months relating to the 2019-20 black summer bushfires and the hailstorms, floods and storms that followed.

Canstar analysis of Australian Prudential Regulatory Authority data shows these events resulted in more than 116,600 building claims and more than 51,400 contents claims.

The original loss value for all claims relating to the events topped $5.8bn, with the black summer bushfires the most damaging, accounting for more than $2.3bn of that figure.

The figures don’t include the costs of last week’s earthquake, with the Insurance Council of Australia on Monday saying although 4600 earthquake claims had been lodged a figure could not yet be put on the damage.

However, the individual insurer numbers paint a clearer picture of cost.

Allianz has been rocked with 900 claims for an estimated value of almost $12m.

Suncorp has only a “relatively small number of claims”, while QBE has seen 335.

The nation’s largest insurer IAG has received 1461 claims in the days since the quake.

Mr Mickenbecker said it remained to be seen whether the earthquake would contribute to further premium hikes.

“Severe earthquake is an unexpected event and recurrence might not be so readily built into future expectations, but if claims from this earthquake prove to be extreme, premiums will have to go up to recover insurance losses,” he said.

The earthquake reignited insurance industry calls for cross-border travel agreements for claims assessors, with Suncorp CEO Steve Johnston telling shareholders last week Covid travel restrictions were causing a claims backlog ahead of peak severe weather season in summer.

Mr Mickenbecker said the added cost of navigating these restrictions put margin pressure on insurers, further contributing to price hikes.

“Insurance premiums have to cover the costs of doing business, not just the cost of claims,” he said.

“Border closures will be inhibiting the flexibility insurers have in dealing with big events and must surely be adding to the cost of assessing and managing claims. This is likely to find its way into premiums.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout