Healthscope, insurers hit stalemate in funding war

The Private Health Insurance Ombudsman has had to step into a funding dispute between Healthscope and six health insurers.

Australia’s Private Health Insurance Ombudsman has been forced to step into a funding dispute between the country’s second biggest private hospital operator, Healthscope, and a group of six smaller health insurers.

Healthscope and the Australian Health Services Alliance — a peak not-for-profit body which negotiates funding agreements on behalf of the smaller insurers — have entered mediation with the ombudsman after the two parties reached a stalemate. Healthscope said the offer from AHSA wasn’t enough to cover its costs, while the AHSA said Healthscope was asking for too much.

Healthscope, which is owned by Canadian private equity giant Brookfield, gave the AHSA 45 days’ notice last month saying it would not proceed with a new two-year funding contract with six of AHSA members including Australian Unity, CUA Health, Commonwealth Bank's CBHS Corporate Health and CBHS Health Fund, Reserve Bank Health Society and Teachers Health Fund.

If an agreement can’t be salvaged by June 17, members of those funds will be forced to pay higher out-of-pocket costs if they are treated at Healthscope hospitals, which include Northern Beaches Hospital and Prince of Wales Private Hospital in Sydney, and Melbourne Private Hospital and Knox Private in Victoria.

But members can switch into other funds that have funding agreements with Healthscope after the federal government made it easier to change insurers in its reforms introduced in late 2018 to simplify the sector.

A Healthscope spokesman said company representatives had a mediated bargaining session with the AHSA in an effort to resolve the contractual dispute.

“While the formal mediated bargaining process has now concluded, we remain in ongoing discussions with the AHSA,” the spokesman said.

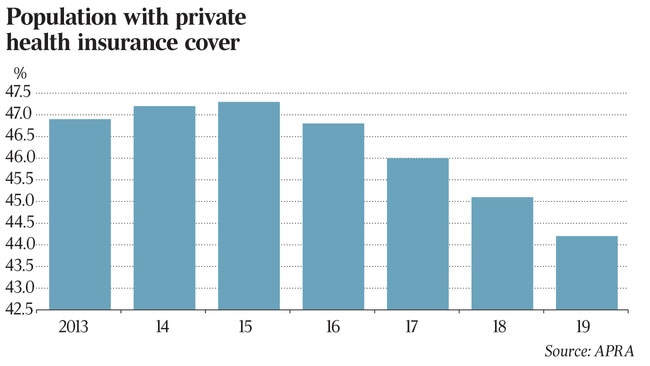

Negotiations between health funds and hospitals are becoming increasingly robust, with private hospitals claiming health insurers are passing on a fraction of the government mandated premium increases. Meanwhile, health insurers have been facing growing cost pressure as younger Australians withdraw their policies, with 11,176 people aged 25-29 and an additional 9565 aged 30-34 abandoned their cover, according to the regulator.

Healthscope said last month that the rate AHSA offered was “simply not enough to allow our hospitals to meet their costs”.

“After several months of negotiations, we have made the difficult decision not to recontract with six health funds represented by the AHSA,” a Healthscope spokesman said at the time.

“This decision was not taken lightly. But we need to ensure that our contracts with private health insurers reimburse us for the work our people do every day, and allow us to invest in our facilities and equipment so we can continue to deliver world-class care for patients.

“Health fund premiums charged to members of these funds went up more than 3 per cent last year, but the rate they proposed to pass through to us as the actual service provider is significantly less. There is a disconnect that needs to be addressed for private hospitals to remain sustainable.”

But in a letter to its members sent on May 26 CBHS Health Fund argued that Healthscope’s proposed changes to the funding contract were not acceptable.

“Healthscope’s proposed terms meant charges for hospital admissions would be much higher than we consider acceptable,” CBHS chief executive Andrew Smith wrote to the fund’s members. “Agreeing to these changes would also put significant pressure on keeping your premiums as low as possible.

“If we are unable to resolve this issue and you attend a Healthscope hospital for a procedure or treatment, you are likely to experience out-of-pocket costs.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout