Hayne shadow hangs heavy over financial system after landmark royal commission

The financial sector today is a very different place to the industry which faced the Hayne commission in 2018.

Australia may still have four big banks, a quartet of major insurers, and a wealth of funds and firms that predominated in the economy before 2018, but scratch the surface and the financial sector is a very different place than it was five years ago.

The titans of the industry have been cruelled, bancassurance is on its last legs, while vertically integrated wealth and advice has faced the trash heap.

Australia’s banks have returned, largely, to banking with many of the financial empires assembled over the 2000s torn down in the wake of the royal commission into misconduct in the banking, superannuation and financial services industry.

Many of the wealth managers that featured on skylines around the country are no longer there, while retirement giants and super heavyweights have faced market shifts and costly remediation bills.

Regulators also face a new reality, with renewed oversight along with heftier powers and more punishing fines to wield.

But for many, the work of Kenneth Hayne’s royal commission remains unfinished, while others are desperate to put the annus horribilis behind them and unhappy to relive the experience.

Some banks prepared for the coming storm, with the likes of Commonwealth Bank assembling a media team almost 20-strong to respond to the public assault on the lenders’ reputation.

CBA came to the royal commission armed with a new chief executive, Matt Comyn, but decades of poor behaviour within the bank’s wealth units on top of explosive money laundering failures revealed in 2017 saw it forced to supplicate itself before Hayne.

CBA axed almost $13bn worth of business units in the wake of the commission after it was forced to admit years of failures.

AMP remains a shadow of the former heavyweight, with sources noting it failed to appreciate the approaching storm with just one staff member put on to deal with the media firestorm that consumed its CEO and chair.

Former AMP chair David Murray, who pulled the company out of its post-royal commission funk, told The Australian the firm faced a “star chamber” in a “politically motivated” inquiry. “AMP and the industry really didn’t have a chance of putting up with this star chamber stuff,” he said.

The royal commission also claimed the scalps of NAB boss Andrew Thorburn and chair Ken Henry after Hayne took aim at the two over their car crash appearances, singling the men out in his final report.

“I thought it telling that Dr Henry seemed unwilling to accept any criticism of how the board had dealt with some issues,” Hayne wrote. “I thought it telling that Mr Thorburn treated all issues of fees for no service as nothing more than carelessness.”

Westpac boss Brian Hartzer and chair Lindsay Maxsted also stepped down in the wake of the royal commission after their bank was subsequently rolled by Austrac over allegations of massive money laundering failures.

Many of those who lost their jobs after the royal commission have since resurfaced, but others remain in the wilderness.

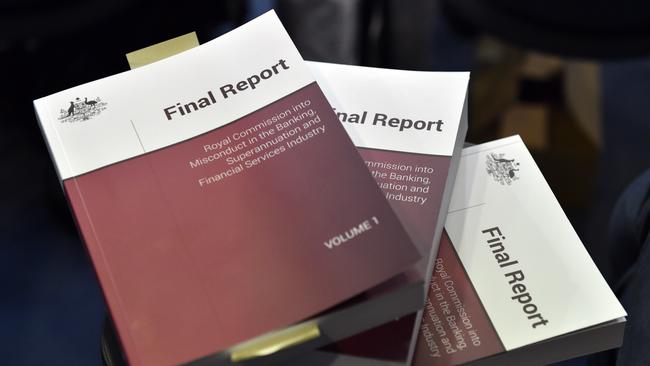

With hearings running across 68 days and more than 130 witnesses called and 10,000 public submissions scrutinised, the royal commission landed with a thump on February 1 when handed to the Morrison government.

At 326 pages across three volumes, the final report from Hayne made 76 separate recommendations for the government to clean up the financial sector.

While it was former treasurer Scott Morrison and prime minister Malcolm Turnbull that kicked off the commission, after months of pressure after a drip feed of scandals surrounding the financial sector, it was Morrison and his treasurer Josh Frydenberg who were charged with implementing its recommendations.

Some have criticised the Morirson government for its response to the royal commission, after Frydenberg issued ASIC guidance and the regulator dropped its catchcry “Why not litigate”.

But the members of the Morrison government are understood to be highly satisfied with their response to the royal commission, pointing to the speed of their response and the significance of the legislative package that followed.

APRA chairman John Lonsdale said there had been a number of important changes since the Hayne royal commission. “Some of them you can see the effects, but there’s a pool of it I think is yet to play through,” he said.

The Hayne report called out a soft-touch by regulators, pointing the finger at APRA over its approach to the banks. Mr Lonsdale said APRA had since adopted a more proactive and tougher approach to enforcement.

ASIC, which faced an excoriation before the commission, nearly faced being carved up after the regulator’s culture came under scrutiny. Former ASIC deputy chair Daniel Crennan said the royal commission delivered a “more focused and powerful financial conduct regulator”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout