Westpac boss says: reforms needed over rate cuts

The head of Westpac Brian Hartzer says a rate cut won’t get Australia out of the doldrums.

Westpac chief executive Brian Hartzer says the nation has an unhealthy obsession with rate cuts that will not deal with the cause of Australia’s economic slowdown, as he urged policymakers to seek out reforms and inject confidence into the business sector.

After handing down a 22 per cent slump in Westpac’s interim profit to $3.3 billion, Mr Hartzer also called for investor calm over renewed trade ructions between the US and China.

Locally, he thinks tax reform in the business sector and cutting red tape will prove more beneficial to the economy than interest rate cuts. Although a cut may spur some life in consumer spending.

“Everyone has been obsessed with this question about whether or not the cash rate should be cut … that is dealing with the symptom — it’s not the cause,” Mr Hartzer told The Australian.

“The question is why isn’t growth stronger? I think we have to look at policy settings as being important for giving businesses and investors confidence to invest. It’s important whoever is in government can push reform.”

Mr Hartzer said Westpac wanted to see more detail on the federal government’s proposed private equity-style growth fund before committing any capital.

The fund is being set up to take passive stakes in small businesses, yet the government is finding it difficult to get industry on board.

While sharemarkets were hit yesterday by increased trade tensions between the US and China, Mr Hartzer said a knee-jerk reaction to comments by US President Donald Trump were not warranted, as the parties had been close to an agreement.

“We are certainly concerned. The Australian economy depends on a vibrant Chinese economy,” he said.

“To be honest, I think it’s a bit premature to be too worried about this.”

Westpac expects the local economy to remain under pressure but to still expand at 2.2 per cent this year, and home loan growth to slow to just 2.5 per cent in the year to September 30 next year.

Mr Hartzer sees some stabilisation in the lacklustre housing market, but is loath to call a bottom.

“Starts to new development have fallen off, so over the next few months we would expect the incremental supply would stop going up,” he said.

“Inherent growth from population and potentially more confidence from investors comes back and you’d expect those two things to balance out.

“My sense is that happens over the next three to six months, but whether that translates into the confidence people want to go and buy will depend on other factors.”

Westpac’s cash profit for the six months to March 31 came in slightly lower than analyst expectations, with all its divisions posting lower earnings bar New Zealand, which had a stronger half. The result was hit by provisions for customer remediation of $617 million.

Westpac’s accounts round out the profit season for the three major banks that have a March 31 half year. Commonwealth rules off its financial year on June 30.

PwC Australia’s look across the sector put interim profits at $14.5bn, down 5 per cent on a year earlier and the lowest first half since 2014.

Firetrail Investments analyst Scott Olsson labelled Westpac’s result soft and noted it was weighed on by $94m in insurance claims from severe weather events.

“They had quite large insurance claims which were a negative surprise to the market,” he said, noting that the big four banks all confronted a challenging environment to grow profit. “EPS (earnings per share) growth looks very challenging to achieve for the next couple of years,” Mr Olsson added.

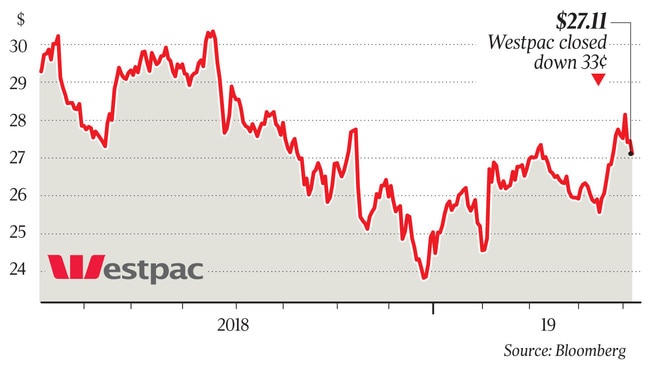

Westpac’s shares fell as much as 2.3 per cent before closing 1.2 per cent lower yesterday at $27.11.

The net interest margin — what it makes on loans after funding costs — fell four basis points to 2.12 per cent in the half compared to the prior six months, excluding treasury and markets operations.

“A disappointing top-line result, marred by a combination of cyclical, structural and self-imposed impacts,” Citigroup analyst Brendan Sproules said.

“Investors should take heed of our view of Westpac taking a more expansive view on remediation to peers in this result.”

Westpac has provisioned $1.4bn pre-tax over the past three years to work on customer remediation programs, including $1.2bn for refunds.

Westpac’s net interest income fell 4 per cent in the half, while fee income slid 32 per cent to $1.7bn. The New Zealand division’s earnings were buoyed by loan and deposit growth in the half, while the consumer bank saw an 11 per cent drop over the period but a 7 per cent rise on the prior six months. The wealth unit — which has been subsumed into business and consumer bank — saw sharp losses of $305m.

Business banking was hit by customer refunds and lower earnings while financial markets income weighed on the institutional bank.

Westpac’s stressed loan exposures ticked up to 1.1 per cent of its total and loans 90 days past due rose 10 basis points. But Mr Hartzer said, while there may be a gradual rise, the bank was not seeing anything “that causes concern”.

Westpac’s operating expenses increased on the half, on remediation and restructuring. Excluding those items, expenses fell 3 per cent, helped by a cut in full-time staff of 788.

Mr Hartzer said productivity was a priority and committed to deliver a target of $400m in savings over the full year.

The common-equity tier-one ratio printed at 10.64 per cent, above the banking regulator’s “unquestionably strong” threshold.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout