Half-price Macquarie battered by market

Macquarie Group’s stock has almost halved in value during the COVID-19 market rout.

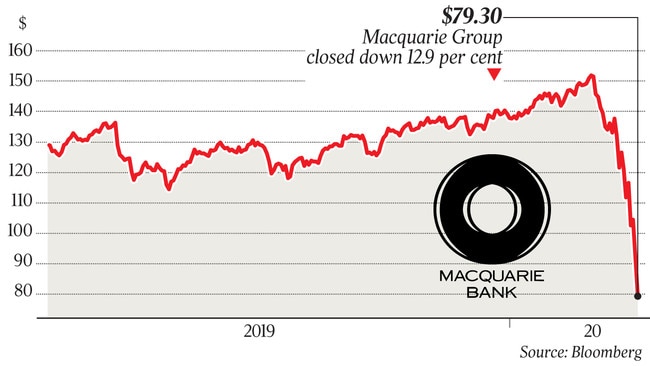

Macquarie Group’s stock has almost halved in value during the COVID-19 market rout, as investors pummelled its shares on fears related to tumbling oil prices, sinking asset prices and funding market fragility.

The asset management giant and investment bank’s stock closed almost 13 per cent down on Thursday at $79.30, a massive 47.7 per cent drop from its most recent high, hit in February.

Investors have punished Macquarie and other financials amid a sharp market correction in the past two weeks, as fears of a global recession increased due to the spread of coronavirus.

“Macquarie is leveraged to market conditions, so is likely to sell off in the current environment given the sharp drawdown and volatility being experienced across all asset classes,” said Opal Capital Management portfolio manager Omkar Joshi.

Macquarie’s business units span areas including infrastructure investments, energy assets and trading, fixed income, equities trading, banking and deals advisory. The group does, however, benefit from a lower Australian dollar as it earns about 69 per cent of its income offshore.

During the depths of the global financial crisis Macquarie’s shares tanked to $14.75, and its local rivals at the time, Babcock & Brown and Allco Financial Group, didn’t survive the funding crisis and market downturn.

Macquarie used that crisis to shift its businesses away from a heavy reliance on markets, and the group now earns about 60 per cent of its income from annuity-style investments, with the rest reflective of revenue from financial and commodity markets.

The Reserve Bank’s newly announced $90bn, 0.25 per cent funding facility for banks, which can be drawn on as lenders seek to boost business loans, will be positive for Macquarie.

For the year ended March 31, however, Macquarie chief executive Shemara Wikramanayake has already cautioned investors that profit will print “slightly down” on 2019’s $2.98bn record.

Last year benefited from large performance fees earned by Macquarie on asset sales including Quadrant Energy and online settlement group PEXA.

Bell Potter banking analyst TS Lim this week cut his Macquarie price target to $146 from $158, and lowered his profit estimate by 8 per cent due to expectations of softer asset management and advisory income.

But he left his “buy” rating unchanged and names Macquarie as his standout pick in the banking sector, saying the company’s strong balance sheet bodes well for dividend payments to be maintained.

“As the top pick in our coverage universe, we view the group as a long-term ‘cash and growth’ story — so look past all the current market noise.

“Macquarie’s investment proposition is also underpinned by a strong balance sheet, risk management capabilities, ability to deploy resources across the group to generate returns in excess of those of its peers, ongoing cost discipline, adaptability to changing market conditions and access to value-adding global growth options,” Mr Lim added.

Macquarie has surplus capital of $5.8bn.

Last week, though, its bank withdrew a $500m issue of capital notes as volatility in secondary markets made investors question the deal’s pricing.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout