Hailstorms hit IAG insurance margin guidance

IAG has cut its full-year insurance margin guidance range because of claims related to recent hailstorms.

Insurers are being tested with their toughest summer yet as hail, fires, storms and floods wreak havoc across the nation, inflicting a damage bill of more than $2bn — and with the typically hottest and driest month of the year still to come.

Insurer IAG, which has been most exposed to the recent natural disasters, was on Friday forced to cut its profit guidance for the full year as it raised its assumptions for natural disaster claims following destructive hail storms in Sydney, Canberra and Melbourne.

But some analysts are warning that its assumptions may still be too optimistic and do not allow for the prospect of further disasters in the coming months.

“It looks like there’s greater risk to the downside (for IAG). I don’t think they’ve got headroom to accommodate for another large event; the allowances they’ve provided for haven’t allowed for it,” Morningstar analyst Nathan Zaia said.

“So if we do see another single event above $100m, that’s gonna hit them … and the margin they’d expect to make will fall again.”

IAG told shareholders it now expected its insurance margin for the year to come in at between 14.5 per cent and 16.5 per cent, down from the previously forecast 16-18 per cent.

The margin squeeze was partly due to it assuming higher net natural peril claim costs, it said. IAG raised its net natural peril claim costs by $74m to $715m for the year and said claims from the hailstorms would cost it $169m, pre-tax.

The insurer also flagged that gross written premium growth would come in at just 1.4 per cent for the first half of the financial year, a result it said was consistent with the “low-single-digit” guidance given earlier in the year, but which disappointed analysts.

“I think the market saw the 1.4 per cent gross written premium as lower than expected,” Bell Potter analyst TS Lim said.

“I’d say a lot of people thought it would be slightly more than 2 per cent, so it’s weaker in that sense and I think that’s why we’re seeing the share price reaction.

“They have been disproportionately hit by bushfires and hailstorms because they have a greater footprint in NSW and Victoria … but the underlying business is still sound and the underlying margin is still strong.”

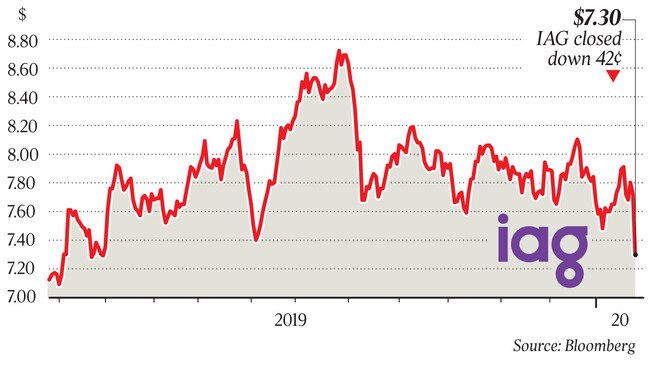

IAG’s shares tumbled 6.4 per cent at the open on Friday, its biggest drop in 17 months, before paring some of the losses. They closed down 42c, or 5.4 per cent, at $7.30.

Managing director and CEO Peter Harmer said: “We are pleased with our underlying business performance, which continues to track in line with our expectations, both at the GWP and underlying margin levels, and in terms of the net benefits being realised from our optimisation program.

“We have, however, revised our reported insurance margin guidance for the full year, to reflect the recent heavy natural peril activity and a reduced expectation for prior period reserve releases following the lower-than-anticipated first-half net reserve release outcome.”

The revised net natural perils cost estimate assumes that no further major events occur before June 30, with year-to-date net natural peril claim costs estimated at $608m.

IAG has so far received more than 28,000 claims related to the hailstorm event, the majority of which were for housing and motor damage, it said. That’s about half of the total 55,650 claims filed across the industry, worth about $514m.

The Insurance Council also told The Australian that since November more than 20,000 claims had been filed related to the bushfires, worth $1.65bn.

IAG separately said it had received 9200 bushfire-related claims since September, at a cost to the insurer of $160m, at which point its reinsurance cover kicked in.

The insurer also flagged an $80m provision for the first half related to customer refunds it issued after it failed to properly discount premiums. The provision will be excluded from cash earnings for dividend calculation purposes, it said.

“This issue was identified as part of a proactive review of our pricing systems and processes which is ongoing,” Mr Harmer said.

“We’re disappointed that some of our customers have not received the full premium discount they should have.

“We will put this right as quickly as possible.”