Greedy banks ‘inhibit stimulus’

Banks’ outsized returns could ‘inhibit’ the RBA’s attempt to revive the economy with rate cuts, according to a new analysis.

Australia’s biggest banks have “rarely been more profitable” and the sector’s habit of squeezing customers to deliver outsized returns for shareholders could “inhibit” the Reserve Bank’s attempt to revive the economy with rate cuts, according to a new analysis.

The boards of major banks are demanding their senior management teams generate a return on equity of 5.5 per cent above their cost of capital, according to the research by UBS analyst Jonathan Mott.

He said the profit target was “concerning” given the sector was facing low interest rates, stricter compliance following the royal commission and tougher regulation of capital buffers in the event of a crisis.

The Morrison government will this week introduce legislation aimed at eroding the power of the major banks, with the consumer data reforms allowing customers to switch lenders and more easily compare products.

Mr Frydenberg yesterday said the reforms would “give consumers more power” and lead to “better prices for customers”, and they would be extended to the energy sector and telecommunications.

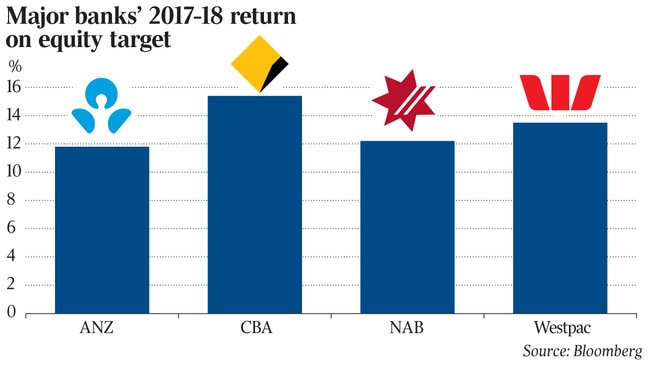

Meanwhile, Mr Mott questioned whether the return on equity targets of Commonwealth Bank, Westpac, ANZ and National Australia Bank — a key indicator of profitability that measures the amount of money shareholders receive for each dollar invested — were “justifiable or sustainable” when the sector’s ability to pummel customers with high interest rates and fees was diminishing as frustrated borrowers and savers began to leave the big four banks for a better deal at smaller lenders.

The banking sector defied Josh Frydenberg after the latest round of RBA rate cuts, refusing to fully pass on the central bank’s rate reductions to customers.

The RBA cut interest rates twice over June and July, slicing 50 basis points off the cash rate, but Commonwealth Bank and NAB reduced their standard variable mortgage rates by only 0.44 percentage points, ANZ dropped its rate by 0.43 percentage points while Westpac held back the most, lowering its rate by just 0.4 percentage points.

Due to years of holding back partial amounts of RBA rate reductions to support their own profits, the difference between the cash rate and the standard variable mortgage interest rate offered by the banks has risen to a 25-year high of 3.94 percentage points.

Although the RBA cut the overnight cash rate by 25 basis points on July 2, CBA will not pass on its incomplete 19 basis point rate reduction to its 1.6 million home loan customers until today. The delay boosted CBA’s interest income by an extra $43 million over the three weeks since the cuts.

Mr Mott said the big four banks “have rarely been more profitable relative to their cost of capital” and that their profit targets were consistent with a pre-financial crisis environment following the deregulation of the financial sector in the 1990s.

“Across the four majors we estimate that the banks’ budget or target return on equity is around 13.5 per cent, which implies a target or budget return on tangible equity of around 15 per cent,” Mr Mott said.

“If management are held to these targets — especially for remuneration purposes — there is an incentive not to pass further RBA interest rate cuts through to borrowers given the negative impact on net interest margins,” he said. “Thus, it is also arguable that such elevated return on equity targets by the banks may inhibit the effective implementation of monetary policy.”

Currently, only Westpac has an “explicit” target rate of a return of between 13-14 per cent. However, executive remuneration packages at CBA, NAB and ANZ imply a management is being asked to achieve a return target of about 13.5 per cent, according to UBS.

The returns of Australian banks are about double that of the large banks in Europe and Japan, and still higher than lenders in the US.

RBA governor Philip Lowe earlier this year questioned how profitable the banking sector was compared to international peers. “I don’t know how long that’s sustainable,” he said.

Along with reductions in the cash rate, the local banking sector has also benefited from tumbling short-term interest rates offered on international money markets, which have slid to their lowest point since 2017 — before the banking royal commission began. However, banks have been reluctant to pass on the savings to customers.

Before the Global Financial Crisis, the difference between the RBA cash rate and what the banks charged borrowers was a margin of less than 2 per cent. Since 2008, that profit margin has progressively increased and now sits at close to 4 per cent. The same has happened to interest rates offered to small business borrowers.

Meanwhile, savers have been short-changed with ultra-low rates on deposits and term deposits, with banks slicing interest rates by more than the RBA’s 25 basis point reduction. Data obtained by The Australian from industry consultants Canstar shows 22 per cent of 12-month term deposits offer a rate under 2 per cent, which is lower than the central bank’s forecast for inflation.

Former chair of the House of Representatives economic committee, Liberal MP David Coleman, found that since the turn of the millennium, the banking sector had made 19 changes to interest rates when the RBA had not made a decision and that 18 of those hurt consumers.