ANZ boss tips devastating downturn

ANZ chief executive Shayne Elliott has brushed off hopes for a ‘V-shaped’ recovery from the COVID-19 crisis.

ANZ chief executive Shayne Elliott has brushed off hopes for a “V-shaped” recovery from the COVID-19 crisis, warning of a severe economic downturn that will be “devastating” for some people and that it could take three to five years for employment to recover.

In some of the most pessimistic commentary from a business leader about the likely depth and duration of the upheaval, Mr Elliott said interest rates were likely to be lower for longer, and behaviour would change for the long-term, including attitudes to risk, use of technology, management of supply chains and ways of working.

“We’re not doomsayers, but the idea of a V-shaped recovery is really hard to imagine,” he told The Australian.

“I’ve had more conversations with customers in four weeks than in the last four years, mostly with the big end of town, and I think a lot of them will be really cautious about going back to normal.”

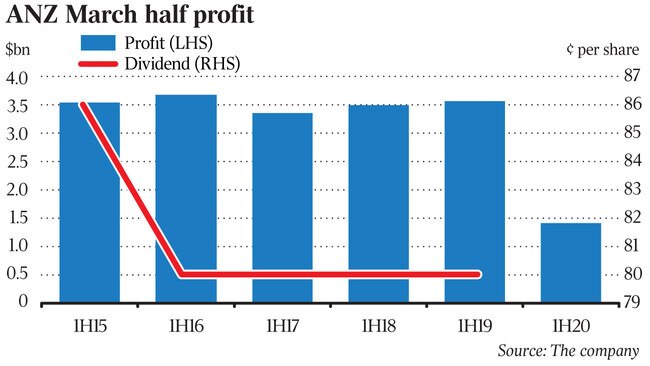

The grim outlook came as ANZ reported a 60 per cent slide in half-year cash profit to $1.41bn, with the board pushing back its decision on the interim dividend until there was more clarity on the economic impact of the pandemic.

“The crisis is evolving at such a pace it is difficult to predict how deep the economic impact will be, or how long the recovery will take,” he said.

While the dividend will be reconsidered in the lead-up to the August trading update, ANZ in the meantime is preserving as much as $1bn cash, based on last year’s interim payout.

The main impact on statutory profit was a $1.7bn charge for provisions, up from $402m in the previous half, including a $1.3bn “economic provision” as the bank braces for a surge in bad debts stemming from COVID-19 fallout.

The individually assessed provision charge was $626m, up $228m from the second half of 2019. At the same time ANZ wrote down the value of investments in across its Asian businesses by $815m, largely due to the impact COVID-19 is having in those markets.

ANZ’s return on equity got smashed from 12 per cent to 4.7 per cent as a result of the profit jolt, with the group’s common equity tier one ratio also taking a hit, down from 11.5 per cent a year ago to 10.8 per cent.

Despite this, Mr Elliott said the result was “reasonable”, given the tough trading conditions before the crisis hit.

The earnings numbers came as figures released by the Reserve Bank showed business lending jumped by 2.9 per cent in March, the fastest growth in more than three decades as companies rushed banks to secure funds to ease a cash flow crunch. The figures took annual growth in business credit to 6.3 per cent.

ANZ, Mr Elliott said, maintained its focus on productivity, reaffirming the target to slash group expenses from $8.7bn to $8bn, and promising to freeze salaries and cut variable pay while sparing junior staff and frontline workers in call centres and the branch network.

ANZ also continued to target balance sheet growth in its preferred segments such as owner-occupied mortgage lending.

Loan losses heading into March were at historically low levels, and the bank was well-positioned to manage the higher credit charges flowing from COVID-19.

On a stronger day for the sector, ANZ put in the weakest performance of the big four, the stock lifting 24c, or 1.4 per cent, to $16.90.

UBS analyst Jon Mott said the market was likely to focus on the lower-than-anticipated common equity tier 1 ratio, and the loan drawdowns by institutional clients which was the big contributor to growth in risk-weighted assets.

“Will these continue to drag on capital?” Mr Mott asked.

“The dividend deferral appears prudent until there is more certainty on the outlook for the economy and asset quality.”

Mr Elliott said ANZ was a bank and therefore it paid to be “conservative and cautious”.

However, he outlined a future in which there would be no low-debt countries, larger governments, more localised manufacturing, and reformed health systems.

Education and tourism would require significant innovation to survive and prosper.

“The crisis is evolving at such a pace, it is difficult to predict how deep the economic impact will be, or how long the recovery will take,” he said.

“As a result, this will be the most profound challenge many will have faced in their lifetime, including some of our own people.”

With the outlook extremely uncertain, Mr Elliott said it was prudent to tolerate short-term use of capital buffers that could see the bank’s CET1 ratio dip below 10 per cent for short periods of time.

“I need to be clear — this does not mean it is our plan to operate below 10.5 per cent; rather it is an acceptance that given high levels of uncertainty, and the multiple variables, we should allow for the possibility that even managing prudently may result in periods where our CET1 dips below that threshold and perhaps below 10 per cent,” he said.

On a more optimistic note, ANZ was open for business and experiencing record volumes in areas like home-loan refinancing applications and financial markets activity, with dramatic falls in ATM and branch transactions. Chief financial officer Michelle Jablko said the collective provision balance was based on weighting the probability of four macroeconomic scenarios — a base case representing the bank’s current economic forecast, as well as upside, downside and severe stress cases.

The base case assumes a 13 per cent slump in GDP in the June quarter and a 4.7 per cent contraction in 2020 before a 4.1 per cent recovery the following year.

The June quarter unemployment rate spikes to 13 per cent, and then lowers to 9 per cent in 2020 and 7.3 per cent in 2021, while house prices fall 4.1 per cent this year and 6.3 per cent in 2021.

Under the pure base-case scenario, the collective provision balance is $4.3bn as at March, or $6.5bn under the severe scenario.

Under NAB’s base-case scenario, released on Monday, unemployment in the June quarter is 11.7 per cent. NAB this week set aside a little over $800m for expected losses linked to COVID-19.