Four MySuper funds notch up second fail on APRA test, must close to new members

Four MySuper products will be forced to close to new members after failing a key performance test for a second time, just as the test itself is set to be the subject of a Treasury review.

Four MySuper products will be forced to close to new members after failing a key performance test for a second straight year, just as the test itself is set to be the subject of a Treasury review.

The Australian Prudential Regulation Authority released its latest annual performance test for the $884bn MySuper part of the $3.3 trillion retirement savings market on Wednesday.

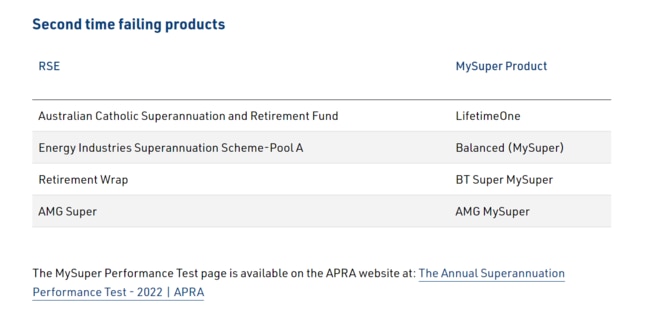

It is a metric that is used to boost accountability for funds that have flailing performance. Funds that notched up a second fail result – across 69 products assessed – came from the Australian Catholic Superannuation fund, Westpac’s BT Super MySuper, Energy Industries Superannuation Scheme and AMG Super.

The latest results come as Treasury readies to review the test as part of an analysis of how the Your Future, Your Super laws are operating. A consultation paper is expected to be released by the new government in coming weeks.

Financial Services Minister Stephen Jones last month said he was aware of concerns the test and other accountability measures may discourage certain investment decisions or infrastructure investments, which could lead to “perverse or unintended outcomes for members”.

The performance test takes into account factors including net investment returns, asset allocation, fees and costs. It typically makes an assessment over an eight-year period, if the fund has been established long enough.

One criticism of the test is that it does not take into account a fund’s risk appetite or risk-taking when assessing its performance.

Funds that fail the annual test – by underperforming a government benchmark by 0.5 percentage points – must notify their members. But if they get that result for two straight years the consequences are severe and the fund’s product must stop accepting new members.

The 2022 result saw five funds fail overall. The Westpac Group Plan MySuper product notched up a first-time fail result this year.

The overall results mark a notable improvement on last year. Last year, 13 products failed the inaugural test including BT Super’s MySuper product, Christian Super’s My Ethical Super product and Colonial First State’s FirstChoice Employer Super.

MySuper funds are a default option that are deemed to be simpler and lower-cost in the form of a balanced product.

APRA member Margaret Cole said the annual MySuper performance test was “driving change and improvements for members”.

“It’s an important feature of the landscape,” she said, adding that the regulator was supportive of Treasury’s review but it was for others to decide if further parameters should be added to the performance test.

“It’s entirely appropriate that two years into this format of the performance test there should be a look at how it is working in practice, whether any tweaks need to be made, whether there are any issues that need looking at again.

“I will be supportive of that process and we do think that performance tests are a feature of the landscape that’s here to stay and that’s important for us in utilising it to drive change and positive change … you’ll see as far as we’re aware that fairly soon Treasury will issue their paper with questions for feedback for those who want to give it,” Ms Cole added.

The five funds that fell short of the 2022 performance test collectively manage almost $28bn in retirement savings. Trustees of products that failed the test for the first time in 2022 must notify their members of the result by September 28. Of the four products that failed for a second year, three were offered by trustees that are exiting the industry, given a wave of mergers and acquisitions across the sector.

Ms Cole said plans were under way for the more than 500,000 members of those three products to transfer to new MySuper products before the 2023 performance test.

Westpac agreed in May to sell its $37.8bn BT superannuation unit to Mercer Australia, while EISS is in talks to merge with larger fund Cbus.

Australian Catholic Superannuation last month signed a successor fund transfer agreement with the larger UniSuper to facilitate a merger.

A BT spokeswoman said the bank was “disappointed with this (performance test) outcome” and had announced its intention to merge the BT personal and corporate super funds with Mercer.

“Mercer Super passed this year’s APA (APRA performance test),” she added.

“We have worked hard to improve member outcomes, including reducing fees, and the outcome was mainly due to some periods of underperformance, particularly in the 2014-15 financial year and in last year’s turbulent global markets.

“We continue to work in our members’ best financial interests and by being part of a much larger Mercer fund BT members will have the potential to benefit from stronger performance, lower fees with most members to see a fee reduction of around 25 per cent off standard fees, more investment choice and broader members services.”

Ms Cole said APRA had certain powers to “nudge and encourage” fund mergers where they made sense, and at times discussed with policymakers the potential for it to receive new powers to compel mergers.

The performance test was introduced as part of the former government’s Your Future, Your Super reforms, which were aimed at boosting efficiency, transparency and accountability in the superannuation industry.

But the not-for-profit Conexus Institute has lobbied for changes after saying it had “serious deficiencies” and that funds could manage super for the purpose of passing the test, rather than members’ best interests.

Ms Cole shrugged off any suggestion that funds were seeking to game the test.

“I wouldn’t describe that as gaming the system … it’s produced a lot of intense focus on performance and fees, and some have certainly adjusted their fees with making sure that they pass in mind. But I don’t think that’s a bad thing,” she said.

Ms Cole said the performance test has contributed to about 5.1 million MySuper members, or just over 38 per cent, paying lower fees than they were in 2021.

The Australian Taxation Office website provides a comparison tool called YourSuper that ranks MySuper products on seven-year net returns, fees and investment performance.

APRA also conducts a broader heatmap analysis of super funds across the entire sector.

The latest test results come as the industry digests draft proposals to overhaul finance advice, contained in a review by Allens partner Michelle Levy. The proposed reforms include broadening the definition of personal advice, while general advice would no longer be counted as a financial service.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout