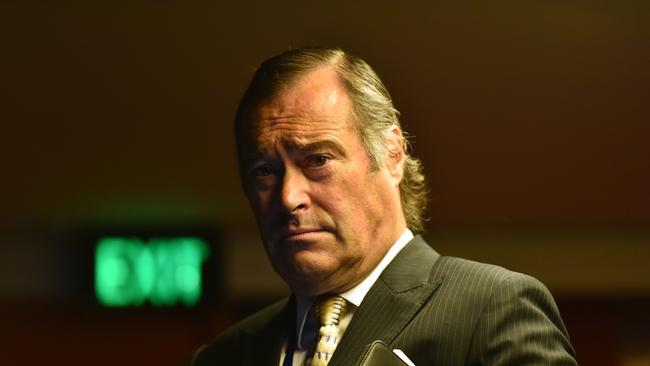

Former Humm chair and major shareholder Abercrombie says Latitude offer too low

The outspoken former chairman of Humm has started a shareholder campaign to trigger a ‘no’ vote against the $320m sale of its BNPL unit to Latitude, labelling offer the ‘too low’.

Humm’s former chairman Andrew Abercrombie has come out swinging against the proposed $320m sale of its consumer finance unit to Latitude – and says he will write shareholder and create a purpose-built website to argue against the deal.

Mr Abercrombie, who remains on the Humm board and owns 20 per cent of the company, said the price was too low and the other directors who recommended the offer are not acting in the best interests of shareholders. “They have a selfish reason for making it happen,” Mr Abercrombie told The Australian. “They have a vested interest in the share price … I want to drive the value.”

The proposed sale of Humm’s buy now, pay later business has seen extraordinary twists and turns, with the company on Monday warning the unit had been unprofitable on an unaudited basis in the four months to April 30 after accounting adjustments, and urging shareholders to accept the offer.

Mr Abercrombie said it was “insincere” for the majority board to “cherry pick one particular item,” adding that volume growth had risen 20 per cent and profitability had declined because of a planned increase in expenses relating to the company’s UK roll out.

The once-hot BNPL industry has suffered a fall from shareholder grace in recent years. While consumer usage of this method of credit has surged, so too have bad debts and fears the industry will soon face a much tougher regulation.

Humm shareholders will vote on the sale on June 23r. A majority of directors have recommended accepting the offer and an independent expert’s report stated the offer price was fair.

Mr Abercrombie said the Humm board should not have accepted the offer without seeking others or entered into an exclusive agreement with Latitude.

However Humm chairman Christine Christian, said there was nothing stopping other companies making an approach.

“The agreement with Latitude does not include any exclusivity restrictions, no-shop, no-solicit clauses or break fees,” Ms Christian said. “If Andrew is aware of any bidders … he should make this information known. If Andrew is seeking to make a bid or increase his holding, he should openly table an offer for all shareholders to consider.”

Latitude announced its takeover offer of 150 million Latitude shares and $35m in cash in January against a challenging backdrop for other players in fintech and personal lending.

“Scale in financial services at the moment is critical and Humm can’t do this alone,” Ms Christian said. “This latest noise demonstrates why independence on the board is required when reviewing this kinds of options,” she added. “This is for all shareholders, not one.”

Meantime UBS said in a research note that the information from the Humm majority directions that business wasn’t profitable, combined with the challenge macroeconomic conditions and the fall in value of the BNPL sector, lead it be supportive of the sale to Latitude

“In light of this information, we believe the sale makes sense for shareholders,” UBS said in a research note.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout