Former CBA boss Ian Narev could forgo up to $16m in pay in wake of governance disasters

Former CBA boss Ian Narev will forgo up to $16m as a result of the Austrac laundering scandal and a damning APRA report.

Commonwealth Bank’s run of governance disasters has blown a gaping hole in Ian Narev’s pay, with the former chief executive forgoing up to $16 million as a result of the bank’s multiple money laundering transgressions and APRA’s damning report on the group’s culture.

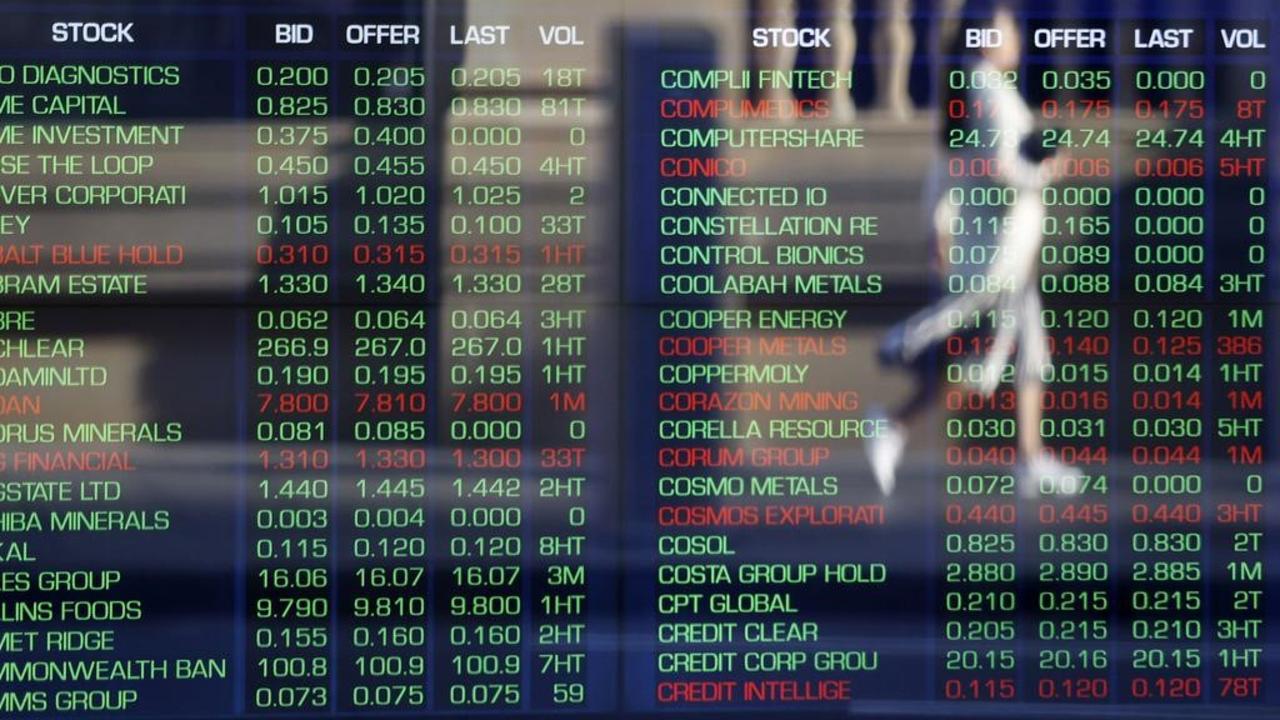

CBA’s annual report, released earlier today, also revealed that 2018 remuneration for all employees including non-executive directors was slashed by more than $100m over the 2017 and 2018 financial years.

But it was Mr Narev who suffered the biggest hit after leaving the bank on April 9 and taking a period of gardening leave until June 30.

The ex-CEO’s maximum pay for last year will be a touch shy of $6m, including a pro-rata cash component of $2m and up to $3.98m of share rights that have converted to equity.

Against that, Mr Narev had to give up $2m in targeted, short-term remuneration and a whopping $13.9m in long-term performance rights.

In the new, straitened environment, the target remuneration of new chief executive Matt Comyn has been lashed by 17 per cent to $8.4m compared to $10.1m for Mr Narev.

The main difference is a reduction in the maximum, long-term bonus from $4.8m to $4m.

In setting Mr Comyn’s remuneration, CBA said in the annual report that it had taken into account the pay of market peers and “broader stakeholder and community expectations”.

CBA remuneration committee chair David Higgins said in a letter to shareholders that the board and Mr Narev had agreed that the ex-CEO would not get any short-term variable pay in 2018 or any of his unvested long-term variable remuneration.

Other former executives to suffer adverse outcomes include ex-chief financial officer David Craig, his now-departed successor Rob Jesudason, former chief risk officer Alden Toevs, and ex-wealth chief Annabel Spring.

Mr Craig forfeited $6.4m in long-term variable remuneration, while Mr Jesudason’s penalty was $7.1m, Mr Toevs’ was $4.4m, and Ms Spring’s was $653,000.

“In making these decisions, the committee and board were determined to address fully, past performance issues identified for former and current executives, and focus their efforts on becoming a stronger, better bank,” Mr Higgins said.

The amounts surrendered, he said, reflected a number of decisions by the board.

First, the short-term, variable remuneration for current and former group executives was slashed by 20 per cent.

Second, about 400 current and former executive general managers and general managers forfeited part of their deferred short-term variable pay, and third, select former group executives gave up their entire long-term variable remuneration.

The annual report revealed Mr Jesudason forfeited his entire short-term bonus target of $955,000, with Ms Spring giving up her targeted bonus of $532,000.

Termination benefits paid to former executives included ex-institutional boss Kelly Bayer Rosmarin ($966,000), Mr Jesudason ($539,000), Ms Spring ($1.4m) and former chief information officer David Whiteing ($915,000).

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout