Five non-bank lenders get access to SME funding scheme

Prospa, Moula, Liberty Financial, Get Capital and On Deck Capital will get access to the $40bn SME Guarantee Scheme.

Five non-bank business lenders have been boosted by the Morrison government’s decision to provide them with access to the $40bn Coronavirus SME Guarantee Scheme.

The five lenders — Prospa, Moula, Liberty Financial, Get Capital and On Deck Capital — were notified by the federal government of their inclusion over the long weekend. By broadening the scope of the scheme, the government hopes to incorporate small businesses unable to access credit through the major banks.

The guarantee provides eligible small businesses with access up to $250,000 in unsecured funding, and a six-month repayment holiday with interest to be capitalised at the end of the period. However, the government stipulated that the loans should only be given to “viable” businesses, and not be to refinance existing debts. Lenders can provide loans to new and existing customers.

At the time of writing, only Prospa, Moula and Liberty had publicly announced their inclusion in the scheme. Confirming Get Capital’s participation, chief executive Jamie Osborn told The Australian the company was pleased to be able to play a “meaningful role” in the program.

“The SME Guarantee Scheme is a great program that the government has managed to operationalise very quickly. Hats off to the Treasury for getting the program live in a very compressed time frame,” Mr Osborn said.

A spokesman for On Deck also told The Australian it had also been included.

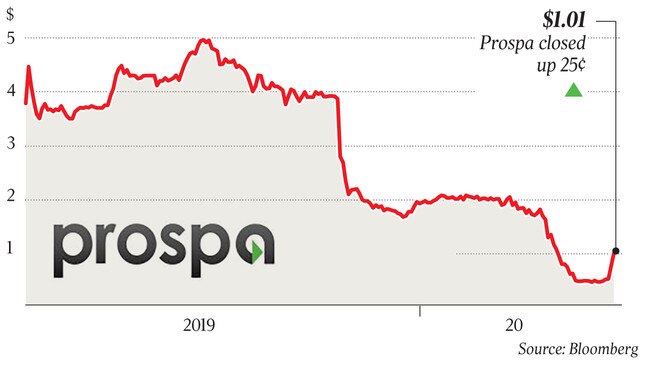

Sydney-based Prospa, which received a $223m allocation under the scheme, saw its shares bounce 33.11 per cent on Tuesday to finish at $1.00 — their highest price since March 12.

Prospa, along other non-bank lenders, will also benefit from a decision by the federal government’s financing arm to delve into secondary markets to buy bonds backed by mortgages and other assets. On Friday, the Australian Office of Financial Management announced it would move to support the smaller banks and other lenders by purchasing up to $15bn worth of bonds.

Meanwhile, Prospa chief executive Greg Moshal, said the company’s history of providing loans for small businesses made it a “good conduit” for the SME Guarantee Scheme.

“We can reach many of those businesses that are eligible, meet our criteria and can benefit from the scheme. We feel there will be a need and we’re just working through that to support thousands of businesses,” Mr Moshal told The Australian.

He said the company’s strong track record of assessing businesses meant it was well placed to evaluate the viability of applicants, but that the company needed to be responsible in its lending. Prospa would overlay current environmental data on top of its general method to determine how businesses had been impacted by the downturn, he said.

While the Australian Securities and Investments Commission has advised lenders to consider how businesses performed historically before the downturn, some lenders said the momentous economic shift made assessing businesses much harder given the uncertainty surrounding the recovery time.

Moula chief executive Aris Allegos told The Australian, he expected a “material” number of customers to access the scheme.

“The government has designed the scheme so we’re not limited in the way we distribute the product. They want it to apply to every small business in Australia that comes our way,” Mr Allegos said.

“It’s material enough that this scheme will make a significant impact. In terms of numbers, it’s not in the thousands, it’s not even in the tens of thousands, we’re talking about hundreds of thousands of businesses that will benefit.”

Liberty Financial chief executive James Boyle said non-bank lenders were particularly well placed to leverage the government’s funds.

“The government wants these funds delivered into the hands of small business as quickly as possible and we have mobilised our resources to make this a priority,” Mr Boyle said.

“Small business has our commitment that we will continue to make vital funding available to support them during this testing period.”