FAST sees quicker uptake of loan brokers

Mortgage broking group FAST expects COVID-19 turmoil to accelerate broker use in commercial lending.

Mortgage broking group FAST expects COVID-19 turmoil and broader difficulties around small and medium businesses accessing credit will accelerate broker use in commercial lending, which may eventually boost take-up to similar levels as those in the home loan market.

FAST chief Brendan Wright told The Australian while brokers accounted for about 30 per cent of the small and medium business lending market, he expected that proportion would over time mirror a rise in the mortgage market and get to more than 50 per cent.

“It will continue to head toward the same themes that have played out in the mortgage market,” he said.

“That is good news for SMEs because competition is increasing as well as optionality.”

In the March quarter, brokers accounted for 52 per cent of home loans written, a dip from the prior three months but more than double the levels seen 15 years ago.

Newer players such as Judo Bank, Prospa and Moula are attempting to make inroads into the business lending sector and chip away at the market share of the major banks. The business sector has, however, taken a big hit from the COVID-19 crisis and some 215,441 companies have deferred repayments on their loans.

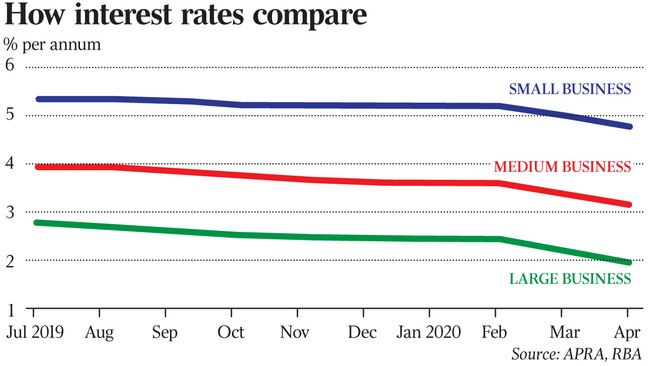

Mr Wright said access to credit and debt advice for small and medium business had “been a challenge”, despite some improvement that came with a with a material increase in providers and higher levels of competition.

He noted businesses were figuring out how to best navigate the COVID-19 climate, estimate their funding needs and take advantage of government stimulus measures such as the instant asset write-off program and the 50 per cent government guaranteed unsecured lending scheme.

“There is activity but it takes time to form up what’s my strategy as a small to medium business enterprise,” Mr Wright said.

This week in minutes of its June board meeting, the Reserve Bank of Australia lamented that capital expenditure intentions suggested a decline in non-mining investment over the next year with uncertainty around the pandemic deferring business investment decisions.

A survey undertaken by FAST – with individual loan writers and broker businesses representing about 400 people – found 28 per cent expected COVID-19 would have a large negative future impact on their income, while 41 per cent anticipated a small negative impact. Commonly cited concerns were fewer inquiries and that lending deals were falling over.

The survey, conducted in April and May during the height of the COVID-19 hibernation period, showed the proportion of business loans flowing to the major banks this year dropped to 62 per cent from 69 per cent in 2019.

National Australia Bank-owned FAST provides back-end technology, compliance and other services to more than 1050 brokers, and its loan book amounts to about $78bn. The bank also owns sister broker aggregation businesses PLAN Australia and Choice.

Judo, Prospa and its own-branded FASTEdge lending product, which is underwritten by Think tank, were recently added to FAST’s lender panel as it seeks to provide more commercial lending options for small to medium businesses.

In the mortgage market where loan approval times at some banks have been notably pushed out, Mr Wright said the worst offenders were taking almost three weeks to provide sign off.

“All lenders are facing into that, none of them are sitting on their hands,” he added.

On the topic of Hayne royal commission reforms, FAST has trained its staff and will start implementing a formal best interest duty for brokers by mid-July, ahead of a delayed January start date. The requirement formalises a requirement for brokers to act in the customers’ best interest, after the federal government backed away from shaking up the industry’s commission-based pay structure.

While Mr Wright wouldn’t comment directly on NAB’s commitment to owning broker aggregation businesses, a bank spokeswoman said:

“NAB is committed to continuing to support our mortgage broking business, particularly in this challenging market, and we continue to look for opportunities to improve the broker proposition, support brokers and enhance service and delivery to customers.

“Brokers play an essential role in enhancing competition and enabling access to credit.”

CBA put its broking business Aussie — which draws on a franchise model — and stake in listed group Mortgage Choice under review as part of a broader divestment spree by the bank, but a transaction hasn’t eventuated. But some consolidation is still on track to occur after the competition regulator on Thursday signed off on the marriage of listed aggregator AFG and Connective.