Facts on the table in home loan inquiry: Samuel

The ACCC’s mortgage market inquiry will get ‘facts out on the table’, and should be acted on, Graeme Samuel says.

The competition regulator’s mortgage market inquiry will get “facts out on the table”, and should be acted on, unlike prior probes into retail petrol and grocery prices, former chairman Graeme Samuel says.

Mr Samuel is confident the Australian Competition & Consumer Commission’s sweeping inquiry into the banks’ home loan pricing will be helpful in unpicking complex arguments around funding costs.

“The banks have been diligent in not explaining properly the way they set their rates,” he said.

“Let’s get the facts out on the table and let the ACCC determine what is going on. If there is a problem let’s find out what it is.”

Mr Samuel warned that politicians should not ignore the inquiry’s findings if they didn’t fit the agenda of the day.

“The allegation (by former treasurer Wayne Swan) they (the banks) are running a cartel is the most egregious.”

At the request of the federal government the ACCC will be able to use compulsory information-gathering powers to gain information and documents from banks on their pricing decisions.

The regulator will also look at “strategies that create an impediment” to customers refinancing their mortgages and the availability of information on home loan rates.

In response, Westpac chief executive Brian Hartzer came out swinging on Monday, labelling competition in the mortgage market “intense”, and saying banks had to make reasonable returns to retain their debt rating.

“Pricing decisions require banks to take into account a number of factors, particularly as the cash rate heads toward zero. In particular we have to manage the net interest margin — that is the difference between deposit and lending rates,” he said.

“Westpac must also retain its double AA rating. This rating allows the bank to import funding at more cost from international investors.

“To lose it would increase the cost of our wholesale funding which would inevitably lead to higher interest rates for our borrowers.”

Australian Banking Association chief Anna Bligh said the industry stood “ready to assist” the ACCC in the latest inquiry.

Yellow Brick Road executive chairman Mark Bouris said part of the issue was the difficulty in assessing a bank or lender’s cost of funds while borrowers also had to take the initiative to seek out better home loan deals.

“Those costs of funds are not easy to calculate. It’s a very complex formula,” he said.

“If it does one thing it gets people starting to think about it (the interest rate on their mortgage).”

The ACCC will look at mortgage prices charged since January 1 and will also assess differences in rates charged to existing and new customers, costs of finance and the timing of rate changes.

A preliminary ACCC report is due by the end of March 2020, with a final version to be submitted by September 30. It follows a spate of reports and inquiries last year including the ACCC’s residential mortgage inquiry, the Hayne royal commission and the Productivity Commission’s look at mortgage competition.

The ACCC’s latest probe comes after the banks were in the political firing line early this month, for withholding a large part of the Reserve Bank’s 25-basis-point rate cut. Scott Morrison accused the banks of “profiteering” from the move.

ANZ chief executive Shayne Elliott on Monday said banks had not explained their interest rate pricing decisions well.

“The inquiry is a good opportunity to provide facts in what is a complex space and we hope it will provide the public with renewed confidence in the way their home loans are priced,” Mr Elliott said.

“We know we have not done a good job in explaining our position.”

Bank share prices rallied on Monday and were in line with or slightly ahead of a 0.5 per cent gain in the broader market, bar Commonwealth Bank of Australia, which edged up 0.4 per cent.

“This is an important opportunity to discuss the challenges of an increasingly low interest rate environment and engage in a broader discussion about how we support all our customers — both depositors and borrowers,” NAB’s head of consumer banking, Mike Baird, said.

A Commonwealth Bank spokesman said: “Achieving the right balance for borrowers and depositors is a constant challenge and the inquiry provides an opportunity to bring transparency to these,” he said

UBS banking analysts said the ACCC probe would “put more pressure on the banks to pass through a larger proportion” of future official rate cuts.

“In a worst-case scenario where the banks were required to eliminate the front-book/back-book discount in full (estimated at about 40 basis points) this could reduce net profit after tax across the majors by about $3.8bn,” they said, adding a rider that the banks would likely offset this in other ways.

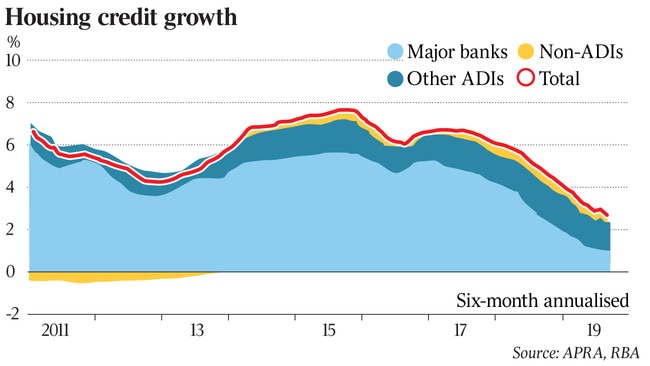

Morgan Stanley analysts said despite a report last year by the ACCC into residential mortgages they had not seen a “material change” in the banks’ repricing strategy for home loans in their existing books.

Customer Owned Banking Association strategy director Sally Mackenzie said the inquiry should investigate ways to make it easier for consumers to switch banks.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout