Extend coronavirus support for small business: BoQ

Bank of Queensland chief George Frazis wants the government to consider extending JobKeeper and other support measures.

Bank of Queensland chief George Frazis wants the federal government to consider extending JobKeeper and other small-and-medium business support measures, as COVID-19 social distancing restrictions weigh on the productivity of many industries for a prolonged period.

His comments came as BoQ appointed former Commonwealth Bank executive general manager Fiamma Morton as its new head of business banking. She starts at BoQ next week after a nine-year stint at CBA.

Mr Frazis said while banks had passed the worst for businesses seeking loan payment deferrals, risks still loomed as a spate of industry operations would still be curtailed by distancing measures.

“What’s happening now is there a proportion of those that requested (loan deferral) assistance that are asking for it to be reversed,” he said.

“I don’t want us to get complacent on the need to safely get down the path of removing the restrictions as the health specialists recommend. A lot of those businesses, because they are not operating at the most productive level, could down the track start running out of cash. We are not out of the woods yet.”

At an update last month, BoQ said 10,000 business customers had requested COVID-19 assistance and repayment deferrals and 5000 personal customers.

The government last week revised down its JobKeeper cost expectations to $70bn from $130bn, after an embarrassing calculation error.

Despite cheaper bank funding and business stimulus, the Reserve Bank expects the pandemic will cause economic output to slump 8 per cent in the year ended June 30, and end calendar 2020 down 6 per cent.

Mr Frazis labelled the RBA’s analysis sound, noting it would take time for smaller business to ramp up, meaning retaining some targeted support measures made sense.

“It needs to be focused on the segments that are unable to get to a reasonable amount of productive output given the social distancing requirements. It’s not their fault,” he said.

“Until you get a vaccine or an antiviral solution, we will continue having social distancing.

“That’s the big unknown and that could create a low growth outcome, which means we kind of bump along.”

Mr Frazis applauded the government measures to contain the virus, but said policymakers could also consider extending the time frame for the COVID-19 higher threshold asset write-off package, which facilitates more business investment, up until June 30.

Relaxing requirements around government guaranteed business loans could also help as parts of the economy open up.

He is treading cautiously as businesses navigate out of the economic turmoil.

“We haven’t seen that growth in the core SME segment,” he said.

“Once the states … open up fully that will be a big positive and obviously that’s dependent on the medical advice.

“Queensland has to do what it thinks is the right thing, given that medical advice. In the scheme of things if it’s delayed a few weeks or a month or so — that’s not going to make or break the outcome.”

Somes states including Queensland have faced criticism for holding off on a reopening of borders.

Business banking is a key part of the BoQ’s operations, and Mr Frazis is keeping close tabs on how SMEs are faring as the economy braces for a recession.

About 35 per cent of BoQ’s business portfolio represents the property and construction sector, 31 per cent healthcare, while hospitality and accommodation accounts for 7 per cent and professional services 9 per cent.

The Australian in January revealed the departure of BoQ’s former business banking boss Peter Sarantzouklis, after just five months in the role.

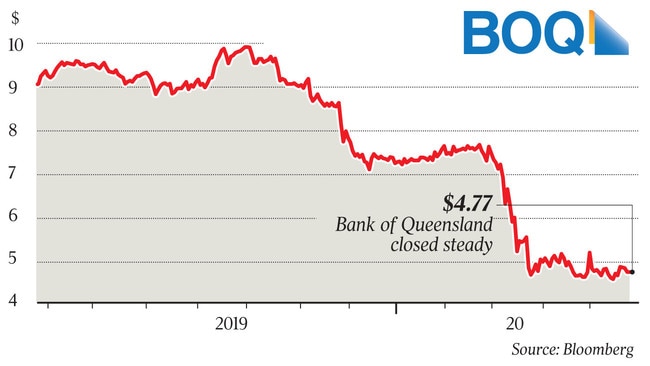

Due to the pandemic and guidance from the prudential regulator, BoQ was the first bank to postpone a first-half dividend decision. ANZ and Westpac have since followed suit.

Mr Frazis said while talks and stress testing with the Australian Prudential Regulation Authority continued, he hoped to be able to update investors on dividends by the end of August.

“It is all about how clear things are. It’s not that difficult to conduct a stress test and it’s more about when do we — obviously in consultation with APRA — conclude that we’re confident about the potential scenarios given the information.”

BoQ’s interim results increased provisioning for potential bad loans, citing the pandemic.

At the half, BoQ’s business bank saw cash earnings fall 3 per cent while its retail division posted a 17 per cent earnings reduction.

Before CBA, where Ms Morton was overseeing global client coverage and transaction banking solutions, she had stints at Westpac, Mastercard and Goldmans.

In November, Ewen Stafford started at BoQ as CFO and operating boss, joining from Deloitte.

Mr Frazis outlined his BoQ five-year strategy blueprint in February as he looks to turnaround years of underinvestment.

The plan aims to consolidate core systems, slash products and boost BoQ’s digital technology, while positioning the lender for growth.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout