Experts split on NAB exec pay overhaul

Experts are split on a new remuneration structure for NAB executives that invoves a single bonus scheme.

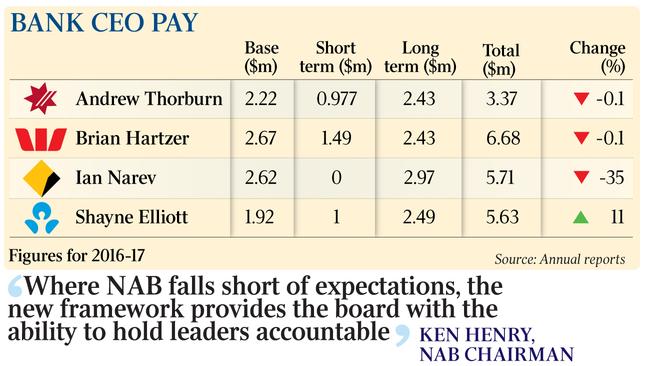

Experts are split on a new remuneration structure for National Australia Bank executives that replaces short-term and long-term incentives with a single bonus scheme and could slash chief executive Andrew Thorburn’s pay this year by $1.05 million.

NAB chairman Ken Henry said yesterday the framework, which provides for increased board discretion in rewarding executives and formalises the deferral of equity grants for at least four years, would help reshape the bank to improve the experience of customers.

“This is a journey that’s consistent with the royal commission,” Dr Henry said.

“The NAB board is determined to drive customer focus at every level of the organisation.”

While the NAB board has been working on a new pay structure for some time, pressure for greater alignment with customer interests has intensified with the revelations in the financial services royal commission.

NAB, like its peers, has been embroiled in the fees-for-no-service scandal, with ASIC launching Federal Court proceedings against the bank earlier this month.

Wayne Byres, the chairman of the prudential regulator, said in a recent speech that an excessive emphasis on financial benchmarks in remuneration frameworks could encourage behaviour that was inconsistent with a company’s long-term performance.

In Australia, he said, performance was too often judged by shareholder-based metrics, such as return on equity and total shareholder return.

“The current structure of long-term incentives in Australia is particularly problematic in this regard, and is out of step with how best practices in remuneration are evolving internationally,” Mr Byres said. “This will have to change.”

The APRA chief also said there were shortcomings in board oversight of remuneration. Dr Henry said Mr Thorburn’s single, variable reward would be in a range of zero to 300 per cent of fixed pay in 2018.

The CEO’s “at target” total reward in 2018 would be $7.94m — $1.05m, or 11 per cent, below the comparable figure of $8.99m in 2017.

The aggregate 2018 reward for members of the 11-person executive leadership team would fall by 15 per cent relative to the year before.

While the lower pay outcomes were welcomed yesterday, some experts said they would wait to see the bank’s remuneration report before backing the new scheme.

“This isn’t a test of what you’re telling us now; it’s a test of what you show us in 10 days’ time (at the close of the bank’s financial year),” one observer said.

The problem with the new scheme, he added, was that executives would get more certainty about their pay outcomes over a shorter period of time, unlike the old framework where a greater proportion of pay was subject to deferral.

Effectively, remuneration was being “de-risked” at a time when earnings were under pressure.

The other issue was that boards were often reluctant to exercise their discretion and make executives accountable for poor outcomes.

Dr Henry rejected this, saying the alternative was to allow the market to determine pay rates using just financial benchmarks.

Under the new system, the performance of individual executives will be judged by a “gateway” metric on risk, which had to be passed to qualify for a performance-based reward.