Expect widespread capital raising across the local market in 2025

Activity across the technology, digital infrastructure, energy and real estate sectors is set to underpin robust local capital raising.

Activity across the technology, digital infrastructure, energy and real estate sectors is set to underpin robust local capital raising activity in 2025, after annual equity capital markets volume finished last year at the highest annual level since 2021.

Despite fits and starts in the local market for initial public offerings, investment bankers expect 2025 to see renewed momentum in capital raisings as companies look to underpin growth initiatives, fund mergers and acquisitions or shore up their balance sheets.

Jabe Jerram, Barrenjoey’s co-head of equity capital markets (ECM), said 2024 had “been characterised by investors favouring companies with strong growth prospects, market-leading positions and, in many cases, a global opportunity set”.

“These are themes we’d expect to continue in 2025,” he added. Macquarie Capital’s joint Asia-Pacific ECM chief, Georgina Johnson, said she expected widespread capital raising across the local market in 2025, reflecting tailwinds including the stabilisation of inflation, anticipated rate cuts and improving economic conditions.

“We’re also expecting investors to continue to seek exposure to the key megatrends including energy transition and digital infrastructure – driving focus for critical minerals and data centre exposures,” Ms Johnson said. “We’re anticipating (an) upswing in activity in the real estate sector after a period of subdued activity in a challenging rate environment.”

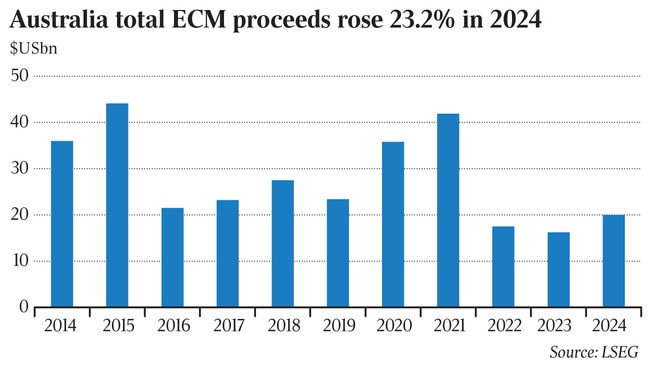

Total equity capital markets volumes for Australia rose to $US20bn ($32.3bn) in 2024, up 23 per cent on the prior year, data from London Stock Exchange Group (formerly Refinitiv) shows. However, the improved annual activity level remained below the 10-year annual average of $US27.1bn. The largest transaction in 2024 was the IPO of HMC Capital’s data centre owner, DigiCo Infrastructure REIT, followed by the block trade selldown by China Investment Corporation in property company Goodman Group.

The latter transaction left investment bank Citigroup – which won the mandate to handle the trade – reeling as it was stuck with unwanted Goodman stock on its books.

The busiest industries for equity capital markets deals in 2024 were the materials, real estate and technology sectors respectively, according to LSEG. Total deal numbers amounted to 1022, about 100 more than in 2023.

Globally, equity capital markets activity increased 19 per cent to almost $US637.7bn in 2024, from the prior year. Those numbers were supported by large capital raisings by companies including Saudi Aramco, National Grid and under-pressure Boeing. The largest listing was the IPO of logistics group Lineage.

The increase in global activity comes as several bourses around the world, including the ASX, grapple with how to attract more companies to their exchanges, which helps to buoy overall activity and market liquidity.

Reforms in capital markets worldwide have been a focus in recent years and, in some jurisdictions, changes have been aimed at making it easier to list.

The US implemented changes to its equities market structure in 2022, while Britain has introduced a simplified listing regime in an attempt to attract more listings and stem the tide of companies leaving due to them opting for the New York bourse over London.

There are similar concerns in Australia as mergers and acquisitions in 2024 resulted in large listed companies including Boral, Altium and CSR delisting from the ASX, while others including Insignia and De Grey Mining are in the crosshairs of deal activity.

Concerns about companies leaving the ASX and New Zealand exchange at a faster rate than they are being replaced through IPOs has spurred a range of investment banks to engage with regulators and market operators.

Jarden, for example, plans to propose a new combined trans-Tasman share index to attract more capital to the Australian and New Zealand equities markets.

That comes after JPMorgan corralled a group of eight investment banks – including Barrenjoey and Goldman Sachs – to make a formal and confidential submission urging sweeping changes to streamline the domestic IPO process.

Law firm King & Wood Mallesons helped draft a submission that was lodged with the ASX and Australian Securities & Investments Commission in September.

While domestic IPO activity improved in the fourth quarter of 2024, annual volumes remained well below the 10-year average. The number of IPOs in Australia last year was just 22, down from 27 in 2023. The IPO pipeline for 2025 includes the likes of electrical equipment maker NOJA Power, hydrogen venture builder United H2 and Virgin Australia, albeit the latter is yet to appoint a chief executive to replace outgoing CEO Jayne Hrdlicka. Private equity firms are also expected to test the market for ASX listings in 2025 as they sell out of portfolio companies they have held for several years.

The bumper growth in private sources of capital has given business vendors “more choice” when seeking to free up equity in their company, according to Eley Griffiths Group executive chairman Ben Griffiths.

He noted that late in 2024 private equity firm Adamantem Capital agreed to buy financial services group Mason Stevens, which had considered a 2025 listing but in the end opted for a trade sale.

“Once Adamantem have completed their plans for Mason Stevens there is still no guarantee that this business will end up in public ownership,” Mr Griffiths said.

The mammoth $24bn sale of data centre group AirTrunk to Blackstone last year also underscored that trend given the capital-hungry company was previously touted as an ASX-listing candidate.

Vendors including private equity firms have been favouring the trade sale route in recent years, given the heightened risks associated with a fickle IPO market.

After a smattering of dismal private equity-led floats over the past two decades (including those of Myer and Dick Smith), fund managers also remain cautious on supporting floats led by buyout firms.

“Certainly, the welts on private and professional investors’ backs suggest to me that an incredulous eye will be cast over private equity vendors for some time to come,” Mr Griffiths said. “Equity investors can sometimes be hard to underestimate. Two or three successful PE (private equity) sales, investors get a good result and all is forgiven!”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout