Ex-ANZ chief Charles Goode calls for bank fightback

Former ANZ chairman Charles Goode has rebuffed the spate of attacks on bank profitability.

Former ANZ chairman Charles Goode has rebuffed the spate of attacks on bank profitability, arguing the nation’s financial institutions have seen their return on equity shrink below that of global peers and cuts by the big four banks to their dividends was hardly a sign of “rapacious profit”.

Deriding bank bashing as “popular politics”, Mr Goode has also sounded a rallying cry to the sector urging it to defend itself, saying banks are the engine of the economy and hold the wealth of the nation through the $2.9 trillion superannuation industry.

“Bank bashing is popular politics but it is not very helpful and we should rise above it,” Mr Goode said in an extended interview with The Australian. “We need banks to provide loans that oil the engine of our economy.

“It is time the banks said enough is enough and got more positive in contributing to our society, including making more loans. The banks have been cowered by the findings of the royal commission. They have done the apologies and are presumably taking remedial action.

“I would like to see the banks stand up and defend themselves more. They have many satisfied customers, they are among our largest employers, they are some of our largest taxpayers and their dividends are a key pillar of the income of many share portfolios and superannuation plans.’’

The veteran banker and former chairman of Woodside Petroleum said bank bashing had gone too far and that on an international comparison bank profitability in Australia had actually weakened in recent years.

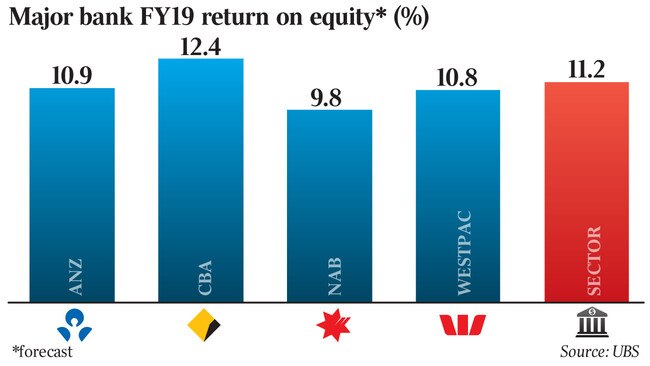

“I don’t think their return on equity is too high. Fifteen years ago it was around 17 per cent and it is now around 12 per cent,” he said. “If we looked at the return on equity of the Top 100 ASX companies the banks would probably fall in the second half. The return on equity of our major banks is less than the banks in the US and Canada, though above that in the UK and Europe.

“We also should remember that we are in a period of very low bad debts, so that we should expect the banks to be earning a good profit to provide a buffer for the times when bad debts rise.

“The last thing we want is unprofitable banks that are unable to make loans to support the economy. Nor do we want banks to be in trouble and need a government bailout as happened in other countries during the GFC.”

He said the banks were also far from profit-gouging and their shareholders were facing dwindling dividends.

“Some major banks in recent years have had to reduce their dividends and there is concern that others may do so in the near future. This is not a sign of rapacious profit,” he said.

Mr Goode this week told The Australian that the RBA should lower and widen its inflation rate target to lessen the obsession with cutting interest rates further to meet an artificially set inflation target. He warned that the fad of bank bashing and overregulation could help freeze lending.

Mr Goode added he thought monetary policy had “run its course” and the government should pause to see the flow through impact of recent tax cuts.

But he also offered up constructive policy suggestions to strengthen the economy, such as spending any surplus on supporting lower-income earners.

“The government is determined to have a budget surplus for this year so in the May budget they may look at accelerated depreciation for tax purposes and they could look to increase the amount of Newstart payments,” he said.

In the next fortnight three of the major banks will report their annual profits, with investors bracing for further potential dividend cuts and commentary on the health of the local economy. ANZ, which Mr Goode served on the board as a director and chairman over a 20-year stint, kicks off bank reporting season on Thursday. Westpac and NAB will hand down results the following week.

Mr Goode said the financial strength of the banking sector was one of the key pillars that propped up the economy during the GFC.

“During the GFC many of the banks in the US, UK and Europe needed to be bailed out by governments and the financial crisis caused a great loss of economic production,” he said. “In Australia we came through the GFC really well because we had a strong economy, the Labor government had inherited a budget surplus and was therefore in a position to make increased fiscal expenditure and the banks were broadly well run and well regulated.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout