EML Payments pins growth hope on reworked Irish deal

For Tom Cregan and investors in Austalian fintech EML Payments, the reworked Irish PFS deal was a company-saver.

It was a deal that barely captured a mainstream headline, but for Tom Cregan and investors in payments solutions provider EML Payments, it was a company-saver.

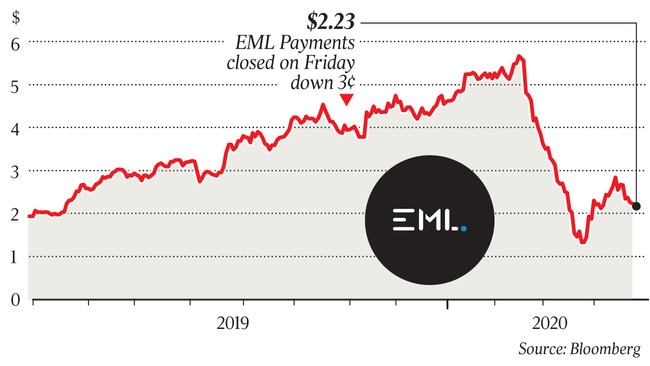

EML shares were one of the best performers on the ASX in 2019, surging 200 per cent higher in a year capped in November by its head-turning $452m acquisition Ireland’s Prepaid Financial Services group.

It was a deal with an eye-watering price that would catapult EML into the digital banking space for the first time before the onset of the coronavirus pandemic suddenly left Cregan with a $130m millstone around his neck.

The PFS deal would see the Irish group become an 7 per cent shareholder in EML but included an underwritten syndicated debt facility of $165m, of which around $130m would have been drawn down. Investors panicked.

Between February 17 and March 24 EML shares fell like a stone from $5.20 to $1.20.

“Having $130m of bank debt would have allowed the sharemarket to have a bloody field day on shorting the stock, speculating on a highly dilutive equity raise. It would have been played,’’ Cregan says.

As investors ran for the hills, Cregan quietly started talks with the management team of PFS.

His message was crystal clear.

“We do take a long time to get to know the people behind these deals and had worked on this one since April last year. We had to build some credibility with their team,’’ he says.

“But them being 6.9 per cent shareholders meant you could talk to them from both sides. It was not in their interests to have a shareholding in a company with so much debt.

“It wasn’t a lot of teeth knashing and fists on the table. They understood.”

After the initial discussions, two weeks later Cregan had another request — to have more cash in the deal. “I told them it was a matter of survival and EML needed $120m at least of cash to cover our expenses,’’ he recalls.

On the last day of March new terms for the deal were announced, including a discounted upfront payment of $252m, including $159m in cash funded entirely by EML’s $278m cash reserve following a November capital raising.

Most importantly the new EML had no debt and more than $100m in cash. The 42 per cent reduction in the purchase price meant Cregan had saved EML and its investors a cool $200m. On release of the news to the ASX following a trading halt, the share price rose a stunning 71.6 per cent.

“We didn’t come up with the 42 per cent number to just reprice them — it was driven by the circumstances of coronavirus. We didn’t want to use COVID-19 to be opportunistic. It was purely driven by the need to come out of this with a bullet proof balance sheet,’’ Cregan says.

“We only gave up a little bit more stock — they would have had 6.9 per cent under the original deal. Now they have 1.3 per cent more (8.2 per cent) or £5m worth.”

The deal has also received regulatory approvals from the Central Bank of Ireland and the Financial Conduct Authority in the United Kingdom.

“This renegotiation will lead to us being bigger over the coming years.

“We will unashamedly talk to the Mastercards and Visas of the world to say we are a company that has no solvency risk, as opposed to our private competitors whose financial status they might be unsure of,’’ Cregan says.

And the original rationale for the PFS deal remains, giving EML an array of digital banking services including e-wallets, payout programs and software for transactional banking services and a presence in eight new European markets including Hungary, Greece and Slovenia.

“The PFS stuff looks in very good shape — 42 per cent of that business was welfare distribution and government payments in Europe. In the past 2-3 weeks we have seen promising signs of that channel being used more for welfare payments,’’ Cregan says.

But investors are still wary.

EML shares soared to $3.20 when the renegotiation of the PFS deal was announced, but have since drifted lower and closed on Friday at $2.23.

Before the PFS deal 55 per cent of EML’s revenues came from providing gift card programs in shopping malls throughout America and Europe, a business that has been hit hard by the coronavirus lockdown in both geographies.

“The malls are all substantively closed in Europe and the US. So those revenues are going to be zero for April and maybe May,’’ Cregan says bluntly. “Thankfully the April-May season are a low season for gift cards — 30 per cent of our revenues for the business comes from one week in December around Christmas.”

But the PFS deal brings gift cards down to less than 40 per cent of EML’s revenues.

Its other core business that continues to grow through the pandemic is offering large corporate brands payment solutions for gifts, incentives and rewards and salary-packaging payments.

“The commercial payments piece in the US is showing decent growth. That business is a replacement for companies that pay their suppliers with a cheque,’’ Cregan says.

EML has an eight-year agreement with salary-packaging firm Smart Group to serve as its general purpose reloadable card program provider. It manages more than 1500 reloadable card programs across 23 countries in North America, Europe and Australia and 30 per cent of its revenue comes from the segment.

Last year it launched a reloadable payments card with fledgling online gaming operator PointsBet.

“In our loadable business, gaming has been incredibly resilient. The volumes in gaming have hardly changed despite COVID-19,’’ Cregan says.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout