Dividend payouts on the way back up: Argo

Expect some happy payout surprises in profit season, tips Argo Investments, but dividends won’t be back at pre-COVID levels.

A lack of guidance from listed corporates will make for an interesting earnings season in the coming weeks, with retailers among those that could surprise on the upside by boosting dividend payouts, according to Argo Investments managing director Jason Beddow.

As reporting season heats up, with results expected in the coming days from Commonwealth Bank, Suncorp, IAG, Transurban, Boral and Telstra, among others, Mr Beddow expects most companies to remain cautious with their payouts, but said the low point had already passed.

“I think we’ve seen the low in dividends in the half just gone, that July to December period. So dividends will improve but I’m not sure that in this reporting season (companies) are going to open their coffers back to pre-COVID-19 payouts,” Mr Beddow said.

“Having said that, some of the retailers, they‘re almost net cash, they pay local tax and have plenty of franking credits, so some of those could pay pretty significant dividends.”

Banks are also likely to pay out higher dividends than last time when they report, but won’t get back to pre-COVID-19 levels just yet, he predicted. (CBA is the only major big four bank to report its half-year numbers this month. The other big lenders will hand down their results in May.)

“They’ll definitely improve; APRA’s removed its restriction and they’ve got plenty of capital. And conditions have certainly far improved on what we thought even three months ago, but particularly six months ago.

“So dividends are definitely increasing in the banks, and maybe significantly, but I don’t think they’re going straight back to pre-COVID-19 levels just yet,” he said.

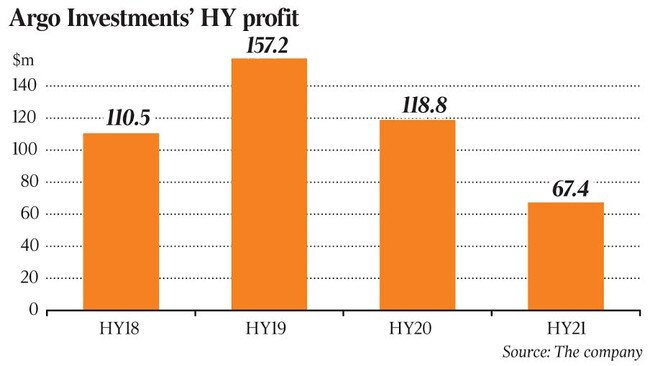

Mr Beddow was speaking after handing down Argo’s half-year numbers for the six months through to December, with the dearth in dividend payouts over the period pushing its profit down 43 per cent to $67m.

The listed investment company delivered a 12.3 per cent return over the period, with “some real winners and losers” in the investment mix, Mr Beddow said.

AP Eagers, Reece and Macquarie Bank offset not owning high-flyers Fortescue and Afterpay, he added.

“Rightly or wrongly, we don’t own them. So considering how big those stocks are and how far they’ve run, we think the portfolio has done relatively well,” Mr Beddow said.

“It’s just hard to get your head around the valuation on Afterpay and clearly buy now, pay later as a as a payment method is very popular with a lot of people. And yeah, as a brand, they’re doing really, really well.

“But equally, the valuation on that stock for what it’s got to learn over the next five to 10 years … maybe there’s a price for it … but if I had to put money into Afterpay with a market cap of $44bn, or Macquarie Bank with a market cap of $48bn, I’d probably put it into Macquarie.”

Argo sold out its remaining holdings in AMP during the half, while also ditching Ansell and reducing its positions in ANZ Bank, Sydney Airport and Westpac.

At the same time, it added Aurizon and Newcrest and boosted its holdings in Downer, Bega and Healius.

“AMP is a challenging business, and to be frank, we probably should have exited a long time ago,” he admitted.

“We’ve been selling it down over time, the last two or three years. But there’s always been a little chance that it might get taken over and we could get an extra 10-15 per cent, so we’ll wait. We’ve been dribbling it out over the last couple of years but we think it’s still got some challenges at lots of levels,” he said.

With the market having already run hard in recent months, Mr Beddow said it was getting more difficult to spy opportunities.

We’re pretty fully invested so we’ll look in results (season) for companies that get beaten up a bit. It’ll be an interesting earnings season, with some random numbers out there. We’re looking for the laggards that we think have a chance to catch up, as opposed to some of the real winners,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout