Digital-only Xinja granted banking licence

Digital-only bank Xinja has finally received a restricted licence, even as it conducts a new crowd-funding campaign.

Xinja is looking to get its full banking license locked in by the middle of next year, with the fintech aiming to be one of the few digital challenger banks left standing in the market by 2022.

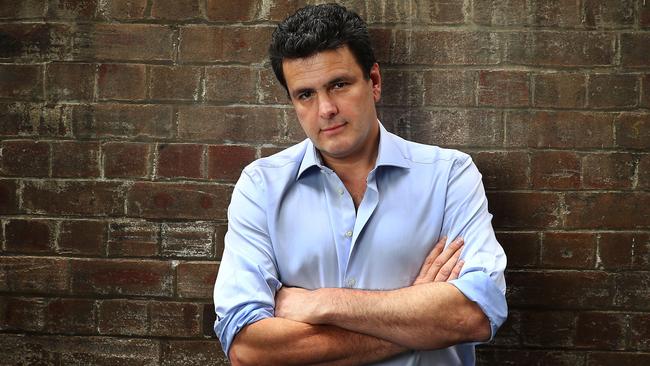

The Sydney-based company secured its restricted banking license from the Australian Prudential Regulation Authority on Tuesday, with company co-founder and CEO Eric Wilson saying that Xinja was now a step closer to delivering real competition in the market.

“We are already a business generating revenue, (getting the restricted license) has been a long and rigorous process and we are happy to get this under our belt,” he told The Australian.

The restricted banking licence category was introduced by APRA in 2017 to help digital banks gain easier entry to the local market and start offering limited services to customers.

Securing the restricted license sees Xinja join the likes of Volt Bank, Judo Capital, 86 400 and Bendigo and Adelaide Bank-backed Up as fully-fledged digital banks looking to steal market share from the traditional players.

According to Mr Wilson, it’s unlikely that all of the neo-bank aspirants will be able to see it through the end.

The “big game” in terms of the competitive dynamics and which digital banks succeed will happens in two to four years’ time, with two, maybe three independents thriving in Australia, he said.

Xinja is aiming to get the full banking license from APRA in the second quarter of 2019 and has already added heavyweight talent to it management over the last couple of months.

The fintech welcomed neo-bank pioneer Brett King Brett King as a permanent adviser in October and appointed Tesla senior engineer Thomas Vikstrom to its board in November.

Mr King, dubbed the godfather of neo-banks, started the trend in 2011 with his outfit Moven, which launched the world’s first mobile, downloadable bank account. Meanwhile, Mr Vikstrom brings almost 20 years of experience in product development and engineering to the table for the fintech.

The license from APRA also comes as Xinja looks to secure new funding through a crowd-funding campaign.

Xinja, which will now be rebranded as Xinja Bank, is in the middle of raising $5 million through crowd-funding platform Equitise, with shares valued at $2.04 each and a minimum investment of $255.

It’s Xinja’s second bite at crowd-funding having already raised $2.4m from 1222 investors in April at $1.25 a share.

“Xinja is all about making banking easy, frictionless and even fun so that people can make better, faster money decisions without the angst,” Mr Wilson said.

“We are very proud that Xinja’s owners include not only local and overseas professional investors but our staff and thousands of cardholders who have invested, as part of our equity crowd-funding, and want to join with us to revolutionise banking.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout