As one observer put it on Thursday night, the demise of former life insurance giant AMP has seen some of the worst destruction of shareholder wealth in recent Australian corporate history.

Despite the statement by AMP that the Italian-born former Credit Suisse private banker “remains” chief executive of the company, questions continue over his future following a leaked story earlier in the day that he was set to resign.

The story prompted the company to request a suspension of trading in its shares at 3.35pm.

It took three hours for the shocked company to put out a curt one-line statement that De Ferrari would stay on as CEO.

Questions remain whether De Ferrari, who has been running the company for just over two years, could become the latest in a string of corporate names sullied as a result of their association with the company that was once the colossus of the Australian financial system.

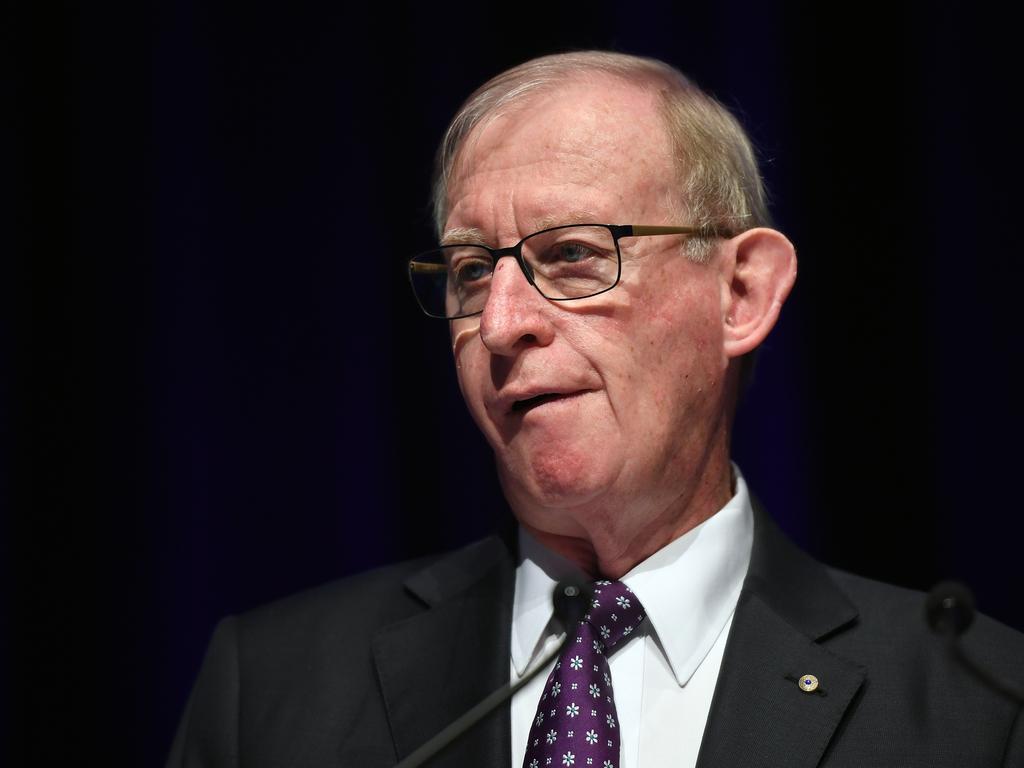

Respected corporate names such as Simon McKeon, Catherine Brenner, Andrew Mohl, Craig Dunn, former Commonwealth Bank chief executive David Murray and former Treasury secretary and UBS executive John Fraser are among the many who have left the company more than a little bruised by the experience.

Along the way other names such as Alex Wade and the former head of AMP Capital Boe Pohari have had rocky careers with the group that did not end well.

De Ferrari was a surprise appointee as chief executive, chosen in 2018 by Murray. He arrived in Australia as an outsider with little knowledge of AMP and the highly regulated Australian financial services market.

His leadership has been beset by problems including allegations of sexual harassment and misconduct by senior executives, an exodus of funds from its super funds and questions over its future — including whether he would preside over a corporate break-up or whether AMP shareholders could be rescued by a takeover offer. In the past six years alone, AMP’s market capitalisation has gone from more than $18bn in 2015 to less than $5bn today.

One of Australia’s oldest financial institutions, AMP was founded in 1849 as a life insurer.

It grew to become the largest life insurers in the country, a bigger entity than any of the banks, with key shareholdings in companies, real estate and even rural land.

It has become a shadow of its former self while industry fund giants like AustralianSuper now dominate the wealth sector.

De-mutual destruction

In the early nineties, the AMP was the leader of the financial services market — one of former PM Paul Keating’s six pillars of the financial system (AMP, its bitter rival National Mutual, and the big four banks.)

The company’s fortunes have lurched from crisis to crisis since it was demutualised and listed on the ASX in 1998.

Things got off to a bad start under the brash American George Trumbull whose outspoken comments got him offside with former PM John Howard and Treasurer Peter Costello.

He oversaw the takeover of GIO, which turned into a loss-making nightmare.

He also oversaw a disastrous expansion of the company’s operations in Britain, before being pushed out of the company with a controversial $13m exit package.

He was followed by Paul Batchelor, who was also forced out of the company in 2002 amid questions about its British operations.

He was replaced by Andrew Mohl and then Craig Dunn.

In 2011 Dunn launched a bid to buy AMP’s long time rival, AXA (the former National Mutual group), a long mooted move that appeared logical on paper but was disastrous in its execution.

The wealth destruction continued.

Melbourne businessman Simon McKeon became chair in May 2014 only to leave two years later for unspecified reasons.

His successor, Catherine Brenner, found herself caught up in a scandal during the Hayne royal commission over the company’s practice of charging fees for no service, which saw the departure of CEO Craig Meller and Brenner’s own exit in early 2018 — as well as the departure of three other female directors of the company.

Brenner was eventually replaced by David Murray who was chosen to lend an experienced, steady hand to the rocky AMP ship, taking over as chair in June 2018.

A former adviser to investment bank Credit Suisse, Murray brought in the Singapore-based Credit Suisse executive De Ferrari in December 2018 as chief executive to help turn around its fortunes.

But Murray himself didn’t last long.

He resigned in August last year after controversy over the handling of complaints over Boe Pohari, who was forced to give up his role as head of AMP Capital and return to London.

While De Ferrari remains as chief executive his term now seems to be under a cloud, with AMP continuing its reputation as an executive graveyard.

While Francesco De Ferrari remains AMP’s chief executive — for now — the question that hangs over his leadership is whether he is set to become yet another corporate casualty of the once great and now beleaguered life insurance and financial services company.