Customers marooned by Westpac exit

Westpac’s retreat from the financial planning industry will see tens of thousands of advice customers displaced.

Westpac’s retreat from the financial planning industry will see tens of thousands of advice customers displaced as the bank undertakes a broader shake-up of its operations, spurring the loss of two top executives and hundreds of jobs.

As flagged by The Australian, Westpac is jettisoning its unprofitable financial planning business by selling some of its salaried advisers to boutique Viridian Advisory. It will wind down the rest of the division, including its dealer groups, by September 30.

The restructure will result in Westpac’s wealth division BT Financial Group being subsumed into the bank’s consumer and business bank, leading to the departure of BT boss Brad Cooper. Head of the consumer bank, George Frazis, will also part ways with Westpac.

The sweeping changes come as Westpac continues the task of remediating customers for its past misdeeds after being embroiled in royal commission scandals including charging fees but not providing the relevant advice.

Under yesterday’s deal, Viridian will take 175 employees, including financial advisers and support staff, with as many as 10,000 bank customers given the option to move across.

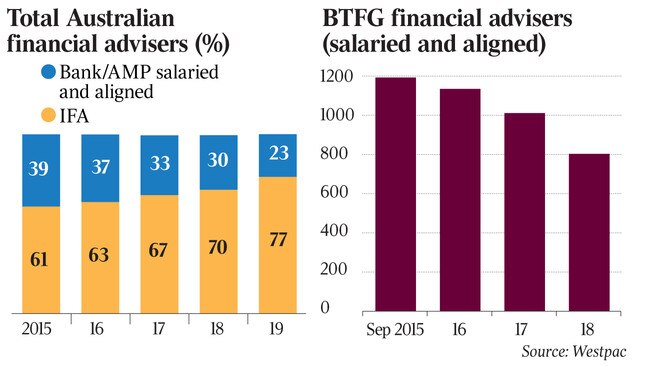

But that pales in comparison to Westpac’s 389 salaried advisers and 414 aligned advisers as of September 30, 2018.

As many as 900 jobs, including those going to Viridian, could be cut from Westpac, although there will be a program to rehire people in other areas.

Westpac chief executive Brian Hartzer admitted the decision reflected a big shift to independent advice and would lead to many bank customers not having a home as their advisers navigated redundancy or redeployment.

“It’s a big logistics exercise that we need to go through with customers and the advisers and we’ll work through that as quickly as we can over the next couple of months,” Mr Hartzer said in an interview.

“A lot of customers that will be going across will be the larger customers and so there is inevitably more revenue associated with those customers that helps cover the costs for the model that Viridian offers.

“It’s when you get to the smaller relationships that the revenue and cost equation starts to get challenging.”

Westpac will tell customers they can go to a referral partner or find advisers on a ratings website, while it is also forming a panel for advisers for its dealer groups so that those practices can find a home, including at Viridian, or get their own licence.

The panel “exists but certainly there is more work there to do to scale it up”, Mr Hartzer said.

Westpac’s move doesn’t, however, signal a wholesale shift away from wealth as several of its rivals have flagged. Westpac is retaining units including life insurance, private wealth and its investment platforms. The bank’s private wealth, platforms and investments and superannuation businesses will move into an expanded business division, while the insurance business will move into the consumer division.

The stock closed 0.4 per cent lower yesterday at $26.42.

Investors and analysts had concerns about what the changes meant for ongoing growth in Westpac’s other wealth and platform business. Part of that is the $16 billion housed in the Panorama platform.

“The separation costs seem high relative to the businesses the group is exiting,” said Matthew Davison, a senior research analyst at fund manager Martin Currie.

“One of the challenges of the new structure will be maintaining momentum in Panorama now it sits within the business banking division.

“The large investment in Panorama by BT was based on deep integration with the bank, so it will be interesting to see if it can command ongoing investment.” Analysts at JPMorgan said: “The exit from advice should see Westpac’s medium-term earnings per share prospects increase slightly, by less than 1 per cent. However, this has come at a material upfront cost and remaining wealth products also face an uncertain outlook.”

Viridian chief Glenn Calder said he expected to engage with the selected Westpac planners in coming days, and is also targeting a licence to take on practices in the bank’s dealer groups by July.

“It will now be full steam ahead,” he said, noting the firm’s model encouraged advisers to take equity in the business to ensure alignment and didn’t pay commissions or short-term bonuses.

While Westpac expects there will be a gain from the sale of the advisers to Viridian, that is more than offset by restructuring costs.

Mr Hartzer said the overhaul of the wealth business was expected to be earnings-per-share positive in 2020 due to exiting a “high cost, loss-making business”.

Westpac outlined initial estimates of one-off costs of $250 million to $300m. Mr Hartzer also said there would be “no ongoing fee relationship” with Viridian and Westpac would be liable for remediation costs that occurred under its watch.

He added that Westpac was on track to complete its customer remediation programs for salaried advisers by the fourth quarter of 2019, but declined to comment on the quantum of repayments to customers stemming from its dealer groups.

Yesterday’s announcement said responsibility for BT remediation programs would move to Westpac chief operating officer, Gary Thursby.

The big four banks have estimated combined remediation costs of more than $1.4bn, but analysts expect the total bill to be multiples of that.

The Westpac shake-up sees head of business bank, David Lindberg, take over as boss of the consumer division.

The general manager of commercial banking Alastair Welsh will lead the business unit on an acting basis.

Westpac will conduct a global executive search for Mr Lindberg’s replacement.

The changes put the spotlight on potential successors to Mr Hartzer, with Mr Lindberg now likely to be seen as a good candidate alongside others including institutional boss Lyn Cobley.

After a long stint at Westpac, Mr Frazis is understood to be in the running for several roles, including chief of Bank of Queensland and CEO positions in the UK.

The process to find a new chief of under-fire National Australia Bank is also getting under way.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout