Credit Corp picks up Collection House’s stressed lending book for $160m

Debt collection company Credit Corp has picked up a $200m stressed lending book and thrown a lifeline to ASX-listed rival Collection House.

Debt collection company Credit Corp has picked up a $200m stressed lending book and thrown a financial lifeline to ASX-listed rival Collection House, which has been struggling under its own debt burden as it attempts a major restructure.

The deal will see Collection House’s Australian lending book change hands for $160m, or 80c in the dollar. Collection House will retain a New Zealand stressed loan portfolio following the deal.

The acquisition comes as debt collection agencies are expected to see a lift in activity as the federal government’s COVID support measures including JobKeeper wind down from March. At the same time banks are preparing to take a tougher line on billions of dollars worth of loans that were effectively frozen when COVID hit Australia at the start of the year.

Debt collection agencies usually buy non-performing loans from banks and other lenders at a discount to face value and profit on recouping the value of the loan.

Credit Corp CEO Thomas Beregi said the acquisition was an opportunity to acquire one of the largest (purchased debt ledger) books in the Australian market.

“Acquisition of Collection House’s Australian book will be the largest single PDL purchase in Credit Corp’s history” he said.

Mr Beregi noted the acquisition would be fully funded using available cash without Credit Corp needing to draw on its presently unused $375m of funding lines.

“Even after this acquisition, Credit Corp will retain almost $400m in available cash and funding lines to deploy as and when suitable investment opportunities arise across all of its segments,” he said.

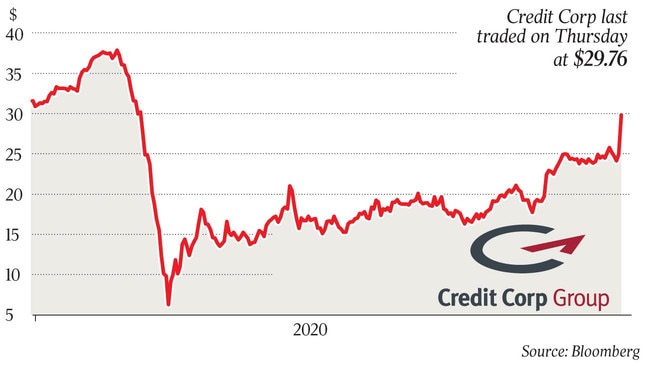

Credit Corp shares last traded on Thursday at $29.76. Collection House’s shares remain under a trading suspension at $1.08.

As part of the deal Credit Corp will provide Collection House with a short-term loan of $15m which is expected to be fully repaid within nine months while Collection House is eligible to receive a proportion of the cumulative collections in excess of the level required to achieve Credit Corp’s hurdle investment return.

Collection House’s senior lenders, Commonwealth Bank and Westpac, have agreed to extend a debt facility of approximately $45m.

Collection House has been struggling for most of the year as its lenders had been running out of patience with the debt-heavy company. Through a restructure process it had seen a string of potential investors including US-based distressed investors Balbec Capital and Oaktree Capital Management.

Collection House posted a net loss for the year ended June 30 of $145.1m after writing down the value of its lending book by $238.9m. The underlying operating profit before impairment and restructuring charges was $16.2m. At the time the company’s auditors said there was “a material uncertainty” related to Collection House as a going concern.

In Collection House’s annual report, chairman Leigh Berkley said the company’s performance for the period was affected by the wider economic effects of the bushfires in late 2019, and then particularly by the pandemic from March 2020, where many bank customers suspended their debt sale activity.

The purpose of the recapitalisation process was to allow the company to refinance its existing senior debt facilities. Finalisation of the recapitalisation was therefore critical for the company’s stability.

Recently appointed Collection House chief executive Doug McAlpine said the company was in advanced discussions with counterparties around the implementation of a long-term partnership to allow it to continue to participate in the purchased debt market in Australia and New Zealand.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout