Crackdown warning for underperforming super funds

This year’s underperforming super funds were largely the same as those that were named and shamed last year.

The prudential regulator has hit out at poor performing superannuation funds ahead of the release of its updated MySuper heatmap, warning that it will crack down on funds that repeatedly underperform and fail to best serve member interests.

Speaking a day out from the release of its refreshed heatmap that assesses super funds on fees and investment performance, APRA deputy chair Helen Rowell revealed that this year’s underperforming funds were largely the same as those that were named and shamed last year.

“These entities have had a year to lift their game. But it’s clear that a stronger approach is needed to protect the members of those funds,” she said as she flagged plans by APRA to step up its action against poor performing funds.

Ms Rowell also revealed the lengths some trustees had gone to in an attempt to improve their rankings.

“We have unfortunately seen some trustees clearly modifying their investment decisions simply in an attempt to manage their performance to the benchmarks rather than in terms of member outcomes.

“Others have tried to rewrite history by resubmitting data to present their funds in a more favourable light,” she said.

“These kind of games indicate poor leadership and are not indicative of a mindset that was genuinely seeking the best outcomes for members,” she said.

Of the 47 MySuper products that underperformed APRA’s investment benchmarks last year, 11 have exited the industry.

Of 11 MySuper products with significantly high total fees and costs, eight have reduced fees by an average of $166 per annum, while two have exited, she said.

APRA will push harder for trustees to reduce fees and improve performance, Mr Rowell said.

“We really want to keep the pressure on … We are looking for trustees to look at how the structure of their fees impact different cohorts and try to find a balanced judgment on how best to structure their fees.

“It is hard and it makes it difficult to set fees in the right way but we want to put that challenge back on to those trustees.”

She also questioned how hard trustees were working to reduce investment fees.

“Some trustees are still charging high administration and investment fees given their performance. The variation in admin fees translates into some members paying 2.5 times what others are paying in similar products.

“Where is the scope to bring fees down? Are you meeting with investment managers … there’s quite a bit of fat in the cost base of the industry that needs to be looked at long and hard,” she said.

APRA has also raised concerns with some smaller funds about their ability to deliver adequate returns, with larger funds generally performing better.

Ms Rowell said APRA expects smaller funds to consider merging or exit if their size or other factors are limiting their ability to perform.

For smaller funds with shrinking member bases, the ability to adequately perform is especially challenging, she said.

“Smaller funds with negative growth and cashflow trends face sustainability challenges.

“Their operating models are relatively expensive and they are shrinking. They have limited options to improve outcomes and a merger or exit is likely to be in members’ best interests,” she said.

APRA has also been stepping up its scrutiny of expenditure and seeking more granular data on spending, she revealed.

The regulator has written to trustees to seek more information on certain expenses including advertising, sponsorship of sporting teams, saying if it concluded it may not be in members’ best interests, “then appropriate supervisory and enforcement action will follow”.

For disclosed fees on MySuper account balances of $10,000, among the worst performers in 2019, as identified through APRA’s heatmap, were BEST Superannuation at 3.79 per cent, First Super at 1.78 per cent, the Pitcher Retirement Plan at 1.73 per cent, IAG and NRMA at 1.59 per cent and the AMP Retirement Trust at 1.54 per cent.

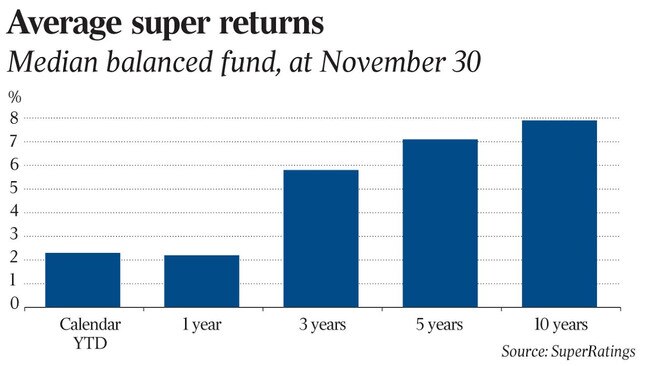

Among the worst performers on five-year net investment returns per annum were Pitcher Retirement at 5.85 per cent, Energy Industries Super with 6.19 per cent and Maritime Super at 6.23 per cent.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout