Covid-19 business interruption test case ruling a shock to insurance sector

The insurance industry has been dealt a heavy blow after a shock loss in the NSW Supreme Court in a test case over business interruption and COVID-19.

The insurance industry could be on the hook for hundreds of millions in Covid-linked payouts after suffering a stunning loss of its own test case that was designed to fortify their position on rejecting claims made through the pandemic.

The decision, released late on Wednesday in the NSW Court of Appeal, found in favour of two insured businesses, that had seen income crunched as a result of the lockdowns.

The unanimous judgment handed down by five members of the bench of the Court of Appeals found in favour of the two test case candidates who were attempting to have their claims for business interruption in relation to the pandemic heard.

Austin Tourist Park caravan park in Tamworth, NSW and Thrive Health and Nutrition, a retail health food store in Melbourne, were the test case defendants. In its judgment, the court found COVID-19 was not to be considered a disease declared to be quarantinable under the quarantine act and exclusions under the respective insurance policies were “not delivered”.

If the judgment stands, the outcome of the case could see insurers forced to pay significant sums to thousands of businesses that have had their operations interrupted by the pandemic.

The Insurance Council of Australia, which funded the case, said it would urgently seek to review the determination and the grounds on which it could seek leave to appeal the judgment to the High Court of Australia.

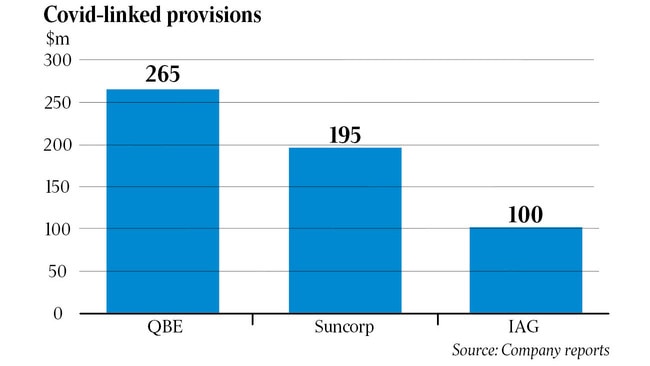

Many insurers, including Suncorp, QBE, Insurance Australia Group, HDI, Chubb and Lloyds, are all exposed to the judgment.

Earlier this year Macquarie analysts estimated insurers faced a loss of at least $535m if they were unsuccessful in stemming the tide of business interruption claims.

The $535m figure excludes legal fees and claims handling costs, as well as claims from the corporate and global segments that Macquarie notes often buy bespoke insurance coverage.

The insurance industry now has 28 days to seek leave to appeal the judgment to the High Court.

The NSW judgment comes after courts in the UK also found in favour of policyholders in September.

QBE is also exposed to the outcome of the UK case, as well as another potential test case in the US.

The High Court of England found in favour of the arguments advanced on behalf of almost 370,000 policyholders by the UK’s Financial Complaints Authority on the majority of the key issues.

But the loss of a high-profile business interruption insurance test case in a superior court is expected to be closely watched around the world and could leave local insurers to battle it out with their global reinsurers.

For holders of policies that reference the Quarantine Act 1908, several legal matters are unresolved and are likely to be subject to further court hearings.

The insurance industry-backed case only sought to examine two policies where insurers referenced the defunct Quarantine Act of 1908.

Questions remain around issues of proximity and prevention of access, which will affect how a policy pays out.

The policies scrutinised by the court both referred to interruption or interference caused by outbreaks of certain infectious diseases within a 20km radius.

Policies that reference the modern Biosecurity Act 2016 were not subject to court scrutiny and for the moment holders of those policies are unable to capitalise on the outcome of Wednesday’s judgment.

Clayton Utz partner Mark Waller, who led the case for the insured businesses, said the outcome was “a clear win for any policyholders that have a like policy in their insurance”.

“The major hurdle for insurance claiming is removed,” he said. “There will still be the same similar issues to those that have been considered in the UK test case regarding whether the insuring clause in the disease extension responds to the business interruption caused by COVID-19.”

Berrill & Watson director John Berrill said the judgment was “the end of the beginning, not the beginning of the end” in the mammoth insurance tussle.

“I’ve got a number of clients, small business people that were smashed by COVID who took out insurance in good faith,” he said. “This decision opens the way for these claims to go forward.”

He said there were legal avenues to make claims even for those who had policies that reference the modern biosecurity act.

“A lot of policies also include separate prevention of access clauses. Typically the prevention of access clauses do not have the (pandemic) exclusion on them,” he said.

“Each individual will still have to prove their case and it will depend on the terms and conditions of their policy.”

Mr Berrill said he was working with Gordon Legal to prepare a potential class action aimed at tackling some of the uncertainties created by Wednesday’s judgment.

Gordon Legal partner Andrew Grech said he and Mr Berrill had between them almost 40 clients who were seeking to make claims.

“We’ve been collaborating for the last few months on it and doing the work necessary to make sure we understand what the legal issues are,” Mr Grech said. “There’s a range of questions and there are many different forms of policy, here are some common features of the polices.”

The judgment from the NSW Court of Appeals, which landed only after the market had closed, leaves Australian and international insurers reeling.

Suncorp this week said that although it was confident the intention of its business interruption policies was clear it was setting aside an additional provision of $70m to cover any potential losses.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout