Coronavirus: big four banks extend business loan deferrals

Banks say tens of thousands of businesses will be protected by new, additional measures to put off loan repayments.

The big four banks have thrown their support behind businesses impacted by the COVID-19 pandemic, unveiling additional measures to support corporate Australia as it hibernates through the crisis.

The Australian Banking Association on Monday announced that banks would extend the six-month deferral of loans to 30,000 more businesses across the country, with the support measures now covering 98 per cent of all businesses with a loan from an Australian bank.

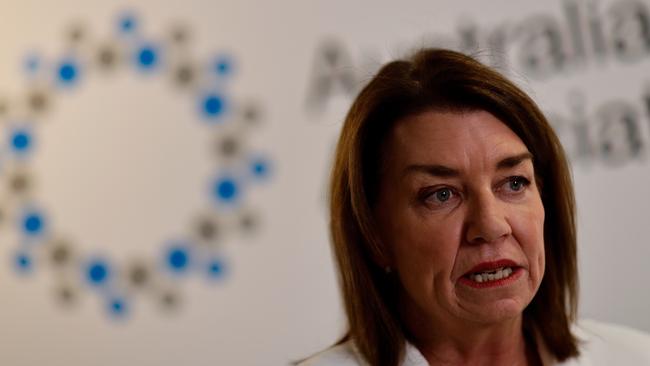

“This will help protect many more thousands of small businesses from being evicted if they are struggling to pay the rent as it covers approximately 90 per cent of commercial property owners who have loans with an Australian bank,” said ABA chief executive Anna Bligh.

The new measures are subject to approval by the Australian Competition and Consumer Commission.

Commonwealth Bank said it would provide repayment relief of up to $3.6bn for its business customers, delivering around $600m back into business cash flows each month.

More than 99 per cent of CBA’s business customers will be eligible for loan repayment deferrals and $1bn of the relief will benefit its commercial property customers, the bank said.

The new support measures include expanding the offer of six-month loan repayment deferrals to businesses with lending limits of up to $10m, up from $5m previously; automatically waiving merchant fees for three months for 70,000 small business customers; and specialised support for larger business customers impacted by coronavirus.

“The economic, physical and personal impact of the coronavirus will be severe. We are dealing with a health crisis which is precipitating a significant economic shock, and the most vulnerable in our community are especially in need of our collective support,” CBA chief executive Matt Comyn said.

NAB chief executive Ross McEwan said the bank would move to implement the new measures as quickly as possible.

“NAB is pleased to extend its support for Australian businesses as part of a significant industry wide initiative announced today,” he said.

“In particular, these new measures will be critical for commercial property customers struggling to meet their own commitments as a result of tenants experiencing difficulty.”

NAB will also provide a six-month deferral for businesses with a loan facility of up to $10m, covering more than 98 per cent of its business lending customers, or over 150,000 businesses across Australia, if they are impacted by the virus.

ANZ managing director for commercial banking Isaac Rankin said the measures would provide some relief to businesses, as well as their employees and tenants.

“While ANZ’s original COVID-19 relief package already covered these larger businesses, we welcome this industry-wide initiative and hope it provides vital relief for these businesses and the Australians they employ in these challenging times. It will also provide a reprieve for the vast majority of commercial tenants.

“Importantly, the measures also cover almost 90 per cent of Australian commercial landlords, provided they undertake not to terminate leases or evict current tenants for rent arrears as a result of COVID19.

“This will help thousands of small and medium businesses hibernate through this crisis,” the bank said.

Westpac chief executive business Guil Lima said the measures would offer immediate and practical assistance to the bank’s customers.

“Ultimately, what’s most important is ensuring businesses – and the economy - can come out the other side of this,” he said.

Westpac’s support package for business will include repayment relief to defer principal and interest repayments of eligible business loans for six months (with interest to be capitalised) for businesses with a total lending exposure up to $10m; an unsecured three-year term loan up to $250,000 for new and existing business customers with turnover of less than $50m; and zero establishment fee for standard equipment finance loans until the end of June 2020.

It will also refund the merchant terminal rental fee for up to 3 months and provide fee-free redraws where permitted under the loan and subject to approval.