Commonwealth Bank in $6bn share buyback, lifts cash profit 20pc to $8.65bn

CBA chief Matt Comyn expects a spike in unemployment and easing in the housing market before the economy starts to rebound strongly.

Commonwealth Bank chief executive Matt Comyn expects a short-term spike in unemployment and easing in the housing market, before the economy starts to rebound strongly in the December quarter buoyed by the Covid-19 vaccine rollout.

His comments came as CBA joined the capital return frenzy with a record $6bn share buyback for investors and posted a jump in annual cash profit to $8.65bn underpinned by strong lending and lower loan impairments.

Adding to its bumper capital returns, CBA declared a final dividend of $2 per share, up from a $1.50 interim payment in the previous six months.

CBA expects an economic contraction in the September quarter, as large parts of NSW and Melbourne continue to endure Covid lockdowns, although Mr Comyn sees a rebound in the December quarter and growth next year.

“We think unemployment will spike probably in about October, but we still believe unemployment will be approximately 4.5 per cent by the end of calendar 2022,” he said.

“Notwithstanding it is very challenging right now there is a light at the end of the tunnel and a well known path – that we to try to accelerate towards the vaccine rollout – which is essential to that strategy.

“Post vaccination of a very substantial majority of the population being vaccinated there will be the virus circulating and it will become more of an endemic disease like the flu.”

Mr Comyn identified a CBA staff survey, which garnered more than 11,000 responses in 24 hours, which showed 89 per cent of respondents intended to get vaccinated against Covid-19, 7 per cent were unsure and just 4 per cent said they did not intend on getting the jabs.

“That’s probably a pretty good cross-section of Australia given our workforce obviously extends into multiple and diverse geographical locations,” he said.

The bank has opened its first site for its corporate vaccination program and is now extending it to 5000 employees and their families.

On the housing market, which had piqued the interest of regulators prior to the latest lockdowns, Mr Comyn said declining confidence and fewer listings would curb price growth in the short term.

“There might be a slight easing in the housing market which is not necessarily a bad thing, given the strong run up in prices,” he said.

Year-to-date national house prices were up 12 per cent and CBA expects a further 3 or 4 per cent growth this calendar year, followed by growth of about 7.5 per cent or slightly below that if lockdowns persist.

CBA anticipates housing credit growth will print at about 7 per cent, while it economic output will grow 1.8 per cent in the current financial year

“A period of relative exuberance... I hope that’s what’s going to accompany this period of lockdown,” Mr Comyn said.

CBA posted a better-than-expected 19.8 per cent rise in cash net profit to $8.65bn for the 12 months to June 30.

The bank also joined the capital return rush after benefiting from a spate of asset sales. CBA, ANZ and NAB have all now embarked on 2021 capital management initiatives.

Investors applauded the capital return and profit with CBA’s shares rallying 1.5 per cent to close at a record $108.17. But some analysts questioned CBA’s higher investment spend and costs and whether it could continue to grow revenue in a challenging environment.

Ausbil Investment Management’s executive chairman Paul Xiradis is positive on the sector and CBA, noting banks were benefiting from the resurgent economy.

“We have been positioned for a big earnings announcement from CBA, and other banks later this year,” he said.

“On the economy, CBA is looking through the current Delta-lockdown impact... they are confident in the economy maintaining growth momentum into 2022. We see this macro environment as very beneficial for banks over the coming year, and we remain overweight the sector.

“Some risks remain in the potential for extended lockdowns and the impact of any persistent inflation.”

Citigroup analysts said the buyback would please shareholders but noted CBA’s revenue growth pointed to a narrowness from home lending.

“Investors will receive the buyback announcement positively, which we expect could drive technical buying,” they said. “However, despite an overall in-line result, the revenue outlook appears more challenged than our expectations.... Business banking revenues declined despite strong volume growth.”

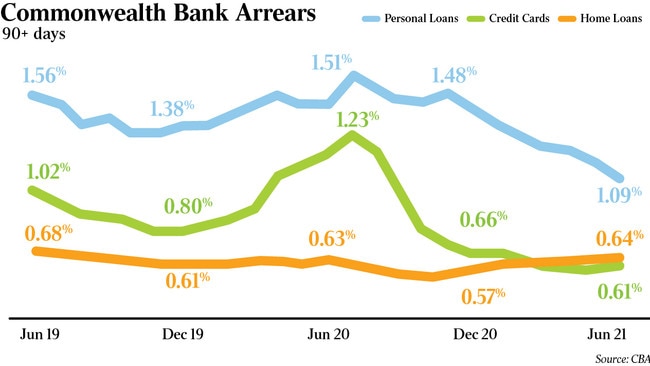

CBA’s loan impairment expenses fell decreasing to $554m as at June 30. The loan loss rate reduced to seven basis points, down from 33 basis points in fiscal 2020, but the bank cautioned it could see higher arrears as lockdowns persisted, particularly in NSW.

About CBA 6,800 loans were on Covid-19 repayment pauses as at July 31, nowhere near last year’s pandemic peak of 158,000 loans.

CBA also released its annual report on Wednesday which showed Mr Comyn’s total received pay climbed to $5.17m for the year ended June 30, from $3.9m the prior year. The increase was helped by him being eligible for 87 per cent of his maximum available short term bonus.

The bank’s annual operating income edged up 1.7 per cent to $24.16bn, buoyed by home an business loan growth and improved fee income.

Profits across CBA’s four divisions were higher, but the results were largely helped by lower impairments rather than a sharp jump in income.

The net interest margin - what the bank earns on loans minus funding and other costs - printed at 2.03 per cent, up on December 31 but four basis points lower than June 30 2020.

CBA finance boss Alan Docherty said as competition and low rates persisted there were “more headwinds than tailwinds” on margins.

He highlighted a $114m rise in customer compensation costs as the “most disappointing “ aspect of the results.

CBA’s operating expenses increased 3.3 per cent, including customer compensation costs, driven by investment spend and higher loan volumes.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout