Commonwealth Bank flags early moves on royal commission’s landmark findings

Matt Comyn has flagged early moves in a string of business areas in response to the royal commission’s findings.

Commonwealth Bank chief executive Matt Comyn intends to implement several of the Hayne royal commission’s landmark findings earlier than required, as he shrugged off suggestions the mortgage broking industry would be hollowed out by scrapping commissions.

Of Commissioner Kenneth Hayne’s 76 recommendations, Mr Comyn believes the bank can move early in a string of areas including farm debt mediation, changing the definition of a small business and not deducting advice fees from lower-cost MySuper accounts.

“There are a number there we feel we can make some early progress on,” he said, noting the bank had already moved to abolish grandfathered commissions in financial advice. “There are a number of things I think we can move ahead of a formalised timeline.”

But on the phasing out of mortgage broker commissions, one of Mr Hayne’s more controversial recommendations, Mr Comyn was less clear on the timing, saying the implementation decision rested with the federal government.

He is the second major bank chief after embattled National Australia Bank boss Andrew Thorburn, who was highly criticised in the report, to front the media after the historic document was made public on Monday. It included outing CBA as the bank with the most legal breaches which have been referred to regulators for further investigation.

CBA faced scrutiny for charging customers fees where no service was provided and its breaches included at least 13,000 counts of failing to move superannuation savers from high-fee accounts into MySuper accounts.

Mr Comyn said he was still of the view that shifting to a flat fee model for mortgage brokers paid by the borrower was the right move, despite the broking industry being up in arms over the hit to its viability and the competitive landscape.

“I do think they are the appropriate recommendations. I can see the challenges for brokers but ultimately I do think they deliver better customer outcomes,” he said.

Earlier this year, Credit Suisse estimated a move to a flat-fee broker payment instead of upfront and trail commissions would result in savings of $100 million to $400m a year for each major bank.

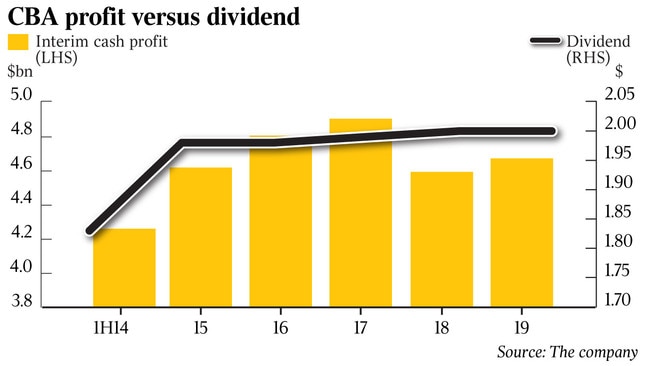

After Mr Comyn delivered a lower-than-expected interim cash profit of $4.77 billion yesterday, he admitted the bank had much to do to restore trust and ensure the failures didn’t reoccur.

“I don’t for a moment underestimate the progress that’s required and the work effort that’s ahead of us,” he said, adding it was “hard to say” how much further remediation and investment CBA would need as a result of heightened regulatory scrutiny.

From fiscal 2014 until the end of December 31 CBA disclosed cumulative remediation and program costs of almost $1.5bn.

“The base case (for CBA) is compliance costs are not going down any time soon, I don’t think that happens for at least the next two years,” Regal Funds Management portfolio manager Mark Nathan said.

“The mortgage brokers (royal commission recommendation) are a huge win for them.”

Mr Comyn also admitted yesterday that the bank’s failure to comply with its enforceable undertaking for its in-house financial planning business was “completely unacceptable”. That saw the corporate regulator ban the division from charging fees or taking new business.

“We’d made commitments to complete a number of steps by January 31, we were unable to do that and we failed to deliver those on time,” Mr Comyn said. On the banking regulator’s action plan for CBA the bank’s latest update said it was “on track” to deliver on 154 milestones on schedule.

Responding to questions from The Australian on whether CBA was weighing distributing franking credits to investors this year ahead of any change of government, Mr Comyn said the topic had prompted feedback from many of its 800,000 retail investors as well as institutional shareholders.

“We have $1.7bn of surplus franking credits,” he said.

“We’ve heard from them (investors) directly about the importance, both of the dividend and of franking credits, and that’s certainly something that we are considering but it would be premature to say anything further.”

CBA’s cash profit fell 2.1 per cent for the six months ended December 31 to $4.77bn, weighed on by lower net interest margins and weaker trading income in the markets division. The interim dividend declared was flat at $2.

The softer-than-expected result and scant detail on the earnings outlook saw CBA’s stock close down 1.4 per cent to $72.60. That followed a sharp rally in bank shares the previous day, the biggest one-day gain for the majors in a decade.

“The takeaway is the environment is tough and will continue to be tough,” Regal’s Mr Nathan said of CBA’s earnings prospects.

CBA’s cash net profit from continuing operations — excluding businesses that are being divested — edged up 1.7 per cent to $4.68bn.

The net interest margin — a key measure of profitability on loans — dipped four basis points to 2.10 per cent due to higher funding costs, loan switching and competition.

Operating income fell almost 2 per cent while operating expenses were 3.1 per cent lower, after the prior period included one-off costs related to CBA’s Austrac penalty for violations of anti-money laundering and terrorist financing regulations.

Mr Comyn provided a new target to get the bank’s cost-to-income ratio at below 40 per cent, and flagged an expense cutting program but little detail on what it entailed aside from increased digitisation and automation of processes.

CBA has agreed to sell a number of business units including its life insurance arm and global asset management division. Mr Comyn reiterated plans to spin off its mortgage broking businesses and the bulk of its financial planning operations, despite reforms mooted in the Hayne royal commission’s report.

Citigroup analysts said the CBA profit reflected a soft first-half result but that was offset but a stronger than expected capital position, above the unquestionably strong threshold required by the prudential regulator.

CBA’s common equity tier one capital ratio was 10.8 per cent as at December 31, up from 10.1 per cent at June 30. Return on equity printed at 13.8 per cent.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout