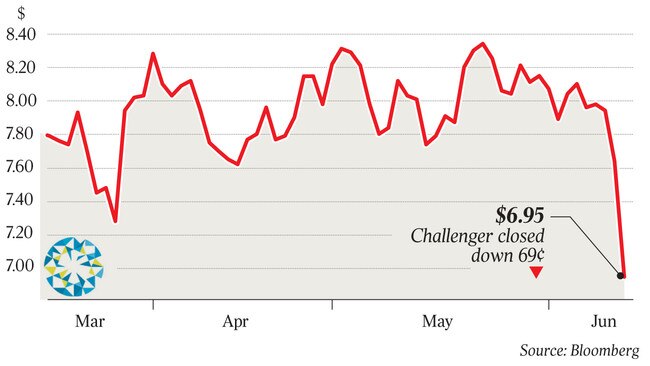

Challenger shares dive on lower profit forecast

Challenger has been punished for cutting its return-on-equity target and for a softer profit forecast.

Investors have punished Challenger’s shares after the annuities group cut its return-on-equity target and warned that low interest rates and higher costs could see profits slip in 2020.

The stock tumbled almost 10 per cent before retracing some losses to close 9 per cent lower at $6.95 yesterday. That was the biggest one-day fall since January, when the shares were pummelled following a full-year earnings downgrade by the annuities provider and funds manager.

During an investor day presentation, Challenger said 2019 normalised net profit before tax would print at the “bottom end” of a $545 million to $565m guidance range. Analysts were expecting $544m.

For 2020, Challenger expects normalised net profit before tax to come in at $500m to $550m, due to factors including lower interest rates on shareholder capital and higher distribution, product and marketing costs.

“Arguably interest rates have become more of a structural factor than a cyclical factor,” Challenger chief executive Richard Howes said.

He told analysts and investors he was confident. However, the company would revert to “stronger profit growth” as it executed its strategy and external headwinds subsided.

“Looking to the year ahead we have a clear plan … I’m certainly optimistic over the longer term,” Mr Howes added.

Challenger also took a knife to its return-on-equity target, cutting it to the official cash rate plus 14 per cent from fiscal 2020, due to a tougher operating environment and lower-for-longer interest rates.

The prior ROE target was the cash rate plus 18 per cent.

The company tipped a slightly higher tax rate of 28 per cent to 30 per cent in 2020 as more earnings are generated in Australia and said its dividend was expected to be maintained.

Macquarie analysts said the market would focus on Challenger’s lower 2020 guidance and the share price would remain under near-term pressure.

“In aggregate the FY20 downgrade to consensus is about 8-9 per cent and about 6 per cent to outer years,” analysts led by Brendan Carrig said.

“Challenger’s pre-tax ROE target has been revised to 14 per cent plus the cash rate from 18 per cent given the expectations for a lower-for-longer rate environment, although we note consensus didn’t have CGF reaching this target over the medium term.”

The Fidante Partners funds management unit was hit by $3 billion in outflows from industry superannuation funds, mostly stemming from a customer taking management in-house.

Funds management boss Ian Saines said the business remained resilient because of a low level of customer concentration.

Mr Howes also spoke of Challenger’s continued push to make “annuities mainstream” in retirement, and said it was investing in that area. Annuities are products that provide regular income payments to retirees.

He also said the company was navigating market disruption in the financial advice industry but that Challenger believed both political parties remained “committed to reforms” in the retirement and superannuation industries.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout