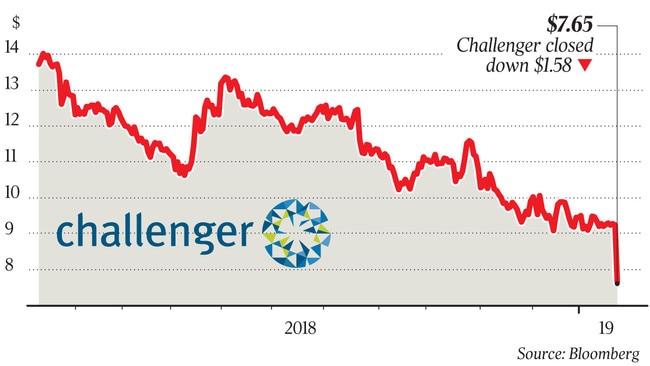

Challenger shares tumble after cut to full-year guidance

Challenger’s shares plummeted 17pc after it flagged a weaker interim profit and cut its full-year earnings guidance.

Annuities provider and funds manager Challenger faces tough earnings prospects and a potential threat to future dividends after its first-half profit was dented by market volatility and lower cash distributions.

Investors pummelled Challenger stock yesterday on the back of an 8 per cent downgrade to full-year earnings guidance and a first half marred by investment losses caused by lower equity markets and wider fixed income credit spreads.

The announcement sliced almost $1 billion from the company’s market value and saw the stock post its biggest fall in a decade, closing 17.1 per cent lower at $7.65.

The profit warning will spur sweeping revisions by analysts to their forward earnings estimates for Challenger, under the stewardship of newly installed chief executive Richard Howes.

Challenger is a large provider of annuity products, which provide regular income payments to retirees, and offers services to self-managed super funds as well as owning stakes in a stable of boutique fund managers. The group’s market exposure is heightened by being an institutional manager across fixed income, real estate and derivatives.

In an ASX statement, Challenger said normalised net profit before tax would print at $270m for the six months ended December 31, subject to an audit review. That is down from $275m in the same period a year earlier.

Statutory net profit — which includes valuation movements on assets and liabilities — would come in at $6m after a negative investment experience of $194m after tax. That represents a slide from statutory interim profit of $195m a year earlier.

Lower cash distributions on the annuity unit’s absolute return portfolio printed at $10m in the first half, about $13m lower than the prior corresponding period. Funds management performance fees also came in lower at $2m, or $4m less than the same period in 2018.

As a result of a weaker first half, Challenger said it had reduced full-year guidance to a range of $545m to $565m. The company had been targeting growth in normalised 2019 before-tax profit of between 8 per cent and 12 per cent, compared to last financial year’s $547m.

“In theory, these (first-half) factors should be relatively one-off in nature. However, Challenger has lowered fiscal year 2019 normalised profit-before tax guidance by a similar rate, highlighting ongoing uncertainty in the second half on this front and undermining confidence in a more ‘normalised’ net profit before tax into fiscal 2020,” UBS analyst Kieren Chidgey said, adding that it was difficult to ascertain whether Challenger’s new guidance was conservative.

“It is unclear whether revised financial 2019 normalised profit before tax guidance is overly conservative or more realistic.”

Switzer Asset Management portfolio manager Shawn Burns said: “Their [Challenger’s] capital position looks fine, but every time this [market downturn] happens it has a big impact on their share price for quite a while.

“At this stage, though, credit spreads and equity markets look like they are stabilising.

“It does get people nervous and the stock doesn’t handle bad news well, as there are a lot of cynics of the business model.”

Mr Howes said he remained positive on the company’s prospects, despite “challenging” conditions.

“Challenger has a strong track record of success through the cycle, which gives me confidence in our performance over the longer term,” he said. “We continue to be well placed to take advantage of growth in the retirement income market.”

Many fund management groups were hit by sharemarket turbulence in the second half of calendar 2018, which hit returns.

The statement said Challenger continued to be strongly capitalised, with a prescribed capital amount ratio of 1.54 times at December 31, up slightly from the prior half.

But Shaw and Partners senior analyst Brett Le Mesurier disagreed with the company on its view of capital and flagged a risk to its dividend.

“The company made a $6m profit in the first half of fiscal 2019 and capital is tight so the dividend could be under threat,” he said.

“Reality is emerging with gusto … 1H19 profit has all but disappeared.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout