CBA shares could slide more than 20pc over the next year, Citi warns

Citi flags concerns about CBA’s valuation premium amid competitive headwinds and slowing home loan growth.

Commonwealth Bank shares’ outperformance has one high-profile broker predicting the stock could slide more than 20 per cent over the next year.

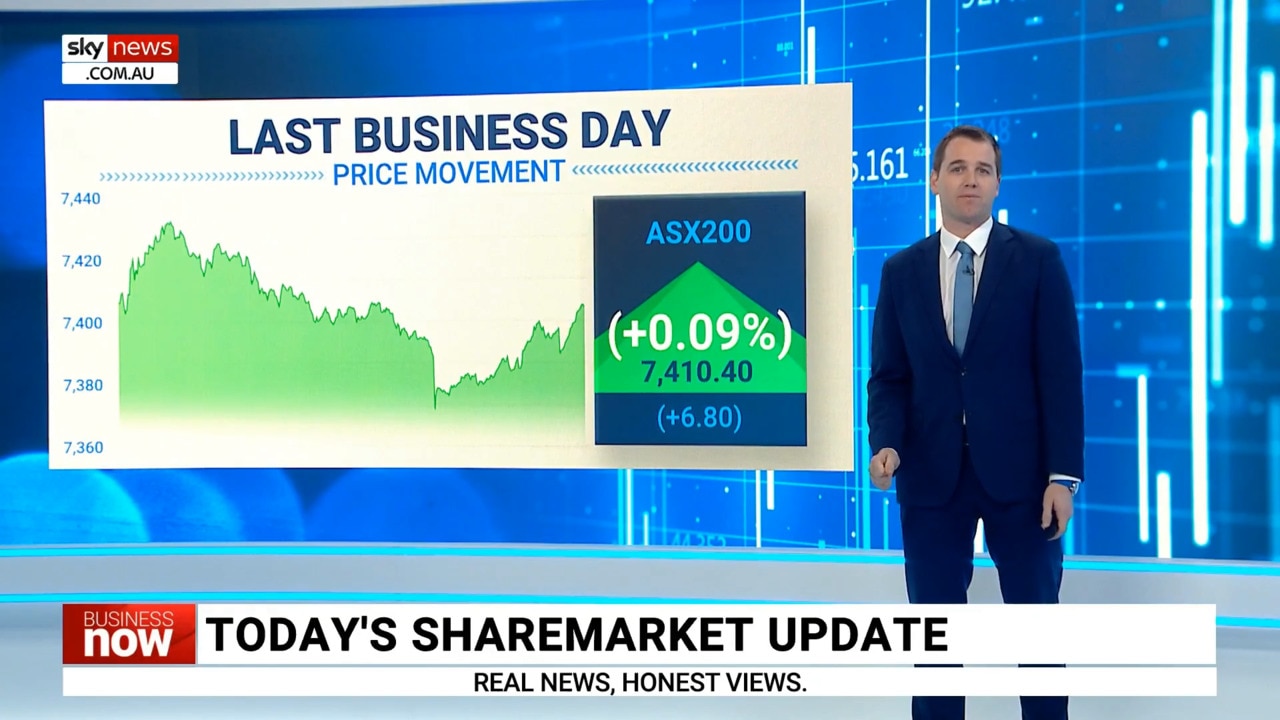

Shares in Australia’s biggest bank have soared over 17 per cent in the past year, more than double the S&P/ASX200 Banks index’s 8 per cent move.

And as the Sydney-based lender prepares to report its earnings on August 9, analysts at Citigroup are doubling down on their negative view on the bank, warning investors that its financial results could disappoint and hurt its shares.

Citi is not the only bear on CBA. Analysts have been recommending investors either sell or, at best, hold CBA shares even as the stock has outperformed peers to be the second best performing bank so far this year.

“One of the key reasons for which CBA has been dearly held in the investors’ portfolio is the market leading retail franchise,” Citi analysts, led by Brendan Sproules recently told clients.

CBA’s “superior execution … particularly on the technology side” compared to its peers “has seen the bank thrive as the household sector increased its leverage over the past two decades, delivering optimal conditions for the bank.”

And its “greater exposure to booming retail credit, accentuated the returns differential vs. peers, and the valuation premium in turn.”

Citi has a $82.5 target price for CBA shares, equivalent to a 21 per cent discount to Monday’s price of $105.4 per share.

“Trends and returns are starting to converge in the sector, with headwinds on both sides of the balance sheets likely to continue to impact well into the next half for all the retail heavy names,” they said.

“CBA will weather similar cost pressures and higher credit costs as peers, yet has to struggle with being overweight the household sector/retail banking at a time where it carries the largest headwinds.”

“Investors should evaluate whether they continue to pay such a large valuation premium versus peers, which has only gotten larger with time.”

Citi believes things have fundamentally changed in the past 12 months, and CBA’s attributes might not protect it from the headwinds presented by the recent “irrational” competition in mortgages and, to a lesser extent, in deposits, in an environment with weaker home loan growth.

On Monday, figures from the Reserve Bank showed housing credit fell to an annual growth rate of 4.5 per cent in June, down from 7.9 per cent a year earlier, while business growth slowed to 8.3 per cent, down from 12 per cent in June 2022.

“The last 12 months have seen a profound shift vs. the prior decade. Business credit growth is now above household credit growth (housing and personal). Retail banking – CBA’s heartland, is at the centre of competition on both sides of the balance sheet, which has further put its profitability under severe stress.”

“As the deposit market has become super competitive, it can no longer be used to cross-subsidise the aggressive mortgage competition.”

“Ultimately, these headwinds have seen its financial performance close rapidly vs. peers. Yet, the valuation premium has not only remained but grown larger.”

Statistics from the banking regulator also showed CBA increased home loan volumes by 0.35 per cent in June, the slowest pace rate since July 2022, and far below the 0.97 per cent growth shown by Macquarie’s bank.

That rounded up growth of 5.2 per cent over the year, the second-highest rate among the majors, behind Australia and New Zealand Banking Group, whose volumes were 6.9 per cent higher than as of June last year.

A big increase in funding costs in the past 3 to 6 months, has forced banks to stop pursuing home loan sales at all costs and temper their “irrational” competitive drive for loans and deposits and move to protect their margins instead. CBA has led the charge on this, reducing the discounts it offers on variable mortgages, and becoming the first major bank to remove generous cashbacks.

But the benefits of this, according to Citi, will not be reflected by profitability this reporting season.

Citi warns that “investors may read these signs and breathe a sigh of relief. We would urge a note of caution for the upcoming results. Despite management actions in response to the competitive environment, banking is a slow game, and the flow through impact of these actions is not likely to be seen for some quarters.”

“We expect the realisation of this in the upcoming result could represent another threat to CBA’s valuation premium to peers.”

It is worth noting Citi’s view is directly opposite that of UBS’s who earlier this month told investors funding costs were looking “shallower” than expected. The broker, which has a “neutral” rating on CBA, then told investors that CBA’s large customer base was the “best placed” to benefit from that.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout