CBA cuts mortgage rates to stem attrition amid silent bank war

CBA is quietly slashing mortgage rates in its own channels and undercutting the other three major banks as it moves to defend its dominant but shrinking market share.

Commonwealth Bank is quietly slashing mortgage rates in its own channels and undercutting the other three major banks as it moves to defend its dominant but shrinking market share, industry insiders told The Australian.

Official statistics released this week shows net new home loans at CBA saw a 20-fold increase to $1.2bn in November, after growing by just $63m in October and shrinking in July, August and September.

CBA, helmed by chief executive Matt Comyn, has carefully crafted its messaging to avoid the impression that it’s willing to engage in a rate-war with competitors like ANZ and Westpac, who continue to offer cashback incentives.

“They were public about being out of the market and moving their pricing out for brokers, but what we are seeing is them stepping back into very aggressive pricing in their proprietary channel,” a market source, who declined to be named, said.

“We are seeing the cheapest pricing of any major from them and we are being asked (by customers) to match it, but we are saying no.”

CBA has been under pressure to defend its dominant position in the home loan market after it recorded several months of market share losses last year.

Mr Comyn has publicly said the lower mortgage volumes being sold reflected “deliberate choices” to “protect margins and returns”.

But the bank has been seen quietly offering cheaper rates to customers that deal with it directly, even as pricing through brokers has not changed as dramatically.

Among brokers, CBA’s mortgage rates have been seen as just marginally more competitive than NAB, the other big bank that has been vocal about sitting out a red-hot market where some banks are pricing loans below their cost of capital.

Mortgage broking sources have told The Australian that while CBA has been adding pressure to increase their application volumes, the bank is, at the same time, offering customers cheaper rates through direct channels. This puts brokers in an awkward bind, potentially compromising their duty to act in the client’s best interests, they said.

CBA has, however, maintained their rates are the same.

A spokeswoman for the bank said: “We are committed to providing our customers with competitively priced home loan products and do not offer differential pricing between brokers and our branch network.”

Bank mortgage pricing is opaque. Advertised and discretionary discounts mean the banks’ advertised variable rates are not an accurate indicator of what customers actually pay. And current pricing dynamics take several weeks to be reflected by the data, given lending and settlement delays.

Over 70 per cent of mortgages are sold through brokers in Australia. However, at CBA, which has by far the largest branch and banker footprint, that trend is reversed.

The vast majority of its loans are sold through branches, mobile lenders and its digital channels, and only 3 or 4 out of every 10 of its home loans go through intermediaries.

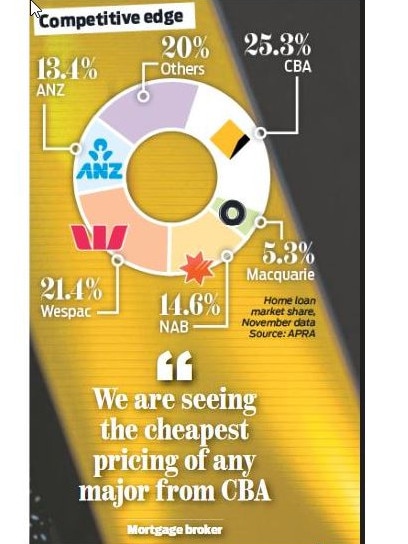

Statistics from the Australian Prudential Regulation Authority released on Tuesday shows CBA has lost 0.56 percentage points of market share in the 11 months to the end of November 2023 to stand at 25.28 per cent. That is its smallest footprint since July 2019, and down from its recent peak of 26.1 per cent of the market in November 2021.

ANZ, on the other hand, increased its market hold 0.30 percentage points to 13.45 per cent over the same 11-month period.

The Melbourne-based lender - which has told authorities fears that competition in the market will wind back if its $4.9bn deal to acquire Suncorp Bank is approved in February are unfounded - has been offering some of the cheapest rates through brokers, as well as a $2000 cash back reward for new customers.

This has cost ANZ dearly, pushing the net interest margin in its retail banking unit – a key measure of profitability – at the end of September to 2.06 per cent, 0.33 percentage points lower than just six months earlier.

The latest statistics for November show ANZ captured a 14.8 per cent share of the banking system’s $9.2bn net increase in home loans. That is larger than its overall market share but was down from taking a 26 per cent share of the $7.8bn so-called “flow” in October, and 36 per cent of the net $7.1bn increase in bank mortgages in September.

The downward trend has encouraged banking analysts, as they believe it could be a sign of easing competition and “a more rational mortgage market” which would have the potential to boost bank revenues.

“ANZ had not expressed any indications to moderate its aggressive stance in the mortgage market,” Citi banking analyst Brendan Sproules told clients in a note on Thursday.

“However, we note this moderation comes post strong criticism from peers, as well as after the recent 2H reporting season where the revenue and profitability attrition from recent mortgage competition was very much apparent.”

“While early days, we wonder if the November statistics indicate a level of rationality returning to the mortgage oligopoly after a period of disruption.”

The data shows CBA attracted 13.8 per cent of the net mortgage flow in November, well below its corresponding overall market share.

Westpac, which has also shown a strong desire to regrow volumes after losing market share during the pandemic credit bonanza due to inefficient systems, took 24 per cent of the flow, higher than its 21.4 per cent market share overall.

National Australia Bank, the third largest, captured 11 per cent of the net increase, as its book of investment loans shrunk slightly, pushing its overall market share a touch lower to 14.6 per cent, down from 14.7 per cent the previous month and 14.8 per cent a year ago.

Macquarie, the fifth largest lender, captured 13 per cent of the increase, more than twice its corresponding 5.3 per cent share of the market, but also down from the 20 per cent and 17 per cent of the flow it took in September and October, the data shows.

Despite moving to stabilise home loan balances, the quiet pricing push by CBA has not yet been enough to repair recent attrition, with its $543.6bn mortgage balance at the end of November still $2.8bn away from its June level.

CBA’s November growth was sharpest in investment home loans. Volumes in the segment grew at an annualised rate of 5.3 per cent, the highest among the four majors and well above system’s growth in that sector of 3.4 per cent.

Owner-occupier loans grew 1.7 per cent per annum compared to system growth of 6.2 per cent.

Overall housing loan growth at CBA was 2.8 per cent per year as of November, the lowest among the majors and about half the banking system’s 5.3 per cent annualised rise. NAB grew home loans at 4 per cent, Westpac grew at 5.9 per cent and ANZ grew its book at 5.8 per cent.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout