Capital idea puts process before fund stars

Los Angeles-based Capital Group is challenging the traditional thesis of following the star fund manager

For decades picking funds based on the big asset management players and their reputations has been a key to successful investing in the Australian sharemarket.

Names like Greg Perry, Ian Harding, Peter Morgan, John Sevior, David Paradice, Kerr Neilson, Peter Cooper and Hamish Douglass have attracted billions of dollars to their firms, and their performances have made them legends of the industry.

But now one of the world’s biggest and oldest fund managers, the $US1.6 trillion ($2.35 trillion) Los Angeles-based Capital Group, is preparing its biggest ever pitch to local investors by challenging the traditional thesis of following the star fund manager.

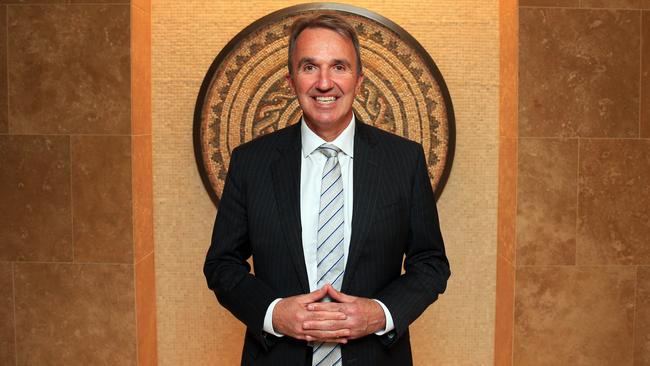

“We certainly see in the Australian marketplace the preference for the star manager system, where 25 to 30 holdings are managed by a single portfolio manager,’’ the group’s Australian managing director, Paul Hennessy, said.

“At Capital our system is designed to provide the longevity to save the issues that come around with the departure of a portfolio manager or one underperforming over a period of time.

“Out of the changes we are seeing with the financial advisory community over the past 12 months, we are seeing movements towards managers that come with greater certainty.

“In terms of trying to find managers, it is those that have a process, as opposed to a star that will lead to long-term deliverables.”

According to research firm FE Analytics, Hamish Douglass’s Magellan Global fund remains the top performer of the star manager model, returning 64.7 per cent over the past three years and 121.3 per cent over five years.

Perpetual’s Global Share fund returned 43.2 per cent and Kerr Neilson’s Platinum International 31.9 per cent over the past three years — below their benchmarks. Mr Neilson stepped down as chief executive last year.

While the vast majority of active managers have a lead portfolio manager supported by a team of analysts, Capital employs several high-conviction ”sleeves” managed by individual managers who are combined to create a total portfolio.

Capital’s flagship global equity offering, the New Perspective Fund, has been running for more than 45 years.

It aims to achieve long-term capital growth by seeking to take advantage of investment opportunities generated by changes in international trade patterns and economic and political relationships

It has seven portfolio managers based in all the major investment jurisdictions around the world, all with differentiated world views.

But Capital claims its managers look beyond analysing company financial statements and meeting executives.

Capital Group’s 320 investment professionals last year logged more than 12,000 visits to factories, warehouses, laboratories, and other sites.

“As Australian investors increasingly allocate more of their investment portfolio to global asset classes, we believe this is the type of active, long-term global equity fund that many of them have been looking for,” Mr Hennessy said.

Capital has been serving Australian wholesale and institutional clients since 2012.

“Capital has identified Australia as one of their key markets going forward, primarily because of the similarity of the dynamics with the US market. Because of the long-term nature of investors in Australia, we see it as a long term-aligned marketplace to grow.”

The group recently appointed the former head of Australian equities at Colonial First State Global Asset Management, Matt Reynolds, as its investment director and late last year launched two fixed income funds in Australia.

“We are looking to bring a diversified range of solutions, both equities and fixed income,’’ Mr Hennessy said.

The NPF has delivered excess returns of about 5 per cent above the index every year for more than 40 years.

More importantly, it has outperformed in 100 per cent of down markets and 85 per cent of rising markets and, according to its statistics, generated 4.3 times more wealth for investors than an investment in the index would have done over the same period.

This is despite the group suffering heavily following the global financial crisis. In the seven years after the crisis, Capital’s clients withdrew $US425bn from its funds.

Active managers have also been under pressure over the past two years amid the global move to less risky, lower fee index funds.

But Capital believes a subset of active equity fund managers do consistently outperform the market. The trick is how to find them.

The group undertook research into finding those active managers among US mutual funds. Among the 521 international equity funds, it identified those that ranked among the least expensive quartile and those whose firms ranked in the highest quartile of management ownership. Applying those two screens dropped the number to 20 funds.

“Yes, fees do matter. Then, if you do a second screen, alignment of interest is very important,’’ Mr Hennessy said.

Most Capital portfolio managers have at least $US1m of their own money in their funds.

The survey also found that the best performing managers had long-term remuneration structures, longer stock holding periods and experienced managers.

“In our case, the average investment experience of a portfolio manager is 28 years,’’ he said.