Build nation on super: Combet

Ahead of a likely ALP election win, Greg Combet has become one of the most powerful figures in the $2.7 trillion super system.

Greg Combet, now one of the most powerful figures in the $2.7 trillion superannuation system, says he wants to advance the use of super in nation-building infrastructure such as the Melbourne airport rail project, and focus public policy back on fund members’ interests, after devastating evidence of bank and retail super fund rip-offs at the royal commission.

The former energy and climate change minister in the Rudd and Gillard governments said superannuation policy needed to “settle down” after five years of Coalition efforts that were regarded as attempts to hobble the industry funds and favour retail offerings from the banks and AMP.

But he said the government needed to bring forward moves to lift compulsory employer contributions from 9.5 per cent to 12 per cent and could take stronger measures to restore $5.9bn in unpaid super

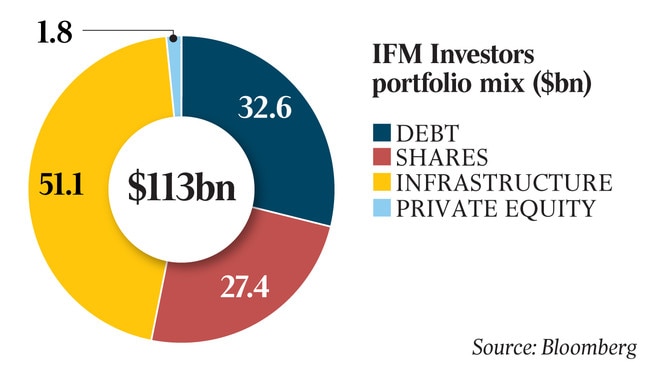

Mr Combet yesterday assumed the chairman’s role at the peak policy body for industry funds and at its jointly owned funds management company, the $113bn IFM Investors, placing him at the top of a major chunk of the national savings market. It is the first time the same person has held the dual roles since compulsory superannuation godfather Garry Weaven — who retired yesterday from the IFM board — and comes as the fund industry prepares for a likely Labor victory at the federal election in May.

Mr Combet’s elevation from deputy chair roles at both bodies comes as industry funds have emerged as arguably the most powerful force in superannuation.

In June, their total haul of $632bn in member funds overtook the retail fund total, and the trustee boards are organising themselves to make big bets on nation building and policy reform. Mr Combet, the one-time union hero of the 1998 docks dispute, said national superannuation policy needed to focus on “member benefit” and the potential to develop nation-building infrastructure rather than seeking to advantage one sector of the industry over another.

“The great benefit of the royal commission process that we have seen is to blow away all of the myths that the banks have created about their own inferior superannuation offerings,” Mr Combet told The Australian.

“There really is an absolutely fundamental conflict that we have seen played out in the evidence where the bank-owned retail funds have been servicing shareholder interests ahead of member interests and it is a contributing factor to their underperformance.

“So how can you justify sticking people into them?”

Industry funds have spent the past five years in a running battle with the Coalition over superannuation policy and regulation, including moves to weaken union representation on boards, remove default fund selection from the industrial relations system and their inclusion in the terms of reference for the banking royal commission.

Legislative changes have failed and the royal commission as well as a Productivity Commission review of super have backfired on the government, with the inquiries backing the industry funds’ claims of superior governance and performance.

A report by the PC in October found there was an “unexplained” gap of 2 per cent between the industry funds — which repatriate profits to members — and retail funds.

Mr Combet claims a 30-year history with superannuation that includes starting his career in 1988 with the Waterside Workers Federation, which had one of the country’s first union funds established in 1968 as consolation for allowing containerisation of cargo.

But as national secretary of the Australian Council of Trade Unions he also led the foundation of the $140bn AustralianSuper — the country’s biggest fund — through a merger of the STA and ARF funds in 2016.

Heather Ridout, who chairs AustralianSuper and was the chief executive of employer peak body AI Group that facilitated the merger, said Mr Combet was “perfect” for both roles.

“A lot of people were very disappointed when he left politics,” Ms Ridout said.

“He has a great ability to reach across the divide.

“There are very few people who can do that and they are very valuable.”

Mr Combet said he hoped to build political and business support to involve industry funds in developing greenfields infrastructure projects.

IFM Investors has previously floated a so-called “inverted bid model” that involves the eventual owners of the project in the design and financing from the outset, but failed to find political support to roll it out.

The model aims to remove development risk that emerged with proposals developed by investment banks and centred on short-term fee generation rather than long-term returns, and generated investment disasters such as the BrisConnections toll road network and the Lane Cove and Cross-City tunnels in Sydney.

IFM and AusSuper have put a proposal to the Victorian government to fund a $15bn development of a rail line linking the Tullamarine airport and the Southern Cross train station in the city and is waiting for a response.

Mr Combet said the proposal would not sacrifice member returns and could deliver socially and economically valuable infrastructure.

“When you have got a pool of capital like this that is long term in its view, that is to the benefit of ordinary Australians and that is prepared to invest in the economy, play a responsible role as an investor in the society and the economy, then I just think that is inevitable that it is desirable to work together,” Mr Combet said.

“The more the business community is engaged in that, alongside industry super funds and government, the greater the benefit for the Australian community. We have huge things to do to build the country, we should be working together to do it.”

Mr Combet said the royal commission and the Productivity Commission both highlighted the consequences of making policy to benefit industry interests over those of fund members.

“We should just have one banner; ‘members first’,” he said.

“That has got to guide the public policy making. That is really very important.”