BOQ blames costs for interest rates lift

Bank of Queensland has hiked interest rates, blaming continued cost pressures for the move.

Regional lender Bank of Queensland has hiked interest rates by as much as 18 basis points, once again blaming funding cost pressures for the move.

From Friday, Bank of Queensland’s Economy Owner Occupier Principal and Interest rate will increase by 11 basis points while a number of other home loans and lines of credit rates will increase by 18 basis points. The lender said it would leave its Clear Path principal and interest rate package unchanged.

Yesterday’s move presents another headache for home owners facing falling house prices. It comes after Bank of Queensland lifted interest rates out-of-cycle last June, hiking rates across a range of owner occupied and investor loans buy as much as 15 basis points. It also comes amid mounting speculation the next move in official cash rates will be down rather than up.

“Continuing funding cost pressures and intense competition for term deposits have contributed to this decision,” the bank’s retail banking group executive Lyn McGrath said yesterday.

“While decisions like these are never easy, offsetting the impact of these costs ensures we balance the needs of our borrowers, depositors and shareholders, ” she said. According to comparison website RateCity, the hike will mean owner occupier principal and interest mortgage holders with a $1 million loan will pay an additional $63 a month.

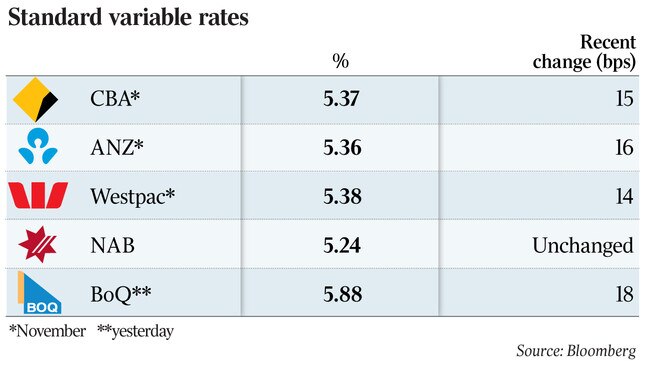

The move puts the bank’s headline variable home loan rate for owner occupiers paying principal and interest among one of the highest among the banks, with the new rate coming in at 5.88 per cent, before discounts. Three of the big four banks also pushed through a round of rate hikes of between 14 and 16 basis points late last year. National Australia Bank bucked the trend and opted to keep its lending rates unchanged.

“The cost of funding pressures continues to be high,” RateCity research director Sally Tindall told The Australian. “Bank of Queensland has clearly made a call that they would need to pass that on to their customers.

“We would expect some of the other banks to follow suit, even with the RBA toying with the idea of a rate cut.”

According to APRA figures, Bank of Queensland has a lending book worth $27.4 billion. The bank has $16.1bn in owner occupied and $11.3bn in investor loans. Yesterday’s announcement came as CBA-owned Bankwest this week cut some of its rates on, which Ms Tindall said was a strategy to boost its home loan book by attracting new customers, rather than increase rates for existing customers.

“It’s a good time to actually become a new customer rather an existing customer,” she said. “It’s interesting to see that some banks are cutting while others are hiking but … they are all facing the same funding pressures and feeling the pinch of the flailing housing market so they are having to compete from a smaller pool of home loan customers at the moment.

“It’s likely that in 2019 we will see competition for new customers heat up and we might see some more rate hikes for existing customers.”

Last October Bank of Queensland reported a full year cash profit of $372 million, a 2 per cent decline for the year.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout