Bloodbath for managed funds as ETFs continue to boom

Australian managed funds haemorrhaged a record net $31bn in 2023 and the wound is set to deepen with the $177bn exchange-traded fund industry poised to triple in size this decade.

Australian managed funds haemorrhaged a record net $31bn in 2023 and the wound is likely to deepen as the $177bn exchange-traded fund industry is poised to triple in size this decade, continuing to lure investor cash.

As a percentage of the industry, the second consecutive year of outflows from unlisted managed funds was relatively small – about 4 per cent of total funds under management – but many of the dynamics driving withdrawals are expected to continue.

“A lot of global fund managers have suffered because the rally in global markets has been very narrowly defined and driven by a small number of stocks,” said Justin Walsh, a Morningstar analyst conducting qualitative research on Australian and New Zealand fund managers.

A group of seven stocks referred to as the Magnificent Seven – Amazon, Apple, Alphabet, Nvidia, Meta Platforms, Microsoft and Tesla – rose 75 per cent last year, versus gains of 24 per cent by the S&P 500.

“If you (as an active fund manager) have not been holding some of those few stocks you have underperformed – and some funds have significantly underperformed – so that’s obviously been a detractor,” Mr Walsh said. The underperformance has driven many away. But investors are also being lured to cheaper passive managers, and particularly those structured as ETFs, as they provide a convenient and liquid option to owning liquid assets such as bonds and international equities.

Superannuation funds are also taking back control of their assets and pulling their investment mandates in favour of bringing asset management in-house, a major headwind for the actively managed fund industry.

Perpetual, Platinum Asset Management, Magellan Asset Management, Janus Henderson and Insignia Financial are a few examples of firms struggling with outflows in recent times.

GQG Partners has been one exception. Earlier this year it told the market it had seen $1.9bn in net inflows during January alone, which sent its shares to record highs.

Pinnacle Investment Management Group was another, as private and alternative assets helped lure net inflows of $4.5bn in the first half of its financial year, reversing the $1.5bn in outflows it suffered a year earlier.

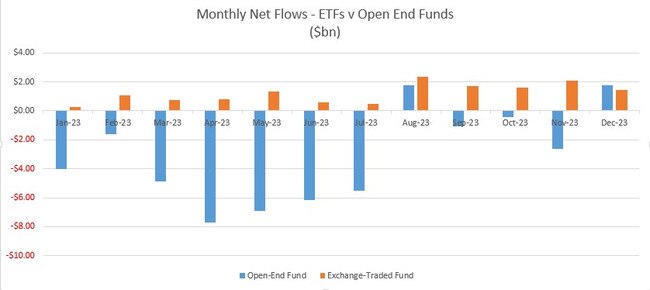

ETFs managed by big offshore names such as Vanguard, State Street and Blackrock, as well as fast-growing local managers such as Betashares, registered net inflows every single month last year, according to an analysis of Morningstar data completed by Betashares.

That pushed net inflows to $14.4bn, a solid but modest 3.4 per cent jump from the previous year. This also represents a 40-fold increase in net inflows in the roughly two decades since 2001, the data show.

Open-ended funds, on the other hand, only saw net inflows in August ($1.77bn) and December ($1.79bn) last year, after seeing a net $24.7bn go out the door in 2022.

“Despite a very strong period of growth over the past decade or so for the ETF industry, they represent only 4 per cent of the managed funds industry in Australia,” Betashares chief executive Alex Vynokur said. “We still have very significant room for growth.”

By comparison, the equivalent proportion of ETFs in other developed markets in the US, Canada, and Europe is more than 20 per cent.

“What it means is that in the next 5 to 10 years, we expect the industry should at least triple in size, at which point it would represent north of a 10th of the managed funds industry, which would still be modest,” Mr Vynokur said.

That would push assets under management in the sector from a record $177bn to more than $500bn.

“The ETF industry is continuing to grow, firstly because ETFs are mostly index tracking and there is a shift from underperforming active managers towards lower-cost, transparent, and better performing on average ETFs,” he said.

Inflows into Betashares ETFs have been ahead of the global giants in recent quarters. But competition is intensifying as the number of managers launching new products, including actively managed ETFs, continues to grow.

Mr Vynokur said indexed funds were overwhelmingly winning mandates from unlisted funds when it came to managing liquid assets. But when it came to private assets, unlisted funds still had the upper hand.

“Resoundingly, in Australia and globally, we are continuing to see interest in active areas which are basically impossible to index,” he said.

“Things like private debt, private equity, physical real estate and infrastructure, where effectively the managers have to wear out the shoe leather in order to generate returns for their investors. Those are the areas in active management which are still protected from the wave of disruption that the ETF industry has brought into the market.”

But competition is arriving even to those difficult areas of the market.

Van Eck Associates, a New York-based investment firm, has just launched a private credit ETF that offers retail investors access to the fast-growing but typically illiquid asset class, the first of its kind in the market, according to Bloomberg.

Advisers are recommending ETFs to clients. Last year, nearly a third of investments made or recommended by advisers were in ETFs, up from 25 per cent in 2022. The trend is even stronger for younger advised investors, with about half of investments advised to those aged between 18 and 24 being in ETFs in 2023, according to figures by wholesale trading platform AUSIEX.

“Over the past two years, ETFs have become an increasingly important part of advisers’ investment strategies,” said Brett Grant, AUSIEX head of product.

“Today, ETFs continue to offer a diversified, low-cost exposure to an index or specific thematic, allowing advisers and their clients to gain exposure to a range of asset classes in a single transaction.

“By taking advantage of ETFs, advisers can construct well-balanced portfolios tailored to the unique risk tolerance and financial goals of their clients.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout