Big four banks face margins squeeze

The big banks are paying about as much for some retail deposit funding as they do for debt from wholesale markets.

The big banks are paying about as much for some retail deposit funding as they do for debt from wholesale markets, crunching margins unless they wind back promotional term deposit rates.

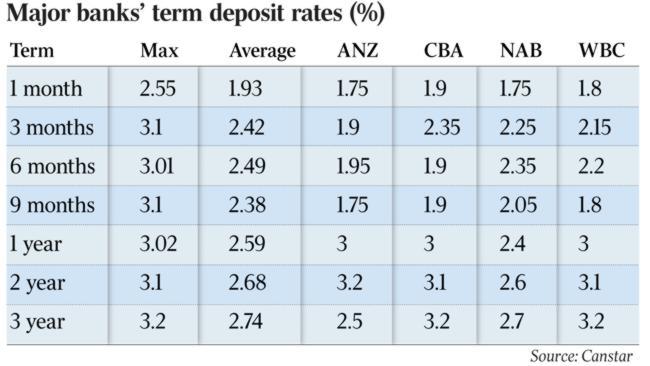

According to Canstar, the big four bank’s 12 to 36-month term deposits are now market leading after hiking rates by up to 60 basis points following the Reserve Bank’s cash rate cut to counter the fallout from holding back the entire reduction from mortgage holders.

The banks’ margins are also being dented by competition for new mortgages, with small lender Reduce Home Loans on Friday dropping its sharpest variable loan by 25 basis points to 3.35 per cent — the lowest Canstar has ever seen and below the 4.4 per cent average.

Reinforcing fears of a “deposit war”, ING Direct and Bank of Queensland pipped the majors by upping one-year term deposits to 3.05 per cent. The majors are offering new customers 3 per cent for a one-year term deposit, above the 2.59 per cent average offered by all banks in the market, according to Canstar.

Commonwealth Bank and Westpac’s 24 and 36-month deals are also market leading, while ANZ’s three year deal of 2.5 per cent is below the industry average and National Australia Bank only increased eight-month term deposits.

Philip Bayley, who runs debt market consultancy ADCM Services, said the increased rates meant the major banks were paying retail investors as much for debt funds as they were to wholesale investors.

He calculated that the banks’ total cost for new five-year wholesale money was around 3-3.1 per cent, based on the 90-day bank bill rate of 1.8 per cent plus a 120 basis point margin.

He labelled as “significant” the banks’ move to boost term deposit rates, underlining the importance of deposits to their funding mix ahead of the net stable funding ratio rule in 2018 that aims to reduces their exposure to volatile short term wholesale markets.

“While the banks have boosted deposit levels since the GFC, the steady fall in interest rates over the same period has made those deposits ever less attractive to savers, with funds increasingly being diverted into higher yielding alternative investments,” he told clients.

“Such has been the waning attraction that the banks have realised that they will have to pay more to stop the rot.”

On Friday, the RBA dealt a blow to the banks’ arguments that higher funding costs forced them to hold back half the cash rate cut from mortgage holders, declaring that less than 2 per cent of funding came from 12-36 month term deposits.

The RBA added that the banks’ cost of new debt — both short and long-term — has “recently been below the cost of outstanding debt”. But with the lower cash rate reducing the banks’ earnings from their overall deposit books and equity holdings, analysts believe the big four’s net interest margins will be affected unless they wind back the term deposit promotions.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout