Big banks all but snub Chalmers’ call to lift deposit rates for long-suffering savers

Action by the major banks on deposit rates since the Reserve Bank started raising the cash rate in May has been selective, conservative or slow.

The nation’s largest banks have all but ignored calls from the federal government to pass on Reserve Bank rate hikes to long-suffering savers by lifting deposit rates.

Since the RBA started a sequence of rate rises in May – raising the cash rate by 175 basis points to 1.85 per cent – the banks have boosted revenue by rapidly passing in full the increases on to variable-rate mortgage customers.

In contrast, action on deposit rates – which reduces revenue – has been selective and slow.

Federal Treasurer Jim Chalmers on Monday told The Australian that savers should be given a “fair go”.

“People are rightly asking why interest rate increases don’t always get passed on as quickly for savings as they do for mortgages”, he said at the time. “It’s the least that can be done, and I urge all banks to give their customers a fair go.”

All four major banks on Thursday said they would pass on the 50bp increase in the cash rate in full.

RateCity, an independent financial comparison service, said the 175 basis-point hike in their average variable rate to 5.18 per cent compared to more modest rate increases for their deposit accounts.

The average rate for an online deposit account rose 66 basis points to 0.71 per cent, while the average bonus saver account went up 127 basis points to 1.5 per cent.

RateCity research director Sally Tindall said the dollar value of deposits in the banking system was currently at a record after government assistance packages and the nation’s savings rate soared in the pandemic.

“This has generated a real ‘meh’ attitude from the banks – they’re not overly interested in fighting for new business because it’s not been a priority for them,” Ms Tindall said.

“What the banks have passed on to savings customers has been a complete dog’s breakfast.

“After each hike, the banks have thrown a bone here and there to select savings customers, however, most savings accounts haven’t risen by as much as variable mortgages.”

In the most recent round of adjustments on Thursday, Ms Tindall said Westpac and National Australia Bank had passed on the full increase to their main savings accounts.

While it was a win for those customers, the Commonwealth Bank and ANZ appeared to be “picking and choosing as to who gets what”.

ANZ had passed on sizeable increases to its new “Save” account, which would soon offer a 2.5 per cent rate, but customers had to be proactive to receive the benefit.

Overall – and since May – Ms Tindall said the banks might have picked their online savings rates “off the floor, but not by much”, as these rates were still well below the cash rate and even further behind the market leaders.

This was despite savers generally benefiting from a rising rate environment. On top of that, inflation was tipped to reach 7.75 per cent by the end of the year.

“Keen savers should be able to get ongoing rates of well over 2 per cent after this latest hike filters through; in fact, we should start seeing some rates nudge over 3 per cent in coming days,” Ms Tindall said.

“Customers who’ve had their money in the same bank since they were knee-high to a grasshopper should check to see whether their loyalty is being taken for a ride.

“If it is, it might be time to break up with your bank – if enough people pick up their nest eggs and move them to a more competitive bank, the big four banks, in particular, will be forced to take notice.”

Chris de Bruin, Westpac’s chief executive of consumer and business lending, said the bank considered multiple factors and stakeholders, including borrowers and savers, with every interest rate change.

“We also take into account the change to the cash rate and other increases to the cost of funding our loans,” Mr de Bruin said.

“We understand the change in home loan interest rates will mean many customers will be reviewing their budgets.

“While more than two-thirds of customers are ahead on repayments, we recognise after several successive interest rate rises, some may be feeling more financial pressure … We’re here to support these customers and encourage them to give us a call.”

The head of ANZ’s retail bank, Maile Carnegie, spruiked the lender’s new app, which has received a mixed reception, saying customers could benefit from the Save rate of 2.5 per cent by downloading the ANZ Plus app “in a matter of minutes”.

“We realise the persistent low-rate environment of recent years has been challenging for savings customers, so we have tried to provide some relief for them with a range of deposit rate increases,” Ms Carnegie said.

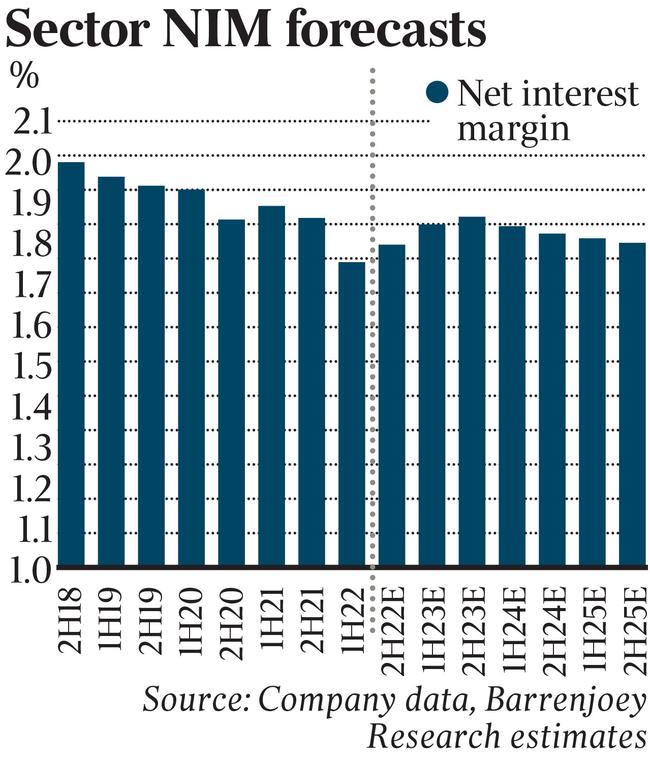

Ahead of the Tuesday rate rise, Morgan Stanley analyst Richard Wiles told clients that failing to pass on this year’s aggressive monetary policy tightening to depositors would provide a “material near-term margin tail wind for the major banks”.

That margin increase could amount to as much as a $7bn rise in annualised bank earnings.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout