Bendigo Bank may slash dividend: Citi

Bendigo Bank could slash its dividend by a third if it embarks on a desperately-needed capital raising, according to Citi.

Bendigo Bank could slash its dividend by a third if it embarks on a desperately-needed capital raising to defend against intensifying cyclical and structural headwinds, according to a bleak assessment by investment bank Citi.

In fiscal 2019, Bendigo Bank paid out a full-year dividend of 70c per share, but Citi estimates the bank will take a knife to its “unsustainable” payout ratio and cut the annual payout to 50c per share if it raises capital to fund a restructure of the business.

The investment bank predicts a capital raising could be announced in a matter of weeks – either when it hands down its half-year numbers on February 17, or shortly thereafter.

Announcing a restructure would be the catalyst to “revisit the appropriate setting for the dividend and capital adequacy”, the analysts led by Brendan Sproules said.

Assuming a restructuring and investment cost of $200m, Citi expects Bendigo would raise $350m to fund the program and restore its common equity tier 1 ratio to be in line with its peers. If it fails to move ahead with a restructure Citi sees the bank’s ratio declining over time as it contends with declining earnings and an unsustainable dividend payout ratio of 90 per cent.

“The increased share count from a raising would have the consequence of worsening the unsustainable position of the dividend. On our pro forma numbers, maintaining the 70c per share dividend would increase the payout ratio to around 96 per cent,” the analysts said.

“In this scenario, we think the board would reset the dividend back to a 70 per cent payout ratio. This would prove a more sustainable position for capital generation given current returns within the business.

“Cutting the dividend to 50cps (down 27 per cent) would therefore provide a more sustainable footing for capital adequacy going forward,” they added.

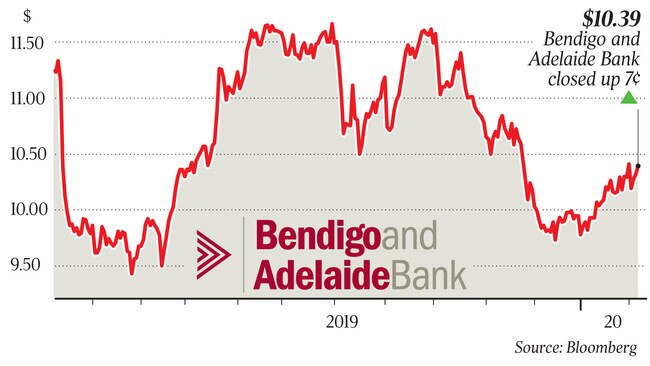

Citi has cut its price target on Bendigo to $9.25 from $9.50 and retained its sell rating on the stock. Bendigo shares were up 0.63 per cent at $10.38 in early afternoon trade.

While Bank of Queensland is facing similar cyclical and structural headwinds, Citi said the majority of the near-term downside had already played out for the lender, with the dilution from funding its own restructuring plan quantified and absorbed. BoQ’s common equity tier 1 ratio would be at the upper end of the target range, the analysts estimated, while a final dividend cut was already priced in.

BoQ’s earnings should also be less exposed to low rates than Bendigo’s, Citi said, because it had further mitigated the impact with a shift away from term deposits.

“BoQ’s head start on coming to market with restructuring plans to address shared challenges and stronger capital position mean that Bendigo’s 20 per cent outperformance of BOQ in the last 12 months is unlikely to repeat,” they said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout