‘No need for regulator to step in on housing, says Bendigo Bank boss Marnie Baker

Bendigo Bank boss Marnie Baker sees no reason for regulators to step in to cool the housing market, saying the rapid price gains are ‘terrific for the economy’.

Bendigo and Adelaide Bank sees no need for regulators to step in to take some heat out of the booming housing market, with buying activity still driven by owner occupiers rather than investors.

Managing director Marnie Baker, speaking after handing down the regional lender’s full-year results, said she was confident in the outlook for the national housing market even as lockdowns in NSW and Victoria threaten to drag on for months, and tipped continued strong demand from buyers seeking to shift from cities to regional Australia.

Rapid house price growth over the past year had been “fantastic for the economy”, she said.

“We’d start to have some concerns when it gets too heady for investors but we haven’t seen that to date. When we see people buying homes and living in them, this is terrific for the economy.

“I’ll leave it up to the regulators as to what decisions they make, but if we look at the market at the moment it’s predominantly driven by owner-occupier lending and I think that’s a great position to be in when we talk about how do we move forward with the economic recovery in this country.”

House prices have surged over the past 12 months, jumping 16 per cent in the 12 months through June as buyers rush in to take advantage of ultra-low interest rates. But speculation has been mounting that the Australian Prudential Regulatory Authority will soon step in with macro-prudential curbs to take some heat out of the market.

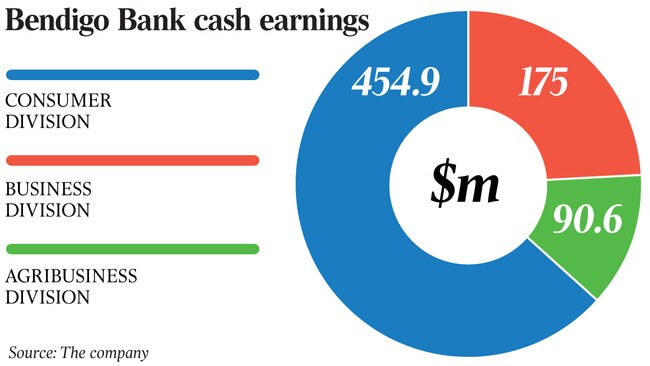

Bendigo, which posted a 51 per cent jump in cash earnings to $457.2m in the 12 months through June, has seen only a small pick-up in investor activity in the latest cycle, and nowhere near the level it was at a few years ago before the banking regulator last stepped in to curb lending activity.

Alongside strong growth in regional Australia, Ms Baker is also eyeing a swift economic rebound once restrictions in the major cities ease, but cautioned on the near-term impact of ongoing lockdowns and the slow pace of the vaccine rollout.

“We anticipate economic and market conditions will continue to provide both ongoing challenges and opportunities for our bank,” Ms Baker said.

“While we expect the housing and employment markets to grow nationally – as well as the economic expansion of regional Australia – we remain cautious of the potential impacts of further pandemic-induced lockdowns, a slower than initially anticipated vaccine rollout and take-up, international trade sentiment and the continuing effects of natural disasters, and climate change.”

Ms Baker, who has been in the top job at Bendigo for three years, said the lender had not yet seen a meaningful jump in deferral requests from customers caught up in the lockdowns, with just $87m across 274 accounts currently on repayment holidays.

Most of these had been from NSW, she said. Hours later on Monday, Victoria announced an extension of its current lockdown until at least September 2, raising the prospect of more Victorian customers requesting repayment holidays.

Updating the market on its full-year results, which saw Bendigo post a 172 per cent jump in net profit to $524m, Ms Baker on Monday also announced the acquisition of Melbourne-based fintech Ferocia and declared a final dividend of 26.5c per share.

Total lending in the year grew at 3.8 times system, but the net interest margin dipped 7 basis points amid headwinds on front and back book mortgage pricing. Bad and doubtful debts stood at $18m.

The bank also guided to a 3 per cent rise in costs in the current year, in part on the back of its acquisition of Ferocia. This unexpected rise in costs partly explains the market reaction, with Bendigo shares plunging close to 10 per cent.

“These results clearly demonstrate our strategy is making us a bigger, better and stronger business. We have delivered on what we said we would do, and more, by growing customer numbers and market share in both lending and deposits,” Ms Baker said.

“At the same time our balance sheet, brand proposition, risk profile and investments have made our business stronger for all stakeholders for the future.”

Deposit growth jumped 14.2 per cent in the year, while the rise in residential lending was “a standout”, Ms Baker said. The bank saw a 36.8 per cent increase in lending applications for the year.

“Our strong capital position ensures we are well-positioned to manage through the pandemic,” she added.

Morningstar banking analyst Nathan Zaia said some investors may have been disappointed with the cost growth.

“The bank had been guiding to lifting investments to achieve growth and to get operating efficiencies, so that looks like it’s stepped up quicker than what they stated before now.

“They’re basically saying the revenue opportunities are there right now, loan growth is there so we’ve decided to spend the money. That might have disappointed some shareholders.”

Ord Minnett analysts said the result was 6 per cent below its expectations on slightly lower revenue, and costs 2 per cent above its forecasts.

Among the positives were that volume growth was strong in the second half, with average interest-earning assets up 5 per cent half on half, they told clients.

But net interest margin, after revenue share arrangements, dropped to 1.92 per cent which was 3 basis points below its expectations, Ord Minnett said.

The acquisition of Ferocia, which the bank has partnered with for close to a decade, was agreed at a price of $116m.

It will allow the bank to grow and advance the Up banking app platform, and further develop its digital ecosystem, the lender said.

“Powered by technology-led customer experience design and an internationally experienced team, the acquisition brings outstanding digital and technical expertise to the bank, internalising Ferocia’s market leading digital capability and consolidating ownership of Up,” Ms Baker said.