Behind WAM Capital founder Geoff Wilson’s war on listed funds

The former stockbroker is only getting started in his quest to shine a light on sluggish funds.

It’s the scrappy one-time Sydney stockbroker versus the funds management veteran. At stake is a $67m cashbox and a whole lot of pride.

The former stockbroker – Geoff Wilson – is used to getting his way, although in this case he is likely to fall short in Monday’s shareholder vote to acquire the underperforming PM Capital Asian Opportunities Fund (PAF), which is backed and managed by former BT funds veteran Paul Moore, who runs investment manager PM Capital.

Instead, an agreed merger between PAF with its bigger sister fund – the PM Capital Global Opportunities Fund – is set to secure the shareholder vote.

But victory for the $580m PM Capital Global will come at a cost and should send a message to all listed investment companies that Wilson is serious in his determination to start a fight when it comes to targeting underperformers.

Wilson, the one-time stockbroker with McIntosh and Potter Partners who has a personal fortune of $526m according to The Australian’s The List, sits on top of the Wilson Asset Management family of funds. These have $5.5bn in assets under management and count more than 120,000 retail investors across eight listed vehicles.

Wilson propelled himself into the mainstream becoming the face of the potent campaign against Labor’s now-defunct policy to scrap franking credits during the 2019 federal election. In the public’s mind at least, that puts him squarely in the pro-investor corner.

At last count there were 97 listed investment companies on the ASX, the bull market means many have been trading at a discount to their net tangible backing all while collecting hefty management fees.

And it’s the proliferation of funds, usually as a spin-off from a master manager is becoming an increasing blind spot. This is a worry because the investment dynamics of the funds means they are widely held by self-funded retirees for an income stream.

Friendly mergers between associated funds often leave a sour taste amid questions around in whose interest is the fund really working — for shareholders or the fund manager.

The fund in the middle of Wilson’s latest battle, PAF, is a relative minnow. It is a $67m low-profile cashbox with a mandate to invest in Asian-based shares excluding Japan.

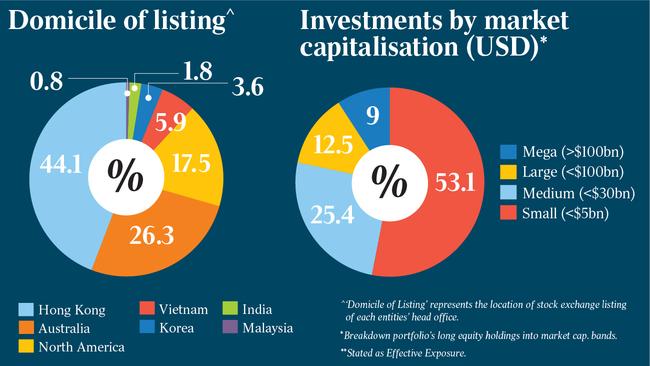

PAF, which listed in 2014, has exposure to up to 35 shares and is currently sitting on holdings in companies such as iCar Asia, MGM China, Freeport-McMoRan and China Mobile. Nearly half the shares are in Hong Kong-based companies.

Wilson is not holding back in arguing the proposed merger of the PM Capital-linked funds is riddled with conflicts and takes aim at the $500,000 break fee entered into by PAF and PM Capital Global.

Their merger, which has been agreed to by the way of a scheme of arrangement, will push PM Capital Global’s assets above $640m.

The battle has already gone several rounds with the takeovers panel, but will push ahead on Monday.

Wilson labels the transaction as “robbing Peter to pay Paul” in reference to the PM Capital Global shareholders paying a relatively full price for the PAF assets.

“They are buying pre-tax assets for essentially the same value as after tax assets. PM Capital Global shareholders will be diluted by this deal. The only person it is a good deal for is the investment manager PM Capital,” Wilson says.

But Moore, who points out he is not on the board of either PM Capital Global or the merger target PAF, says Wilson has a “big incentive” to win Monday’s vote.

“If they were successful in their offer, the size of WAM Capital goes up which increases the management fees,” Moore says in an interview on Sunday.

Moore, a former GWS Giants board member, argues he is just watching on the sidelines as a shareholder in both funds. He also notes an independent expert has taken into account all factors including the break fee and still back the PM Capital Global proposal.

For its part PM Global is urging investors to look through the share-based valuation on offer and focus on a measure of returns measured by pre-tax net tangible assets.

“I look at it as a shareholder it makes a huge difference,” Moore says. “Stay away from all the noise … There is one clear issue that stands out. If you look at the alternative offers under one (PM Capital Global) you get accretion to your pre-tax capital of approximately $1.14 whereas the alternative [Wilson] offer you get around 95c.

“From a shareholder perspective the only thing that really matters is how much capital do you have at work as an investor and the returns you will get on that over time.”

Wilson is going for a scrip takeover that offers 1 share in his flagship WAM Capital share for every 1.99 PM Capital Asian Opportunities fund, this represented a 10.6 per cent premium to the pre-bid closing share price for PAF.

In terms of valuation on Friday’s close, Wilson’s scrip offer represents $1.115 a share. PM Capital Global’s offer is more complicated given it is based on a NTA measure. At current values PM Global values the target at $1.14 a share. PAF closed on Friday at $1.10 a share.

Listed investment funds with less than $200m in assets are general struggling in the current bull market and are trading at sharp discounts to their underlying assets.

This is the market’s way of saying – that in any given moment of time it doesn’t believe the manager is creating value from the assets sitting in the fund.

“We’re proud that a number of our listed investment companies have been able to trade at a premium because it means over time we perform,” Wilson says.

“It’s understandable why PAF was looking to delist “given its poor performance,” he adds.

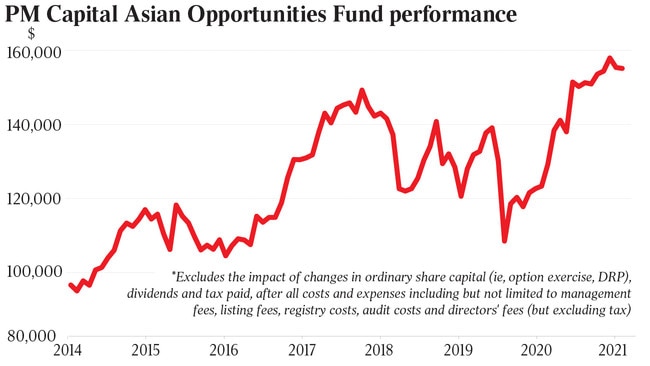

Prior to the takeover PAF was trading as much as at a 17 per cent discount to its net tangible assets. PAF last year delivered a 12.2 per cent outperformance of the MSCI AC Asia ex-Japan index but has fallen short of the index for each of the three, five and seven years. Indeed, over seven years PAF’s has underperformed the index by 3 per cent over this period.

Wilson’s flagship fund, with more than $2bn in assets is trading at a hefty 18 per cent premium. That’s why its using the power of its share price to buy cheaper assets. PM Capital Global shares are trading on par with their pre-tax NTA of $1.62.

PM Capital Global has just under a 20 per cent stake in PAF, but it can’t vote in Monday’s meeting. Paul Moore can vote his own stake of just under 10 per cent which he intends to vote in favour of PM Global offer on Monday.

At last count Wilson had 13.8 per cent of PAF. Not enough to defeat the vote on its own, but if a number of PAF shareholders sit out of Monday’s meeting, it could go down to the wire.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout