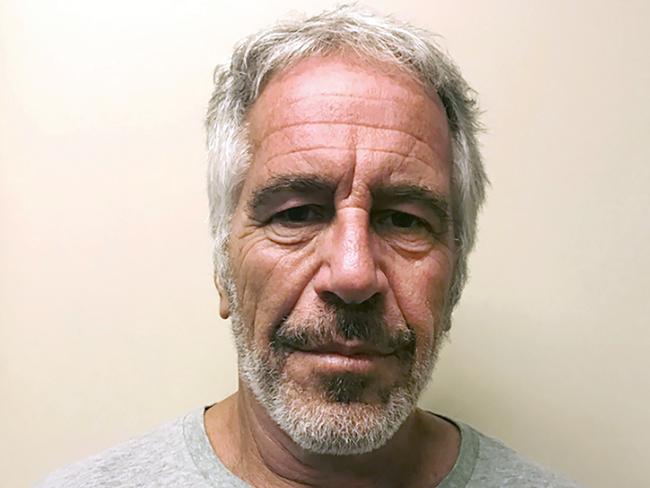

Barclays boss Jes Staley in Jeffrey Epstein links probe

Barclays CEO Jes Staley ‘deeply regrets’ any link to sex offender Jeffrey Epstein, as regulators investigate their professional ties.

Barclays said UK regulators are investigating the professional relationship between chief executive Jes Staley and Jeffrey Epstein, the financier and convicted sex offender who died in jail last year.

The UK’s Financial Conduct Authority is examining how Mr Staley characterised his relationship with Mr Epstein to Barclays, and how the British lender described it to the regulator, the bank said.

The probe marks the latest brush with authorities for Mr Staley, an American. In 2018, he was hit with penalties equal to about a quarter of his 2016 pay over his efforts to unmask a whistleblower, which UK regulators called a “serious error of judgment.” US authorities also fined him over the episode.

“Mr. Staley retains the full confidence of the board, and is being unanimously recommended for re-election at the annual general meeting,” the London-based bank said.

Mr Staley worked at JPMorgan Chase & Co for more than 30 years before becoming Barclays’s CEO in December 2015.

He told journalists his contact with Mr Epstein went back to 2000, when he led JPMorgan’s private bank and the financier was a client. He said his contact with Mr. Epstein began to “taper off” after he left JPMorgan in 2013 and the last time he had contact with him was in the “middle to fall” of 2015.

In 2008, Mr Epstein pleaded guilty to soliciting an underage prostitute, in Florida’s state court.

“I thought I knew him well and I didn’t,” Mr Staley said. “For sure, with hindsight, with what we all know now, I deeply regret having had any relationship with Jeffrey Epstein.”

Mr Epstein was found dead in August at a New York detention centre, where he was awaiting trial on federal sex-trafficking charges, in what the New York medical examiner ruled as a suicide.

Barclays said Mr Epstein’s death renewed interest in Mr Staley’s dealings with him, and that the CEO gave an explanation to executives, including Chairman Nigel Higgins. Mr Staley confirmed he had no contact with Mr Epstein after becoming Barclays’s CEO, the bank said.

The FCA investigates whether executives are “fit and proper” to lead based on considerations including honesty, integrity and reputation, as well as competence and financial soundness, according to the regulator’s website.

Shares in Barclays, the UK’s second-biggest bank by assets, were down 1.7 per cent in afternoon trading in London. It was among the weakest performers in the Stoxx Europe 600 Banks index, which also fell.

Mr Staley was encouraged by a senior executive to get to know Mr Epstein when he was running JPMorgan’s private bank, a person familiar with the matter said. Mr Epstein, who built a fortune by establishing close relationships with a small group of rich and powerful individuals, started connecting acquaintances to Mr Staley and recommending the private bank, a person close to the relationship has said.

Mr Epstein connected JPMorgan to Glenn Dubin, co-founder of hedge fund Highbridge Capital Management. JPMorgan hired Mr Dubin’s fund to manage assets tied to offshore reinsurance products that helped private-banking clients minimise taxes, people close to Highbridge said. Mr Staley was impressed with the performance and started funnelling private-banking clients’ money into Highbridge’s fund.

The announcement of the investigation overshadowed the release of Barclays’s annual results.

Mr Staley is battling to cut costs and boost profits in the face of a series of unexpected obstacles, including the whistleblower controversy. He also waded into a messy dispute between KKR & Co. and his wife’s brother, causing the US private-equity giant to pull business from the bank.

Last year, activist investor Sherborne Investors waged a campaign to have Mr. Staley scale back in investment banking. Mr Staley has defended Barclays’s mix of businesses, saying it makes the bank resilient to market conditions to have a large UK retail and business bank, a New York- and London-based corporate and investment bank and a US credit-card business.

Mr. Staley said the model was working. Net profit rose 54 per cent to £2.46 billion ($US3.19 billion) in 2019 from 2018 and revenue was flat at £19.72 billion. But Mr Staley gave a cautious outlook for the year ahead. Barclays said it hit its return-on-tangible-equity target of 9.0 per cent in 2019, excluding £1.58 billion of litigation and misconduct costs, but improving on that will be difficult.

“It is appropriate to target a return greater than 10 per cent, and we are managing our business to achieve that,” Mr Staley said. “However, given the low interest rate environment, it has become more challenging to achieve that target in 2020.”

Wall Street Journal

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout