ANZ’s Shayne Elliott on the defensive over interest rates

ANZ cut almost 20 term deposit rates in the lead-up to Tuesday, with the biggest reduction at 0.6 per cent.

ANZ chief Shayne Elliott was yesterday forced to defend the bank’s strategy as it rushed through an increase to deposit rates after passing through only part of the Reserve Bank’s official cuts to home owners.

An analysis by RateCity found ANZ cut almost 20 term deposit rates in the lead-up to Tuesday, with the biggest reduction at 0.6 per cent. Westpac has also changed a range of term deposit rates since the beginning of the week, with one of those a 0.5 per cent cut.

After copping criticism over its policy, ANZ raised the rate for its 11-month term deposit by 80 basis points yesterday afternoon.

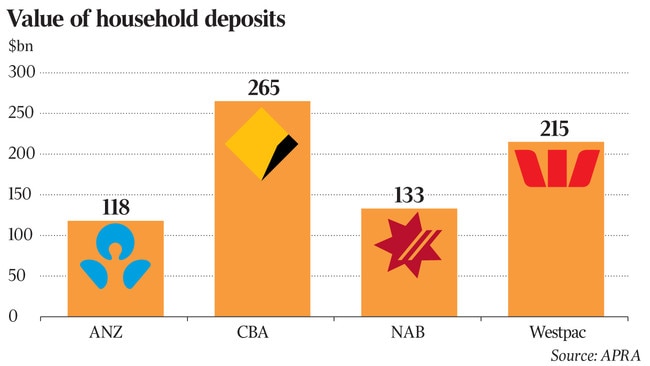

ANZ and Westpac were lambasted by Treasurer Josh Frydenberg on Tuesday when they decided not to mirror the Reserve Bank’s 25 basis point cash rate cut. Commonwealth Bank and National Australia Bank committed to pass on the full reduction to borrowers.

Mr Elliott had attempted to get on the front foot by saying the ANZ decision was linked to maintaining rates for savers. “We think on balance it’s the right thing to do,” he said in a radio interview.

“As I said, thinking about depositors, thinking about shareholders. There are a lot of pensioners out there, retired people — people who need interest income to sustain their lifestyle. The Treasurer also understands we run a commercial enterprise that needs to balance the needs of many different stakeholders.”

RateCity’s director of research Sally Tindall yesterday said: “It’s frustrating to see ANZ and Westpac hold back part of a home loan rate cut with one hand and slash some of their deposit rates with the other.”

She added that more than 50 banks had cut term deposit rates in the past two months.

On mortgages, ANZ has said it will pass on 18 basis points of the RBA’s move while Westpac will give owner-occupiers a 20 basis point reprieve.

Later on Wednesday, as pressure mounted on the issue, ANZ announced a new 11-month term deposit rate of 2.35 per cent, available from Friday. That was 25 basis points higher than its prior best rate in the market of 2.1 per cent for four months.

Co-founder of new non-bank lender Athena, Michael Starkey, a former NAB executive, said banks were dudding borrowers by not delivering the rate cuts immediately.

His analysis shows that a 10-day delay in passing through rate cuts by the banks costs borrowers $100 million.

ANZ’s rate cut for borrowers becomes effective on June 14, while Commonwealth Bank’s new rates apply from June 25.

“There is a much larger public awareness (post the Hayne royal commission) ... on some of these dodgy pricing practices,” Mr Starkey said. “We (Athena) pulled the trigger immediately”, passing on the 25 basis points.

Yesterday Suncorp cut its mortgage variable rates by 20 basis points, effective June 21, and said that small business “essential loans” would fall by 25 basis points.

ING said it would pass on the RBA rate cut in full, as did Macquarie. “We carefully consider a range of factors when reviewing our rates, and we’re pleased to be passing on the full cut in the official cash rate,” said Ben Perham, Macquarie’s head of personal banking. “This rate cut now means we have Macquarie’s lowest ever home loan rate.”

AMP has its lending rates still under review.

Banks and other lenders typically assess funding costs, the bank bill swap rate and other factors in assessing their home loan and deposit pricing.

Australian Banking Association chief Anna Bligh defended the industry, saying banks made their decisions carefully. “Banks are determined to earn back the trust of the Australian people, both with borrowers and depositors,” she said.

“Ultimately this is a decision for each individual bank to make, weighing up both the impacts on borrowers and depositors. However, it’s important to note that interest rates are at historic lows and competition between banks for the business of Australian customers remains at an all-time high.”

But retiree groups came out swinging yesterday, unhappy at the cuts to deposit rates.

“This announcement by the Reserve Bank comes at a time when living costs are increasing. In recognition of this, the national minimum wage has just been increased by 3 per cent, but retirees will face a cut of up to 10 per cent in the returns from bank term deposits,” said Wayne Strandquist, acting president of the Association of Independent Retirees.

“Comments from the RBA indicate that the interest rates have further to fall and this will see even deeper cuts to income.”

Interest rate cuts are also a drag on bank earnings and analysts revised their numbers on Wednesday as further RBA rate reductions loom.

UBS downgraded its profit forecasts across the banks by about 2 per cent in financial year 2020 and 5.5 per cent by 2022.

“In the event the RBA cuts the cash rate below 1 per cent or initiates quantitative easing, we see further downside to earnings and dividends.”

Macquarie analysts said they expected the RBA’s rate cut to hit major bank profits by 2-3 per cent and the regional banks by 4-7 per cent. If the RBA reduces again, potential earnings hits are as much as 7 per cent for the big four.