Banks should reward customer loyalty, says survey by Pega and Omnipoll

A majority of bank customers believe loyalty should translate to the best rewards and interest rates, in contrast to common practice in the sector.

An overwhelming majority of bank customers believe long-term customers should receive the best rewards and interest rates, in contrast to common practice in the sector, a new survey has revealed.

Loyalty benefits have emerged as a key topic for bank customers, with 85 per cent saying those that stick with their financial institution should reap the rewards, according to a poll by Nasdaq-listed Pega and research group Omnipoll.

Banks typically seek to entice new customers with rate discounts and cashback offers, while existing customers are slugged with rate rises as official increases are passed on.

“With interest rate hikes continuing, I’d expect people to shop harder and put more legwork into finding the best possible rates, increasing customer churn,” said Jonathan Tanner, Pega’s Asia-Pacific and Japan senior director of industry principal financial services.

“If people are forced to choose between paying their current mortgage and paying their bills, they’re going to look for a cheaper mortgage. Banks can retain customers by rewarding their loyalty as they transition from a fixed to variable rate, and support their customers through this challenging period by offering the best possible rates and discounts,” Mr Tanner said.

The results came from a national survey of 1230 people.

Bank customers are grappling with rising interest rates and consumer prices – and many face the prospect of significantly higher repayments as $500bn in fixed mortgages near expiry.

Pega’s survey shows 57 per cent of respondents believe their bank is more concerned with trying to sell new products and services than rewarding loyalty. Just 53 per cent of customers say their bank provides long-term customers with the best rewards and rates. A lack of loyalty rewards is on par with interest rates as the main trigger for bank customers to switch providers, the survey found.

Pega’s financial services customers include Commonwealth Bank and HSBC while in other sectors Ford and Google are among its clients.

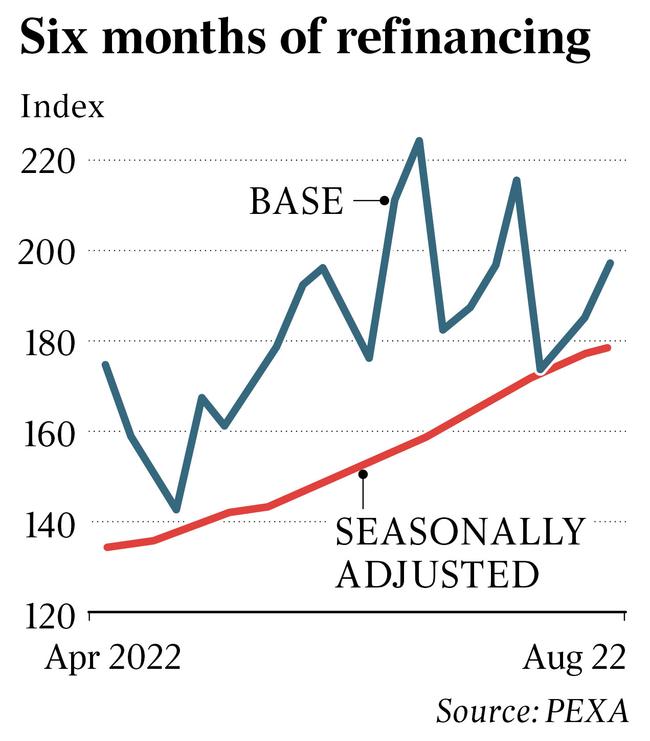

The survey results come as the Reserve Bank is expected to lift interest rates this week for a fifth straight month. The official cash rate is at 1.85 per cent, compared to a record low 0.1 per cent in April and through the depths of the Covid-19 pandemic.

Non-bank lender Athena is one of very few players to price home loans at the same rate for new and existing customers.

It also rewards loyalty by reducing a mortgage customer’s rate by a small amount as their debt reduces relative to the value of the property, if they remain with Athena.

CBA’s digital mortgage, which launched this year, gives customers a loyalty discount that increases by one basis point every year for up to 30 years.

But on Friday, on its broader mortgage product, CBA cut its basic loan rate by 0.1 percentage points to 3.69 per cent but only for new owner-occupier borrowers. RateCity said that it was the second time CBA had discounted variable rates for new customers since the RBA hikes began in May.

“CBA has cut its lowest variable rate down to a competitive 3.69 per cent, yet not a single existing customer will get this discount unless they do something about it,” RateCity research director Sally Tindall said.

“CBA is not alone in offering up discounts to new business. A total of 24 lenders have now cut some variable rates for new customers since the RBA began hiking,” she said.

RateCity said a borrower taking out a $500,000 loan three years ago, on CBA’s lowest advertised variable rate and without renegotiating, would be paying an estimated 4.72 per cent.

Anecdotal evidence suggests some banks are also ramping up their customer retention efforts as mortgage growth slows.

However, banks may be relying on customers not bothering to change providers. Pega’s survey shows 61 per cent of respondents have been with their main bank for more than 10 years.

The poll also found smaller banks are outperforming their larger rivals. Some 44 per cent of customers at smaller banks report being “very satisfied”, compared to 33 per cent of big four bank customers.

Despite the size of the bank, they all score well on providing clear and transparent information, with 82 per cent of customers saying their bank delivers on that.

The Pega survey also shows environmental, social and governance concerns are top of mind. About 60 per cent of respondents are concerned about green, sustainable environmental business practices, but just 45 per cent think that is a priority for their bank.

“ESG is increasingly important to Australians, and they are looking to all providers they engage with to follow suit.

“Offering greener products, being conscious of dealing with big emitters, and of course, looking in their own backyard at their own emissions are important steps for banks to take,” Mr Tanner said.

“However, people care about green initiatives when they can afford to care about them.

“In 2022, there’s a huge variety of issues impacting Australians, but cost of living is top of mind for many. So, while ESG is important, we believe best rates and rewards will still be the key decision factor.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout